Natural Gas Market Oversold, Trader Says; March Futures Seen as Rising to $4-Plus

Physical natural gas traders hunkered down Thursday and got their deals done before the weekly Energy Information Administration (EIA) storage report.

Overall, physical prices moved little, with robust gains in the Southeast and Northeast proving sufficient to offset broader weakness in the Midwest, Midcontinent, Rockies and California. The NGI National Spot Gas Average gained 2 cents to $3.51.

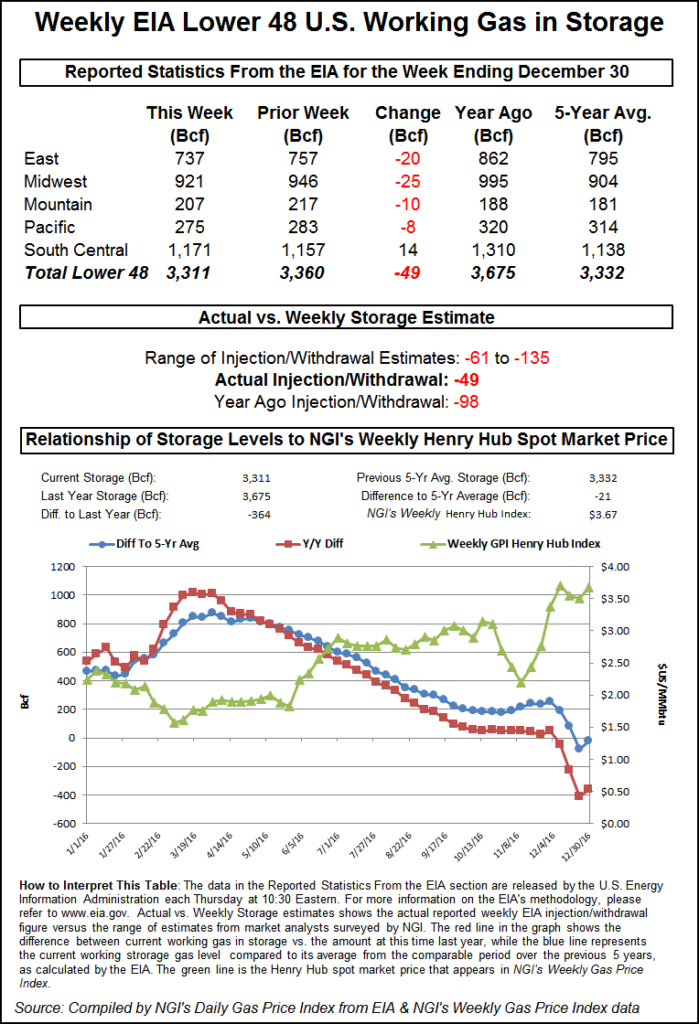

The EIA weekly storage report offered what at first seemed to be a big bearish surprise in the form of a storage report for the week ending Dec. 30 showing a withdrawal of 49 Bcf, about 30 Bcf less than market expectations and outside the range of analyst forecasts. The withdrawal was also a far cry from both the 98 Bcf that was taken out the same week a year ago and the five-year average pull of 107 Bcf.

At the close, however, February had managed to climb into positive territory by six-tenths of a cent to $3.273 and March had risen 1.9 cents to $3.268. February crude oil rose 50 cents to $53.76/bbl.

Initially, futures tumbled once the figures were released. The February contract reached a low of $3.172, and by 10:45 a.m. February was trading at $3.199, down 6.8 cents from Wednesday’s settlement.

“The number sent the market aggressively lower, but it’s attempting to recover those initial losses,” said a New York floor trader shortly after the data hit trading screens.

“It was a real shocker to the market,” said Steve Blair, vice president at Rafferty Technical Research in New York. “I was surprised the market bounced back a little bit.”

Tim Evans at Citi Futures Perspective said he “think[s] reduced demand over the holidays played a key role in the small decline for last week and anticipate[s] a significant rebound in the rate going forward. We’ll see how quickly the market may pivot from the bearish data for last week to the prospect of stronger numbers going forward.”

Inventories now stand at 3,311 Bcf and are 364 Bcf less than last year and 21 Bcf less than the five-year average. In the East Region 20 Bcf was withdrawn and the Midwest Region saw inventories decrease by 25 Bcf. Stocks in the Mountain Region fell 10 Bcf, and the Pacific Region was down 8 Bcf. The South Central Region added 14 Bcf.

Seasoned traders see an opportunity. “I’m a buyer. I think they overdid it,” said Alan Harry, director of trading at McNamara Options LLC, referring to the combined Tuesday-Thursday collapse of futures prices.

I think what happened is that [storage] numbers were coming in and over the previous four weeks, not including this one, and the draws were greater than what everyone expected. I think this is a one-time reversal to get the numbers back in alignment. I think numbers went incorrectly for four weeks and now they are going the other way.

“We are going to need some cold weather [to get to $4] because the producers are going to ramp up and start selling again. There will have to be some real cold weather and confirmation of that cold weather [colder than what is already in the market] to get the speculative traders to add to their position.

“I think they will get it. Next week I think we will see longer-term weather reports turn colder and bolster the market. If we get that, the specs will get long again. They are long now, but they liquidated a lot over the last two days. I think we’ll get a push to $4 but not in the February contract, $3.70 to $3.75 at best, and I think the March contract will see $4 to $4.25,” Harry said.

In physical market trading next day gas in New England and the Mid-Atlantic rose as forecasts called for temperatures in major market areas to hold well below seasonal norms. Forecaster Wunderground.com predicted that the high Thursday in New York City of 33 would creep up to 34 Friday before settling in at 26 on Saturday, 12 degrees below normal. Chicago’s 13 high Thursday was forecast to slide to 11 Friday before climbing back up to 23 on Saturday, 8 degrees below normal.

Gas at the Algonquin Citygate gained $1.18 to $7.85, and deliveries to New York City on Transco Zone 6 rose 82 cents to $5.32. Gas at the Chicago Citygate, however, slipped 17 cents to $3.32.

Elsewhere, packages at the Henry Hub were quoted 7 cents lower at $3.30, and deliveries on El Paso Permian shed 6 cents to $3.20. Gas priced at the SoCal Border Avg. Average dropped 12 cents to $3.33.

Forecasters are mulling just how much cold, Canadian air is likely to make it south into the U.S. during the six- to 10-day period, and according to WSI Corp. the “changes are mixed, but the colder changes over the central and northern US outweigh any warmer revisions,” the firm said in its morning report to clients. “As a result, CONUS GWHDDs are up 2.7 to 122.9 for the period, which are still 32.3 below average.

“The forecast has some risks in either direction. There are colder risks across the northern states, especially the north-central US due to its proximity to the polar air over west-central Canada.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |