Shale Daily | E&P | NGI All News Access

Montage Turning Shut-in Production Back to Sales as Crude, NGL Prices Increase

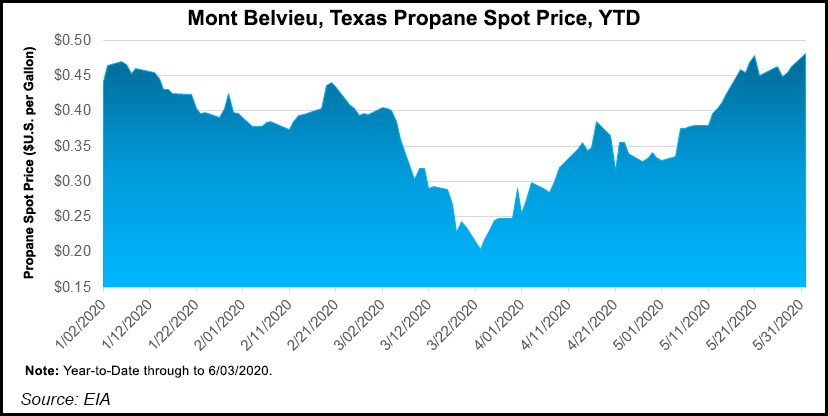

Appalachian pure-play Montage Resources Corp. said rising oil and natural gas liquids (NGL) prices have prompted it to bring back production curtailed earlier in the year, which has led to an increase in full-year guidance.

Like other operators across the country, Montage shut in production in April after oil prices fell precipitously and Covid-19 destroyed energy demand. The company primarily curtailed liquids-rich volumes from Ohio’s Utica Shale. However, as of Monday (June 1), all of the shut-in volumes had been returned to sales.

The company is now guiding for 565-585 MMcfe/d of production this year, or 2% above the midpoint before the Covid-19 lockdowns began in March. Montage now expects 2Q2020 production to be 535-555 MMcfe/d.

“Upon realizing an accelerated rebound in oil pricing and cash margins, the company moved very quickly to return its previously curtailed condensate production back to sales,” CEO John Reinhart said.

Brent crude gained on Monday on rumors that the Organization of the Petroleum Exporting Countries and its allies would maintain significant production cuts beyond June. West Texas Intermediate (WTI) prompt prices briefly flirted at the $40.00/bbl mark on Wednesday but quickly retreated. WTI sank into negative territory in April.

Tudor, Pickering, Holt & Co. (TPH) noted Monday the oil price rally is “checking all the right boxes” for other U.S. producers to reverse curtailments this month. TPH said it expects 1 million b/d of U.S. supply to return through July.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |