NatGas Bears Deal Bulls Another Head-Scratcher Following Supportive Storage Data

November natural gas futures surprisingly fell Thursday following a report by the Energy Information Administration (EIA) showing a storage injection that was less than what traders had been expecting.

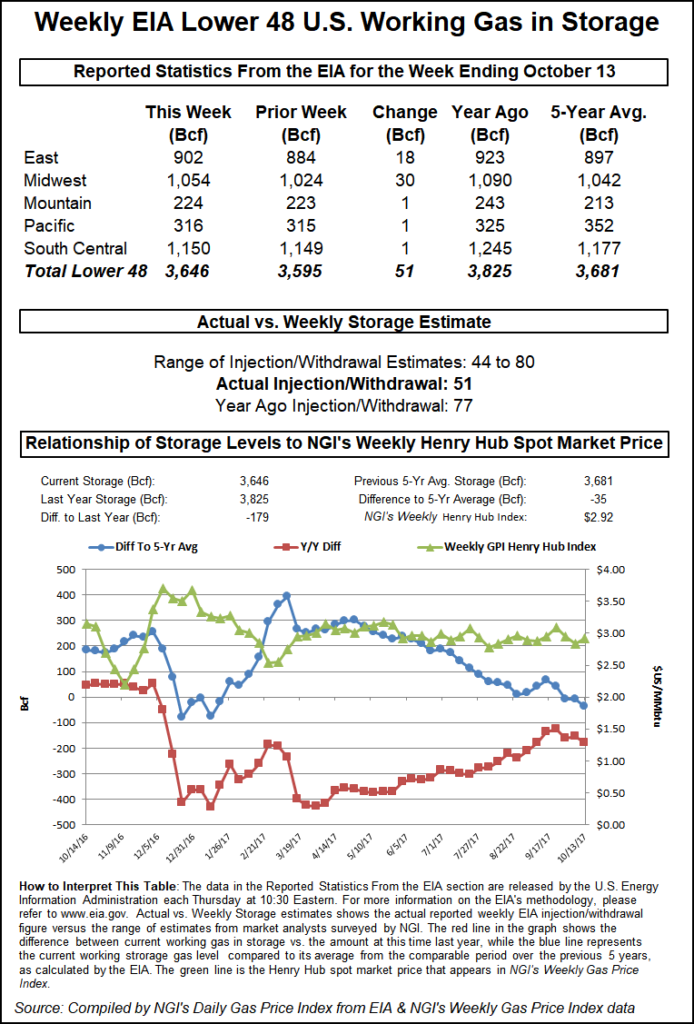

The EIA reported a storage injection of 51 Bcf for the week ended Oct. 13, about 4 Bcf less than consensus estimates. Just before the 10:30 a.m. EDT release the market was hovering around $2.840 and following the release of the number November futures dropped to $2.806. By 10:45 a.m., November was trading at $2.815 down 3.9 cents from Wednesday’s regular session close.

Before the release of the data traders were looking for a storage build that was somewhat larger, but less than historical norms. Last year 77 Bcf was injected and the five-year average stands at 78 Bcf. Citi Futures Perspective calculated a 63 Bcf injection and ION Energy was looking for a 78 Bcf build. A Reuters survey of 26 traders and analysts showed an average 55 Bcf injection with a range of +44 Bcf to +80 Bcf.

“We were hearing an increase of about 55 Bcf so the market is a real head-scratcher,” said a New York floor trader. “In the natty world there are a lot of puzzling days.”

The trader estimated that there may be resting stop loss orders “just below” $2.75, and “if we trade under $2.75 for a couple of days, this market may go south in a hurry, but we have been at these levels before and it has come back.”

He offered the caveat that “guys don’t put stops in the market anymore. They find that once they put a stop [loss order] in the market, it takes them out and goes right back to where it was. They will just pick a spot they want to get out and if the market trades down to that level or within a tick or two they just get out.

“It’s like the algorithms look for these stops and they literally take them out within one or two ticks and rally right back. It’s not worth even putting your stop in,” he said..

The analytical team at Wells Fargo called the report neutral. “The focus remains on weather forecasts for the remainder of shoulder season and current projections from the NOAA (National Oceanic and Atmospheric Administration) forecast warmer than normal temperatures across most of the northeastern U.S. for the next two weeks.

“As we move into late October/November, warmer temperatures become bearish for demand as Heating Degree Days (HDDs) are lost. Therefore, if warmer weather persists into November we could see storage creep back up to levels in-line with or above the five-year average.”

Inventories now stand at 3,646 Bcf and are 179 Bcf less than last year and 35 Bcf less than the five-year average. In the East Region 18 Bcf were injected, and the Midwest Region saw inventories rise by 30 Bcf. Stocks in the Mountain Region were 1 Bcf greater and the Pacific Region grew by 1 Bcf as well. The South Central Region added a Bcf also.

Salt storage fell by 8 Bcf to 302 Bcf and non-salt storage increased 9 Bcf to 847 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |