Natural Gas Futures Fly to 14-Year High, Approach $9.40 Handle Intraday

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

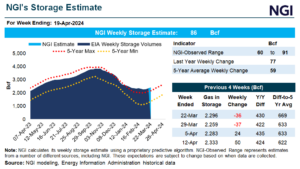

More operational wobbles at the Freeport LNG terminal and worries of an expected bearish government storage print Thursday triggered another bout of selling in natural gas futures Wednesday. At A Glance: Freeport LNG Train 3 trips EQT sees curtailments through May Analysts expect above-average build The May Nymex contract dove around 10.0 cents in the…

April 24, 2024Infrastructure

Energy Transition

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.