Regulatory | E&P | NGI All News Access | NGI The Weekly Gas Market Report

NFG Management Again Takes Aim at New York Energy Policies

National Fuel Gas Co. (NFG) CEO Ronald Tanski on Friday once again took New York’s energy policies to task, scoffing at Democratic Gov. Andrew Cuomo’s plans for a “Green New Deal” and indicating his company would be getting more involved in discussions with the state’s lawmakers going forward.

The Cuomo administration has staunchly resisted natural gas, banning high-volume hydraulic fracturing and challenging, or even stopping, major gas pipeline projects designed to meet growing demand in the state and in the Northeast. Tanski has derided state policies in the past, especially after regulators denied a water quality certificate (WQC) in 2017 for the 490 MMcf/d Northern Access expansion project after nearly three years of review. NFG has battled the state since, as the move has made it difficult for the company’s exploration and production subsidiary, Seneca Resources Corp., to get more gas out of shale fields in northwest Pennsylvania.

Tanski said during a call to discuss NFG’s fiscal first quarter results that Cuomo’s latest proposal to cut carbon emissions by 70% by 2030 is a “tall order,” considering fossil fuels account for 66% of the state’s electric generating capacity. He also aired concerns about Consolidated Edison’s recent moratorium on new natural gas customers in Westchester County, NY, because of a supply shortage. NFG, headquartered near Buffalo, NY, has gas utility operations in the state.

“In the National Fuel service territory, our system can adequately handle our customers’ needs without a problem, but I’m not sure what might happen if state policies are fully enacted that will require our customers to change out their heating systems and move away from natural gas, a fuel that they’ve relied on forever,” Tanski said. He’s also concerned about how the Democrat-controlled legislature’s policies might impact costs for consumers.

“We’ll be keeping an eye out and getting involved in state energy policy discussions and try to ensure that our customers can maintain access” to affordable energy, he said.

Tanski said there were few updates to share about the company’s pipeline projects. Management is encouraged by a federal court ruling in a hydropower case that found state agencies can’t exceed the statutory timeframe of one year to issue a WQC. The Federal Energy Regulatory Commission found last year that New York waived its authority to issue a certificate for Northern Access by failing to act within that period, opening a path to construction. New York has since filed for a rehearing of the Commission’s latest decision and again slowed progress on the expansion.

NFG reaffirmed its fiscal year (FY) 2019 financial guidance for Seneca of $460-495 million and production estimated at 210-230 Bcfe.

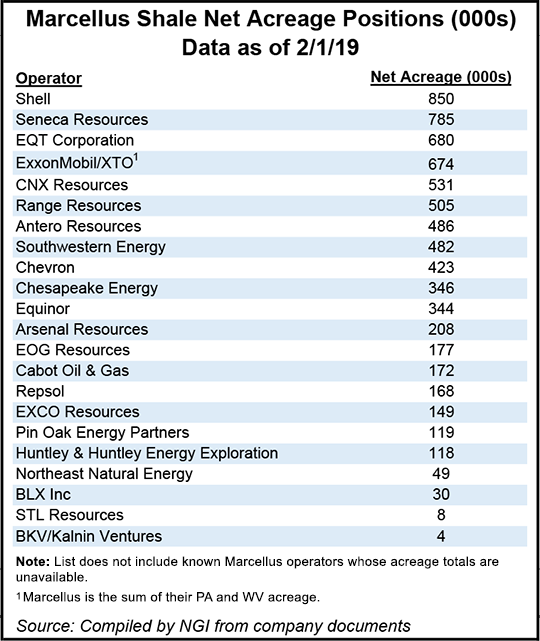

Seneca produced 49.2 Bcfe in fiscal 1Q2019, a 23% increase from the year-ago period and a 4% increase from fiscal 4Q2018. Pennsylvania, where Seneca operates in the northwestern and northeastern parts of the state, accounted for the bulk of that growth with volumes of 45.3 Bcf. Oil production from assets in California decreased by 101,000 bbl to 571,000 bbl following the $43 million sale of its Sespe field in Ventura County last year.

Seneca President John McGinnis said the Utica appraisal program in its Western Development Area of Pennsylvania is still ongoing. Seneca transitioned to a full-scale Utica development program in 2017. It so far has 17 Utica wells online in the WDA, with plans to bring another 10 online before the end of fiscal 2019.

“We have many years of Utica development inventory on our WDA acreage, so we’re going to be deliberate and patient in our approach to optimizing well and completion design as we move forward.”

NFG reported fiscal 4Q2019 consolidated earnings, which includes its upstream, midstream and downstream business segments, of $102.7 million ($1.18/share), compared with earnings of $198.7 million ($2.30) in the year-ago period. Revenue increased slightly to $490.2 million in fiscal 1Q2019 from $419.7 million a year earlier.

Seneca’s average natural gas prices, including the impact of hedges, were $2.61/Mcf in the fiscal first quarter, down 11 cents year/year. Average oil prices, including hedges, were $61.70/bbl, or $1.91 higher than they were in fiscal 1Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |