NatGas Rigs: End of The Century

After threatening to do so for weeks, the U.S. natural gas-directed rig count breached the century mark in the latest tally from Baker Hughes Inc., which was released on Friday.

The U.S. gas rig count fell by five units to 97; that’s down by 171 units from one year ago when it was 268.

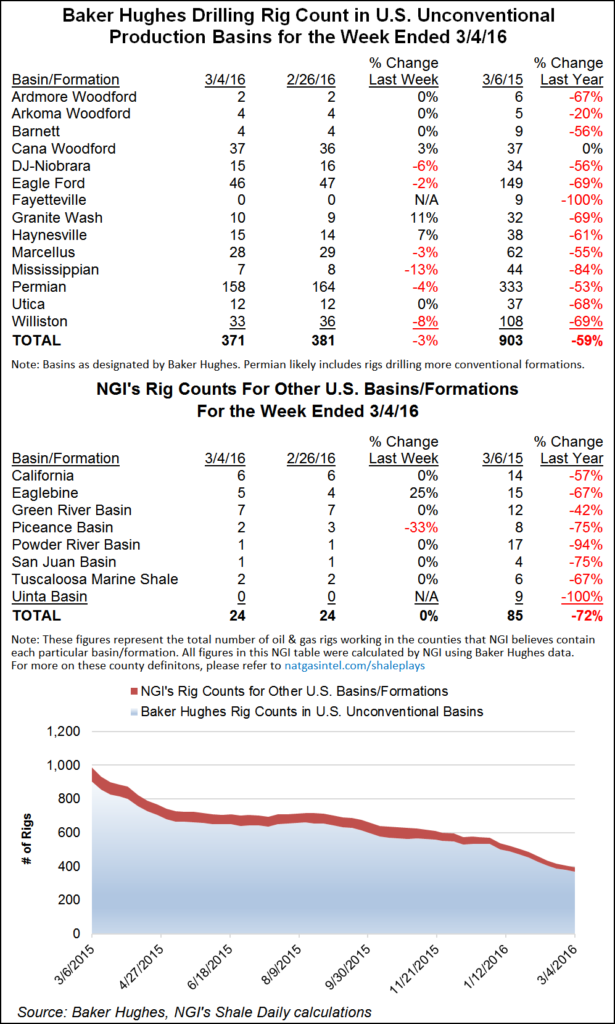

Among the big gas plays, the Barnett held steady at four active rigs, as did the Fayetteville, with no rigs running. The Haynesville Shale actually added one unit to end at 15 running.

The U.S. oil rig count ended at 392 after losing eight units. That’s a decline of 530 rigs from the year-ago level of 922.

The overall U.S. rig count came to rest at 489 active units, a decline of 13 from the previous week and 502 from the year-ago level.

Ten rigs left land action and three were taken out of offshore operations. Five of the departing rigs were directionals, and the remaining eight leaving were horizontals.

Texas gave up four, leading the pack of declining states, and the Permian Basin lost six units, leading declines among plays.

A 46-unit drop in the Canadian rig count was driven by an early spring break-up.

“Typically, the first few months of the year are the busiest part of the year. However, to date in 2016 activity levels have remained well below seasonal norms, and warm weather combined with weak customer demand appeared to be leading to an early spring break-up,” Lyle Whitmarsh, CEO of Calgary-based Trinidad Drilling Ltd. said during an earnings conference call on Thursday.

Alberta alone saw 33 rigs leave the game, letting the count of active rigs there rest at 79. British Columbia lost four rigs to end at 27 active. Saskatchewan lost eight rigs to end at 19.

Spring break-up happens as Western Canada thaws, driving frost from the ground and softening roads too much to be traveled upon by heavy trucks. During this period, rigs can’t be moved, and many of them must shut down until road bans are lifted. Trouble is, this year’s spring break might run longer than usual — or desired.

“We have limited visibility for post break-up, and competition remains very strong,” Whitmarsh said during the conference call. “Day rates remain under pressure, although we continue to be focused on maintaining reasonable margins in our operations…We expect the first half of 2016 to be quite weak in Canada and an improvement in the back half of the year only if there is an improvement in commodity prices.”

During a speech late last month in Edmonton, Alberta, ATB Financial Chief Economist Todd Hirsch said, “Between now and probably mid-summer, I do expect that we will see more pain in the petroleum sector, more rounds of layoffs…A lot of those work crews [off for spring break-up] just aren’t going to be called back for the summer drilling season,” he said, as reported by CBC News.

Canada’s rig count stands at 129, down by 171 units from its year-ago level of 300. Thirty-three oil-directed units left in the latest round, and 13 gas-directed rigs left.

The Railroad Commission of Texas (RRC) just came out with preliminary production figures for December, which, of course, will be revised, most likely upward.

Production for December was 74.58 million bbl of crude oil and 625.41 Bcf of total gas from oil and gas wells.

Production reported for December 2014 was: 71.07 million bbl of crude oil preliminarily, updated to a current figure of 91.30 million bbl; and 627.69 Bcf of total gas preliminarily, updated to a current figure of 756.75 Bcf.

RRC said that in the preceding 12 months, total Texas reported production was 1.009 billion bbl of crude oil and 8.3 Tcf of total natural gas. Crude oil production is limited to oil produced from oil leases and does not include condensate.

Texas December production came from 184,829 oil wells and 90,182 gas wells.

More recent — for January — and potentially more heartening production data came from the economist who compiles the Texas Petro Index. Karr Ingham said January Texas crude production declined from its year-ago level.

“Although the decline was modest, we can expect the pace of production decline in Texas and the U.S. to accelerate in 2016,” Ingham said (see Shale Daily, March 3).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |