Story of the day

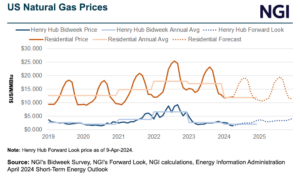

EIA Cuts 2024 Natural Gas Price Forecast, Projects Record-High October Storage

Markets

Natural Gas Forwards Steady as Market Waits for Summer Cooling Demand

With the market weighing mild shoulder season weather and bloated storage against weaker production, regional natural gas forward prices generally held steady at the front of the curve during the April 4-10 trading period. Fixed prices at benchmark Henry Hub finished the period at $1.888/MMBtu for May delivery, up 4.3 cents week/week, according to NGI’s…

April 11, 2024Markets

Mexico Natural Gas Imports Ticking Up in April Amid Bearish Outlook for Pricing – Spotlight

North American natural gas futures gained some ground this week with signs that U.S. production was scaling back, but still held under $2.00/MMBtu. The longer term picture remains bearish, at least for this year. This week, the U.S. Energy Information Administration (EIA) cut its projected average Henry Hub natural gas spot price to $2.20 for…

April 11, 2024LNG

Biden Commits to Japanese Energy Security While Holding Firm on LNG Pause

As the United States moves to reassure allies that reliable LNG exports are still a priority, market analysts warn the Department of Energy’s (DOE) pause on new export permits has already opened the door for international competitors. President Biden met with Japanese Prime Minister Kishida Fumio Wednesday where, along with security and economic cooperation, the…

April 11, 2024LNG

Freeport Again Restarts Train 3 After Unplanned Outage – Three Things to Know About the LNG Market

NO. 1: Freeport LNG Development LP said Train 3 at its export plant on the upper Texas coast tripped offline late Tuesday due to an issue with the ventilation flow meter. The train, which only recently came back online after a lengthy outage, was restarted Wednesday, according to a regulatory filing with the Texas Commission…

April 11, 2024Trending News