E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mitsui Taking Stakes in Four Promising Shell Deepwater Blocks

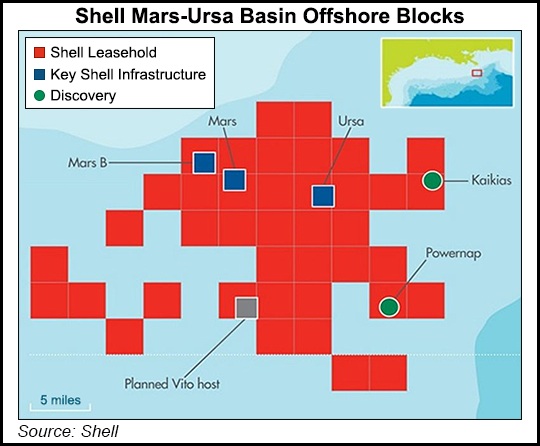

A unit of Japanese trading house Mitsui & Co. Ltd. is buying into some potential powerhouse deepwater Gulf of Mexico assets within the Mars-Ursa Basin owned by Royal Dutch Shell plc that could capture at least 100 million boe in recoverable reserves.

Moex North America LLC agreed to take a 20% working interest in four blocks that encompass Shell developments Circius and Kaikias in Mississippi Canyon (MC). Shell spokesperson Kimberly Windon said Moex is buying stakes in MC blocks 767, 768, 811 and 812. Financial details were not disclosed.

Kaikias and Circius are about 60 miles south of Louisiana, where Shell owns and operate three of its largest tension leg platforms (TLP) in the world — Mars, Ursa and Olympus.

“The assets are located in the Mars-Ursa Basin in close proximity to existing Shell infrastructure in the deepwater heartland, and where Shell has the proven knowledge, technology and expertise to safely and cost-effectively find and produce oil and gas,” Windon said. The basin, which “presents opportunities with lower development costs,” also is attractive “because appraisal drilling in 2014-2015 revealed more than 300 feet of net oil pay, and Kaikias development could exceed 100 million boe recoverable resources.”

Moex executives said the existing near-field infrastructure presents “opportunities for early commercialization at reduced development costs…In addition, there is further exploration potential within the blocks, which may contribute to further build up the reserves and continue production over the long term…” Mitsui also plans to continue to “accumulate cost competitive reserves by taking advantage of current market conditions.”

Shell discovered Kaikias in August 2014, and the discovery was appraised last year through the longest well ever drilled by Shell at 34,500 feet measured depth in 4,575 feet of water. The licenses for Circius were acquired this year.

“The full development plan for these assets includes a five-well program,” Windon said.

The Mars production hub alone, which includes the Mars, Europa, Diemos and King fields, has a processing capacity of 220,000 b/d of oil and 220 MMcf/d of natural gas. Production from the Mars B development through Olympus, which was Shell’s seventh and largest floating deepwater platform in the GOM, ramped up in early 2014.

Mars B was the first deepwater project in the U.S. offshore to expand an existing field with new infrastructure, extending the life of the greater Mars-Ursa Basin to 2050 and beyond. Combined future production from Olympus and the original Mars platform is expected to deliver an estimated 1 billion boe.

Other Shell projects in the GOM include the Stones development, which ramped up in September as the world’s deepest offshore oil and gas project to date. Shell’s Appomattox project, sanctioned last year, has an estimated 650 million bbl of resources. The Cardamon deepwater discovery in Garden Banks Block 427 began producing from the Auger TLP two years ago. Other Shell producing assets in the U.S. GOM include Perdido, a floating production facility with a host spar in Alaminos Canyon Block 857 that began operating in 2010. Production is slated to begin within the next few years on a new geological play in the Jurassic Norphlet formation.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |