NGI All News Access | Coronavirus | Markets

More Volatility for Natural Gas Futures as Markets Weigh Coronavirus Impacts

Volatility continued in the natural gas futures market Thursday as traders were left to weigh the inherent uncertainty of the escalating coronavirus pandemic against a fundamentally more bullish supply outlook. The April Nymex contract traded as high as $1.883/MMBtu and as low as $1.750 before going on to settle at $1.841, down 3.7 cents.

In the spot market, Western U.S. hubs gave back some of their gains from the previous session as NGI’s Spot Gas National Avg. sank 14.0 cents to $1.605.

Natural gas had been in a steady downtrend throughout the winter months driven by mild weather and a supply glut, but that changed this week as the market recognized the potential upstream impacts of the collapse in crude prices, according to Powerhouse Vice President David Thompson. The drop in oil prices “changes the baseline assumptions” for the market moving forward.

“This has been a very interesting week in natural gas, even though everybody’s been focusing on crude oil,” Thompson told NGI. “The natural gas story could be about to enter a different chapter in that we might have something coming to potentially reduce supply.”

Even after declines over the past two sessions, as long as prices stay above $1.770 for the front month it will represent a pause in the downtrend, which stretches back to November, according to Thompson.

As for the potential demand shocks from the coronavirus outbreak, Thompson said the impact on natural gas is not clear-cut, at least not in the same way that reduced travel will have a direct hit on oil demand, as one example.

“I’m not sure coronavirus is a prime driver for natural gas,” he said. “What might be an issue for natural gas is more” oil production from the Organization of the Petroleum Exporting Countries leading to more associated gas entering the global market. “Domestically speaking, if you have some reduction in economic activity you might have some reduction in commercial and industrial gas demand in the U.S.,” but this wouldn’t compare to the impacts on crude.

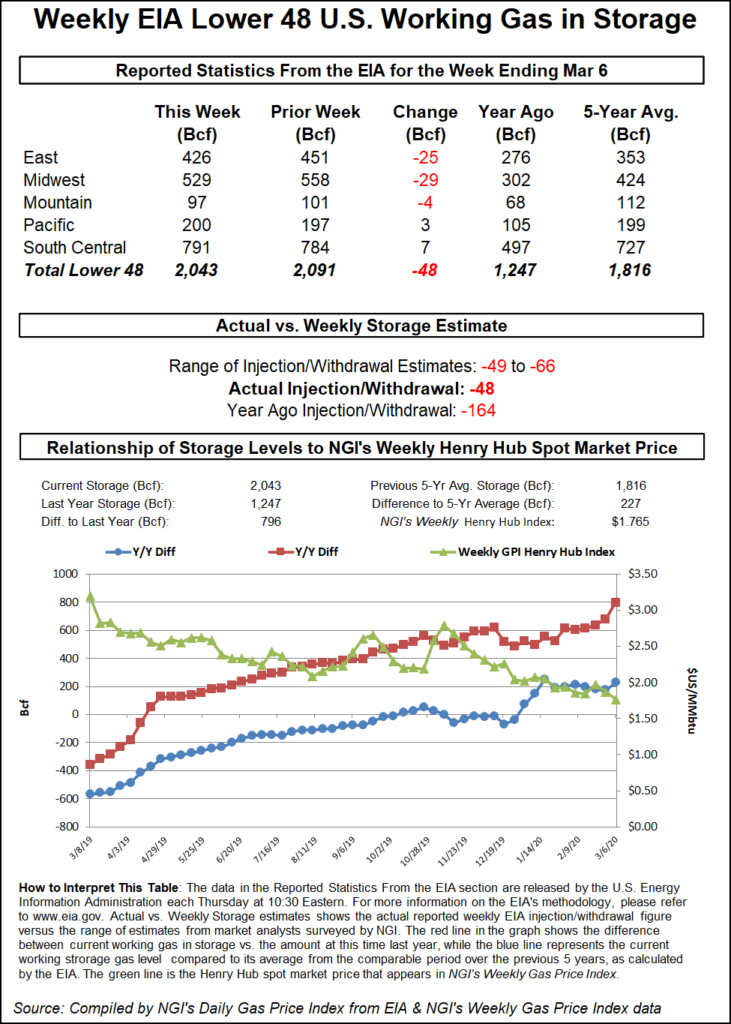

Meanwhile, the Energy Information Administration (EIA) Thursday reported a lighter-than-expected 48 Bcf weekly withdrawal from U.S. gas stocks, prompting a mixed response from futures.

Major surveys had pointed to a withdrawal in the mid- to upper-50s Bcf, putting the actual figure well to the bearish side of expectations. The draw also is much smaller than historical norms. The actual withdrawal was much smaller than both last year’s 164 Bcf pull for the similar week and the five-year average withdrawal of 99 Bcf.

During a discussion on energy-focused social media platform Enelyst, EBW Analytics Group analyst Eli Rubin said the firm’s latest estimates show inventories at 3.9-4.0 Tcf for the end of the 2020 injection season.

There are “huge uncertainties depending on how fast producers can react and slow production and on how much” liquefied natural gas (LNG) gets exported, Rubin said. “But many risks are to the downside” in terms of prices.

Enelyst managing director Het Shah said there are currently offsetting factors affecting end-of-summer inventory expectations.

“Any drop in production from lower prices is being offset by lower LNG exports,” Shah said.

Prior to the report, a Bloomberg survey had shown a median 56 Bcf pull, while a Reuters poll had landed on a withdrawal of 59 Bcf. NGI’s model had predicted a 51 Bcf withdrawal for the report, which covers the week ended March 6. Estimates had ranged from minus 49 Bcf to minus 66 Bcf.

Total Lower 48 working gas in underground storage stood at 2,043 Bcf as of March 6, 796 Bcf (63.8%) higher than year-ago levels and 227 Bcf (12.5%) above the five-year average, according to EIA.

By region, the Midwest withdrew 29 Bcf week/week, while the East pulled 25 Bcf. The Mountain region saw a 4 Bcf withdrawal, while the Pacific injected 3 Bcf. The South Central injected 7 Bcf during the period, including 6 Bcf into salt stocks and 1 Bcf into nonsalt, according to EIA.

The palpable sense of anxiety over the coronavirus pandemic, which had equity markets swooning Thursday, made parsing the natural gas market’s attitudes about the weather and storage outlook more difficult.

Changes to the latest forecast guidance didn’t seem to have any correlation with intraday gains following the EIA report, according to NatGasWeather.

“Recent weather trends have been a little cooler across the northern U.S. for early next week but milder over much of the country March 18-23 by showing less subfreezing air over Canada pushing across the border,” NatGasWeather said. “No changes overall, with weather patterns exceptionally bearish this week, better this weekend into early next week…but then back to being too mild for most of the country by the middle of next week through March 25.

“…As we’ve been mentioning, it’s been rather difficult to know exactly how much weather patterns have been influencing prices due to huge moves in oil, gold and equity markets every hour, and that’s likely to continue into the Friday close.”

The volatility in the futures market appeared to spill over into spot trading Thursday, with prices posting sizeable discounts after two straight days of widespread gains. Henry Hub dropped 10.0 cents to $1.820.

Hubs throughout the Western United States retreated despite forecasts showing a drop in temperatures for major cities throughout the region heading into the weekend. Genscape Inc. called for a “moisture-laden cold front” moving into the Pacific region to boost demand over the next few days.

Day-time highs in cites including Seattle, Los Angeles, Phoenix and Denver could see large swings lower over a 24-hour period associated with this system, according to the firm.

“The system is also expected to drop hefty amounts of moisture,” Genscape senior natural gas analyst Rick Margolin said. “Coastal areas are expected to receive as much as 10 inches of rain over the next five days. This rain may erode some of the bullish impacts of the event by triggering an uptick in hydro generation, a situation that could be exacerbated by regional reservoirs being forced to spill since many are already at or above normal levels.”

Demand across the areas included in EIA’s Pacific and Mountain storage regions is expected to reach a 10-day peak of 16.8 Bcf/d by early next week, according to Genscape.

“Based on forecast temperatures through Monday we expect to see Pacific Northwest demand rise close to 3 Bcf/d, a level that has been breached just one day this calendar year,” Margolin said. Regional demand in Southern California is expected to surpass 4.2 Bcf/d.

Still, after strong gains in the previous session, spot prices eased lower throughout the Rockies and California Thursday. Northwest Sumas shaved off 8.5 cents to average $2.090, while SoCal Citygate eased 4.5 cents to $2.350.

Farther upstream in West Texas, heavy discounts were the norm, including a 31.0-cent drop at Transwestern, which finished at 85.5 cents.

The recent gains in forward trading in West Texas likely stem more from the rout in WTI prices — and a potential resulting drop in associated gas output — than from any change in the outlook for new gas takeaway capacity out of the Permian Basin, according to Genscape.

“We do not believe recent Waha gas price action is tied to any major infrastructural changes, like the anticipated in-service of Wahalajara,” Margolin said. “…We do expect Mexico’s Wahalajara pipeline to begin service sometime this month, which will provide about 1 Bcf/d of new takeaway capacity out of the constrained Permian Basin. However, we do not see any signs yet that the system has begun operations.”

Elsewhere, hubs throughout the Gulf Coast, Southeast, Midwest and Northeast recorded discounts of around a dime or more. Northern portions of the country continued to experience mild conditions Thursday, while the South enjoyed “warm highs” in the 60s to 80s, according to NatGasWeather. Overall, conditions to close out the work week were expected to result in “very light national demand” amid sparse coverage of truly chilly temperatures.

“Cold air will release out of the Northern Plains and sweep across the northern U.S. this weekend into early next week, with lows” in the single digits to 30s, resulting in a “modest increase in demand after being very light before then,” the forecaster said. The latest data from the Global Forecast System Thursday showed cold lingering “across the Great Lakes and Northeast longer early next week for added demand.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |