NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Most E&P Efficiency Gains Tied to OFS Pricing Concessions, Not Better Drilling, Says Schlumberger CEO

The challenges now facing the oil and natural gas industry partly are driven by the sharp decline in commodity prices, but they also result from failing to improve performance enough to tackle increasingly more complex hydrocarbon developments, Schlumberger Ltd.’s chief charged Monday.

Paal Kibsgaard, who helms the largest oilfield services (OFS) company in the world, was keynote speaker on the opening day of the Scotia Howard Weil 2016 Energy Conference underway in New Orleans.

“In spite of the unique structural nature of this downturn, oil and gas operators have once again activated the traditional playbook they have used to navigate every industry downturn since the 1970s,” he told the audience. “This dictates halting investments in exploration, aggressively curtailing development activity and relentlessly squeezing service industry prices.

“This ”hold-your-breath and-hope-for better-times-soon’ playbook has in the past allowed the industry to live through shorter-term demand downturns, while waiting for business to return to normal.”

It’s unlikely that oil prices will return to $100/bbl anytime soon, he said. The Organization of the Petroleum Exporting Countries (OPEC) has turned the screws to protect market share rather than oil price, demonstrating it continues to have a firm grip on the global exploration and production (E&P) industry.

The international oil companies (IOC) within OPEC still generate significant returns because of the low cost base of their conventional resources, which means a much longer wait until prices strengthen long-term.

“Assuming a 1% demand growth scenario, it first means that the ”hold-your-breath’ approach of the oil and gas operators will be unable to deliver the required production growth,” said Kibsgaard.

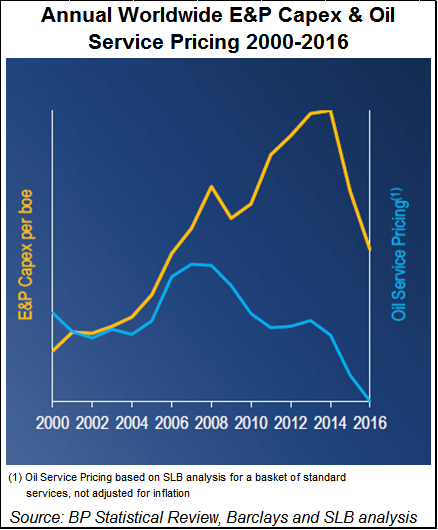

Another myth is the drilling efficiencies being touted by E&Ps. Yes, drilling has gotten better, but most of the price gains touted by E&P management are related to pricing concessions extracted from the OFS sector. OFS operators simply are fighting for survival and are doing what it takes to keep customers — cutting prices as much as they can and even taking losses. Once activity begins to pick up, OFS pricing mostly will reverse, he said.

“The fact remains that the industry’s technical and financial performance was already challenged with oil prices at $100/bbl, as seen by the fading cash flow and profitability of both the IOCs and independents in recent years,” Kibsgaard said.

“Over the past decade, our industry has simply not progressed sufficiently in terms of total system performance to enable cost-effective development of increasingly complex hydrocarbon resources. This can be seen by the escalating industry cost per barrel.”

The U.S. land rig count peaked in October 2014, and the “rate of disruption” across the energy sector has led to a “full-scale cash crisis.”

Schlumberger expects 1Q2016 revenues to drop by more than 15% sequentially from 4Q2015 to about $6.5 billion. The weakened E&P outlook further suggests earnings declines in the second quarter.

“The latest data points have, in recent weeks, sent the oil price up toward $40/bbl, and we would expect the upward trend to continue as the physical balances tighten further in the coming quarters,” said Kibsgaard.

“In spite of this, we maintain our view that there will be a noticeable lag between higher oil prices and higher E&P investments given the fragile financial state of our customer base, which means that there will be no meaningful improvement in our activity until 2017,” something Kibsgaard has stressed for months (see Shale Daily, Jan. 22).

Schlumberger is being proactive to prepare sustainability once the upturn occurs. One push is to remake E&P commercial contracts because he said the “procurement-driven contracting model,” used since the late 1990s, has become an obstacle to improving performance.

The rationale for that approach was driven in part because OFS companies generally are perceived to have little to offer in creating fit-for-purpose designs or optimizing execution for E&Ps, so they generally don’t have a big impact on the technical/financial performance of projects until late into the process.

“This limited engagement is in spite of the service industry producing the lion’s share of the hardware and software technologies used to develop the world’s hydrocarbon resources,” said the CEO.

A collaborative contract model, one which aligns with E&P commercial interests, would “change the way the industry works in order to restore technical performance and financial results to match that of other technology-based industries.” The oil price downturn has only strengthened Kibsgaard’s belief that the contracts have to be revised to improve projects once development again gets underway.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |