Natural Gas Futures Fall as Market Mulls November Temps; FERC Unleashes Rover Laterals

Natural gas futures slid a few cents Thursday as weather data provided little certainty on temperature trends past the second week of November, while government storage data that missed to the bullish side of most estimates failed to impress.

In the spot market, mild temps pressured Northeast points, while Appalachian points could soon see a lift from more takeaway capacity as FERC on Thursday cleared the Rover Pipeline’s remaining two laterals for service. The NGI Spot Gas National Avg. climbed 2.0 cents to $3.005/MMBtu.

The December Nymex contract dropped 2.4 cents to settle at $3.237 after trading as high as $3.318 and as low as $3.216. January fell 2.7 cents to $3.275, while February gave up 3.7 cents to $3.173.

The midday weather data maintained warmer trends for early next week and cooler trends for Nov. 9-14 on a series of weather systems expected to move across the northern, central and eastern United States, according to NatGasWeather.

“The data suggests a milder break around Nov. 15-16, then mixed on whether additional cool shots will follow into the northern U.S. Nov. 17-18,” the firm said. “…Going forward, the markets will be closely watching the Nov. 15-18 pattern since some solutions show a mild pattern setting up and others show cold shots returning.

“Clearly, if cool shots were to continue for the third week of November, deficits wouldn’t have much opportunity to improve,” NatGasWeather said, adding that it continues to view the $3.13-3.14 area as the target for the bears to take out and for the bulls to hold.

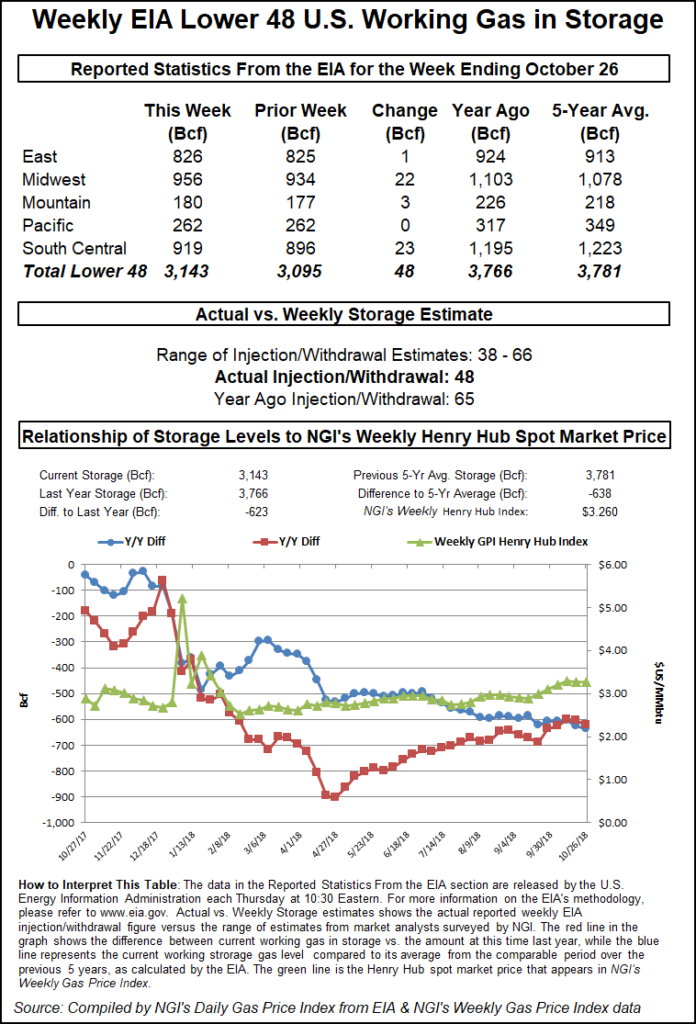

On the storage front, the Energy Information Administration (EIA) reported a 48 Bcf injection into Lower 48 natural gas stocks for the week ended Oct. 26, slightly below survey averages, prompting a mixed reaction from the futures market.

After probing above $3.310 in early trading Thursday on the colder temperatures expected during the second week of November, only to drop back to around $3.270 after 9 a.m. ET, Nymex front-month futures got a brief jolt at 10:30 a.m. ET as traders caught their first glimpse of the final number. The December contract briefly added about 1.5 cents to trade as high as $3.295, but within minutes prices reversed down to $3.252.

Shortly after 11 a.m. ET, December was trading down around $3.241, off 2.0 cents from Wednesday’s 3.261 settle.

The 48 Bcf build widens the year-on-year and year-on-five-year deficits on the last full report week before the start of the traditional November-to-March winter heating season. Last year EIA recorded a 65 Bcf injection for the week, and the five-year average is a build of 62 Bcf.

Prior to Thursday’s report, predictions from market participants had clustered around the low-50 Bcf range.

Bespoke Weather Services, which had called for a 53 Bcf injection, viewed this week’s report as slightly tighter, indicating the “extreme looseness” evident in last week’s 58 Bcf injection was a “relative one-off.” Still, the forecaster said it sees enough looseness in the market that prices could “pull back significantly on any warming trends” as weather continues to steer the direction of prices.

Total working gas in underground storage stood at 3,143 Bcf as of Oct. 26, down 623 Bcf (16.5%) from last year and 638 Bcf (16.9%) below the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 23 Bcf, including 16 Bcf injected into salt and 8 Bcf into nonsalt. The Midwest posted a 22 Bcf net build for the week, while only 1 Bcf was refilled in the East. The Mountain saw a 3 Bcf injection, while Pacific inventories held flat week/week, according to EIA.

Appalachia Up, West Texas Down

Spot prices were mixed in the Northeast Thursday but generally came under downward pressure as above-normal temperatures were expected to linger along the Interstate 95 corridor into the end of the work week. Algonquin Citygate and Transco Zone 6 NY continued to trade below $3 and well back of Henry Hub as Radiant Solutions was calling for highs in the mid- to upper 60s in Boston and New York Friday.

Prices strengthened across the Midwest and Appalachia amid reports of chillier temperatures and precipitation accompanying a system expected to push eastward over the next few days.

“Warm high pressure” was expected to “rule the southern and eastern U.S. another day with mild to warm conditions as highs reach the 50s to 80s,” NatGasWeather said Thursday. “Although, there’s a weather system with slightly cool conditions over the east-central U.S. and portions of the South producing heavy showers that will track into the East Friday through Sunday for a swing back to near normal demand, but still not exceptional with lows behind the cool front only in the 30s and 40s.”

In the Midwest, Chicago Citygate added 6.5 cents to $3.170, while in Appalachia, Dominion South climbed 3.0 cents to $2.720.

Potentially signaling further upward pressure on spot prices in Appalachia, FERC on Thursday authorized Rover Pipeline LLC to place the last of its 3.25 Bcf/d, 710-mile greenfield pipeline into service.

Federal Energy Regulatory Commission staff granted Rover’s request to place its Sherwood and CGT supply laterals into service, along with its Sherwood Compressor Station, Sherwood Receipt Meter Station and CGT Delivery Meter Station.

Heavy rainfall has caused some restoration and construction delays for crews constructing pipelines in Appalachia in recent months, and FERC on Thursday said it would continue to inspect and monitor the Rover right of way to ensure restoration and winterization progress and that it repairs 44 slips documented for the project.

The order should clear the way for Rover — designed to connect Marcellus and Utica shale supplies to markets in the Midwest, Gulf Coast and Canada — to gather additional supplies out of West Virginia and make full use of its substantial capacity this winter heating season.

The recent capacity additions out of Appalachia, including Rover, Transco’s Atlantic Sunrise and the Nexus Gas Transmission pipeline, have been “nothing short of a game-changer for the Northeast gas market, particularly for Appalachian producers who’ve been selling their gas at severely discounted prices for years,” RBN Energy LLC analyst Sheetal Nasta said.

“While Marcellus/Utica production is continuing to drive U.S. production growth,” narrowing spot basis differentials at Appalachian hubs “signal a sea change in the regional market balance, namely the ability for excess gas supply to leave the Northeast.”

Nasta pointed to Cabot Oil & Gas Corp.’s recent earnings results as evidence that the new capacity is already paying off for producers.

“Given stronger Northeast supply prices and improved margins, RBN’s production economics model suggests that the Marcellus/Utica gas market is poised for another few years of impressive growth, with the potential to unleash at least another 8 Bcf/d into the market by 2023,” the analyst said. “Long-term, however, that optimism assumes takeaway capacity continues to keep up or stay ahead of production growth.”

Returning to the near-term, another major producing region, the Permian Basin, could see constraints with El Paso Natural Gas set to begin a three-day maintenance event starting Friday as the operator conducts a flow control valve installation, part of its Permian North expansion, according to Genscape Inc.

“The ”EUN PECS’ and ”PERM N’ flow points will both experience operating capacity reductions,” Genscape analyst Joe Bernardi said. “EUN PECS, which tracks southwestern flows between the Eunice and Pecos stations, will be limited to zero. It only averaged 21 MMcf/d across October, but it spiked up to 166 MMcf/d during the initial cycles for Thursday’s gas day. PERM N posted steadier volumes in October, at an average rate of 130 MMcf/d, and will be limited to 83 MMcf/d.”

Seven non-throughput meters on El Paso were also expected to see reduced operating capacity. The maintenance is part of a larger series of events as El Paso looks to expand capacity flowing north out of the Permian, according to Bernardi.

Spot prices were mixed in West Texas Thursday, with most points declining. Transwestern dropped 18.0 cents to $1.420, while El Paso Permian fell 13.5 cents to $1.565. The exception was El Paso – Plains Pool, which added 5.5 cents to $2.060.

In the Rockies, Northwest Sumas prices continued to moderate amid recent reports of capacity returning along Enbridge’s Westcoast Transmission System in British Columbia following last month’s pipeline rupture.

“Westcoast has completed repairs on the section of pipeline that exploded on Oct. 9, and as a result expects that it will be able to return some additional southbound flow capacity over the next 48 hours,” Bernardi said. “However, Westcoast will not be able to resume full pre-explosion flow capacity for some time yet, as both the ruptured 36-inch line and the parallel 30-inch line will be operating at reduced pressure while Westcoast conducts inspections.”

The completed repairs on the 36-inch line will allow up to 900 MMcf/d of flows through the Station 4B South and Huntingdon constraint groups, versus previous maximum capacity of 800-850 MMc/d, according to Bernardi.

“Going forward, Westcoast will be inspecting its T-South system at various points along the line to ensure operating integrity,” the analyst said. “It will be making stepwise capacity increases as these pipe segments are inspected and approved. Westcoast has stated that it expects maximum capacity for the Huntingdon constraint to increase to 1.2-1.3 Bcf/d by the end of November.”

Northwest Sumas dropped 33.5 cents to $4.075 Thursday. In California, Malin gave up 5.5 cents to $3.000.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |