Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Continue Slide as EIA Reports Relatively Stout Inventory Pull

Although most physical traders try to get their deals done before the release of Energy Information Administration (EIA) natural gas inventory data, it looked as though the cash market was dancing to the same tune as futures Thursday. Both lost about a nickel.

In physical trading, Thursday for Friday delivery cash natural gas was lower at most points by a few pennies and the NGI National Spot Gas Average fell 6 cents to $1.54. The EIA reported a withdrawal somewhat greater than expectations, but with natural gas inventories bursting at the seams, futures continued on the path downward. At the close April had lost 3.9 cents to $1.639 and May had shed 3.3 cents to $1.767. April crude oil fell 9 cents to $34.57/bbl.

Next-day gas was down by double digits at eastern points as weakness in next-day power markets gave gas buyers for power generation little incentive to make incremental purchases. Intercontinental Exchange reported that on-peak power at ISO New England’s Massachusetts Hub fell $5.96 to $33.63/MWh and Friday peak power at PJM Interconnection’s West terminal fell $3.48 to $30.28/MWh.

Gas at the Algonquin Citygate tumbled 94 cents to $3.36, and gas on Tenn Zone 6 200L was quoted 75 cents lower at $3.28. Deliveries to Iroquois, Waddington came in 20 cents lower at $2.04.

Gas on Texas Eastern M-3, Delivery fell a penny to $1.21, and parcels bound for New York City on Transco Zone 6 changed hands 11 cents higher at $1.82.

In the Midwest, soft power prices also reduced the need for additional gas to fuel power generation. Intercontinental Exchange reported that at the Indiana Hub on-peak Friday power slipped $1.69 to $23.01/MWh.

Next-day deliveries to Alliance skidded 6 cents to $1.68, and gas at the Chicago Citygate shed 6 cents as well to $1.66. Deliveries to Joliet were seen a nickel lower at $1.68.

Wednesday’s gains of about a dime at points downstream from the REX Zone 3 shut-in were adjusted as REX declared the end of a force majeure on westbound Zone 3 gas (see related story).

Zone 3 receipts at the Moultrie County, IL, interconnect with NGPL fell 9 cents to $1.53, and gas at the Douglas County, IL, junction with Trunkline skidded 11 cents to $1.53. Packages at the Panhandle Eastern point in Putnam Country, IN, fell 11 cents as well to $1.53.

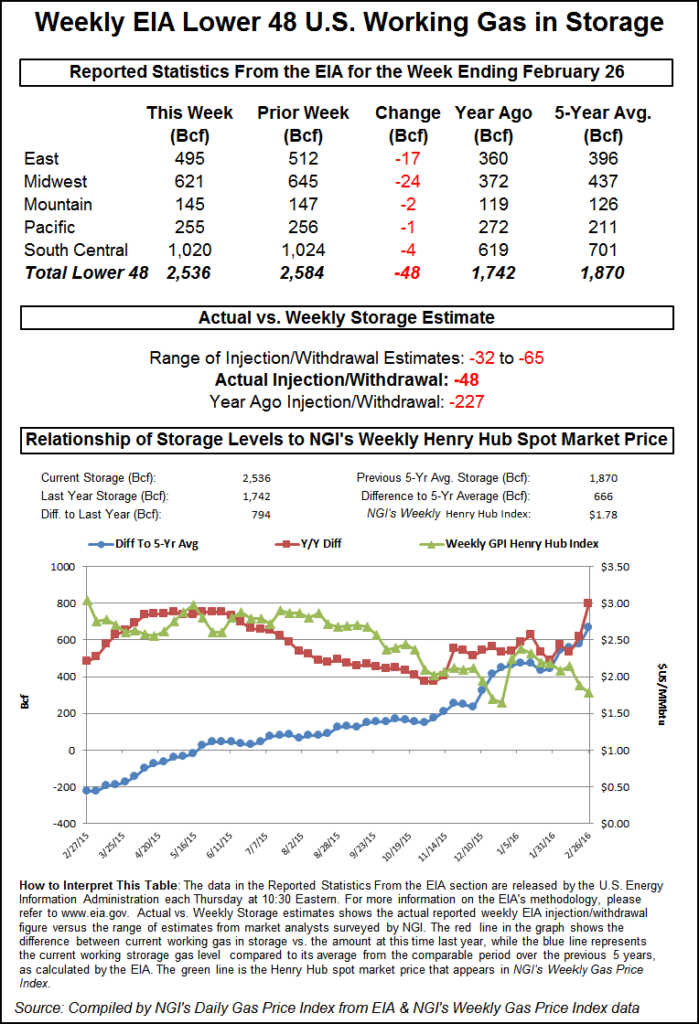

The 10:30 a.m. EST release of storage data resulted in the futures market seemingly having to deal with a bullish number as the reported withdrawal of 48 Bcf was a bit more than the market was looking for. Last year 227 Bcf was pulled and the five-year pace is for a 137 Bcf withdrawal. Citi Futures Perspective calculated a 35 Bcf withdrawal, and a Reuters poll of 22 traders and analysts revealed an average 41 Bcf decline with a range of -32 Bcf to -65 Bcf.

The market, however, did not move out of the session’s trading range. The April high for the day prior to the release of the number was $1.682 and the low was $1.633. Once the number was released, April futures rose to a high of $1.660, and by 10:45 a.m. April was trading at $1.645, down 3.3 cents from Wednesday’s settlement.

“If you look at it last year was a draw over 200 and the five-year average is 137. It would have had to have been a much higher draw to affect the market,” a New York floor trader told NGI. “There’s no upward momentum off these numbers. Next week I’m hearing about the same.”

Randy Ollenberger, an analyst at BMO Nesbitt Burns said, “We believe the storage report will be viewed as positive, since the draw exceeded expectations. Weather will remain the key driver of natural gas prices over the next month; however, the winter heating season ends this month and storage levels are more than ample.”

Inventories now stand at 2,536 Bcf and are a plump 794 Bcf greater than last year and 666 Bcf more than the five-year average. In the East Region 17 Bcf was pulled, and the Midwest Region saw inventories fall by 24 Bcf. Stocks in the Mountain Region fell 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region withdrew 4 Bcf.

Weather models are coming into sharper agreement, thus giving greater confidence that the warm patterns will continue. Commodity Weather Group in its Thursday morning report said, “We continue to track an impressive story rivaled only by December’s persistent warmth in terms of widespread above normal temperature intensity and duration.

“The models continue to be in impressive agreement on the prevailing pattern, too, which is helping to boost our forecast confidence to fairly high levels for both the six-10 and 11-15 day. The six-10 day remains the warmest of the two periods, but there are concerns continue that the 11-15 day could ultimately surprise even warmer, too, given the prevailing pattern situation,” said Matt Rogers, president of the firm.

Tom Saal, vice president at FCStone Latin America LLC in his work with Market Profile said to “look at Monday/Tuesday breakdown weekly targets…we are seeing a combination of weak front month prices and stronger forward carry…be aware of this situation (not a trend yet).” Saal places the 50% weekly breakdown target at $1.640 and the 100% target at $1.595.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |