NGI The Weekly Gas Market Report | E&P | NGI All News Access

New Path Fails to Change Old Trends at Mexico’s Pemex

Mexico’s state oil and gas giant Petroleos Mexicanos (Pemex) was able to stabilize quarterly oil production in the fourth quarter at 1.69 million b/d, but 2019 production fell 7% on a year/year comparison to 1.68 million b/d, the company said in its fourth quarter earnings report.

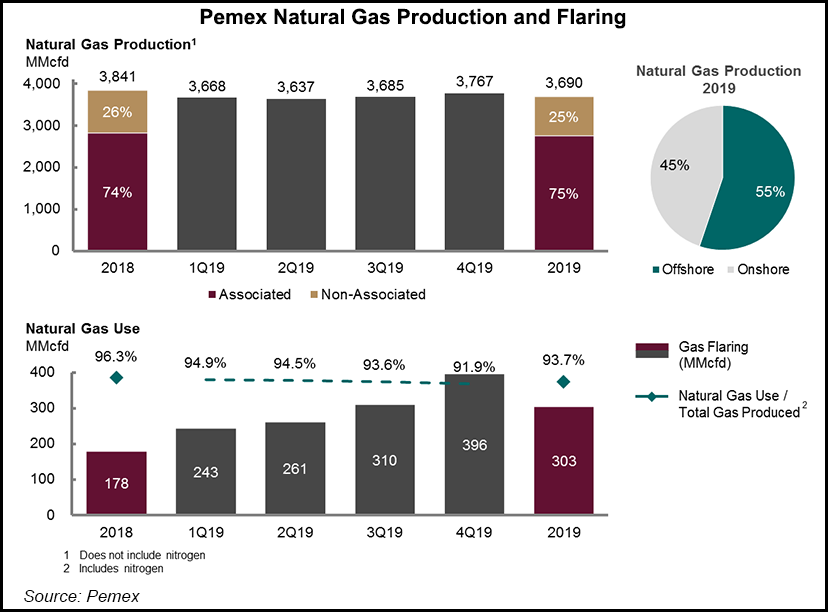

Natural gas production fell slightly to 3.69 Bcf/d in 2019, from 3.84 Bcf/d in 2018.

Pemex posted a net loss of 345.5 billion pesos in 2019, or about $18.3 billion, almost double its 2018 loss. The company also registered a fourth quarter loss of 169.8 billion pesos, its biggest quarterly loss in two years.

The news comes as a significant blow to President Andres Manuel Lopez Obrador, who vowed to “rescue” the state company when he came to power in late 2018. It also comes only days after official 2019 gross domestic product figures showed that Mexico’s economy shrank by 0.49% in 2019. Lopez Obrador had promised annual growth of 4% during his six-year term.

Pemex officials, who did not take questions during their fourth quarter earnings call, highlighted in the presentation the fact that fuel theft fell by 90% in 2019 thanks to efforts to secure key energy infrastructure. They also said January crude production had risen slightly on a year/year basis, attributing the gain to increased well maintenance and completions.

There was also no mention during the call of the costly Dos Bocas refinery being built in Lopez Obrador’s home state of Tabasco.

Pemex executives said they were optimistic that the 20 onshore and shallow water fields deemed as high-priority would start to see increased production soon. They blamed bad weather, delays in infrastructure and operational problems on delays at the fields, which are seen as a crucial part of the business plan launched last year that seeks to add 1 million b/d crude production and about 1.2 Bcf/d of natural gas by 2024.

Pemex executives said they expect new production at these priority fields to lead to an additional 80,000 b/d by the end of March.

The results will also do little to quiet concern of further downgrades to Pemex’s credit rating. Last June, Fitch Ratings downgraded Pemex debt to junk status, while Moody’s Investors Service revised its outlook on the state energy giant to negative from stable.

Some analysts said the latest results from Pemex were negative and indicative of the government’s mishandling of the state company and the energy sector, which includes canceling oil rounds and farmouts, as well as abandoning deepwater and unconventional fields.

“They came within $1 billion of matching their performance in 2014, when oil prices collapsed,” energy consultant Gonzalo Monroy told NGI’s Mexico GPI.

Meanwhile, President Lopez Obrador said earlier this week the government is evaluating whether an ethane supply contract between Pemex and the Braskem-Idesa consortium composed of Brazil’s Braskem and Mexico’s Grupo Idesa should be canceled.

“There is an ongoing investigation,” said Lopez Obrador Wednesday at his daily press conference.

The government is arguing that under the terms of the deal Pemex has had to supply ethane at below market rates to Braskem-Idesa’s Etileno XXI petrochemicals plant near the port of Coatzacoalcos.

Braskem-Idesa said it remains committed to Mexico and is in discussions with Pemex and the authorities over the issue. The company has argued that it won the contract in an international and open tender in 2009 and blamed the “insufficient production of ethane gas” in the country for the dispute.

The conflict brings to mind a similar dispute between state utility Comision Federal de Electricidad (CFE) and private sector pipeline companies that resulted in the renegotiation of natural gas transport contracts last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |