Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s CNH Cancels Upcoming Oil, Natural Gas Bid Rounds

Mexico’s Comisión Nacional de Hidrocarburos (CNH) confirmed on Tuesday it has canceled onshore bid rounds 3.2 and 3.3, and it has postponed for six months a farmout tender for stakes in acreage held by national oil company Petróleos Mexicanos (Pemex).

The decision makes official what had been pledged by President Andrés Manuel López Obrador, who took office earlier this month, and Energy Minister RocÃo Nahle, and it could be a sign that the new authorities should be taken at their word.

CNH said rounds 3.2 and 3.3 were being canceled to “revise the energy policy and evaluate the results and advances of the exploration and extraction contracts currently in effect.”

Both López Obrador and Nahle have expressed distrust of the auctions, and of the 2013 constitutional energy reform that made them possible. They have said previously upstream investment in Mexico should be led by Pemex.

In a ceremony last Sunday at the site of a planned oil refinery in López Obrador’s home state of Tabasco, the president pledged a 75-billion peso ($3.7 billion) year-on-year increase in Pemex’s 2019 budget. The goal is to raise national oil output to 2.4 million b/d by 2024 from just under 1.8 million b/d currently.

The president also reaffirmed a campaign promise to reduce dependence on gasoline imports by modernizing Pemex’s six existing refineries, and by building the new one in Tabasco. A tender for the refinery will be launched in March 2019 at the latest, López Obrador said.

The 2013 reform allowed foreign oil companies to enter the upstream segment in Mexico for the first time since the oil industry was nationalized in 1938, an event that López Obrador has praised as a high point in the country’s history.

More than 100 contracts were awarded to foreign and Mexico-based firms in bid rounds held between 2015 and 2018.

Still, López Obrador has alleged that the auctions held to date have failed to live up to their goal of attracting investment and increasing production. Last week, he pledged to suspend bid rounds for three years, and to resume them only if the contracts awarded move beyond development into production.

This impatience, however, is at odds with the lead times and due diligence required to bring a prospect from the exploration phase all the way into production, according to GMEC energy consultancy founder Gonzalo Monroy.

The president’s message, Monroy told NGI’s Mexico Daily is, “”All the companies have to drill now, and they have to produce.’ Well, guess what? That is not how the industry works.”

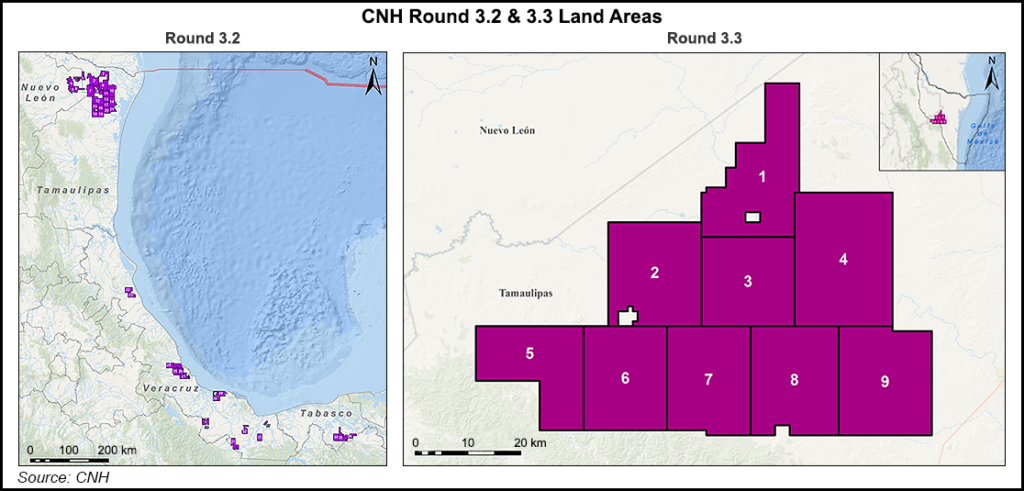

Round 3.2 sought bids for 37 onshore blocks targeting conventional resources, mostly natural gas, in the Burgos Basin in the northeastern region.

Round 3.3 would have placed on offer nine blocks targeting unconventional gas resources in the Burgos Basin as well, and would have been the first auction for unconventional acreage in Mexico’s history.

In addition to his skepticism of the bid rounds, López Obrador has also said he opposes hydraulic fracturing, which is a central part of unconventional production when combined with horizontal drilling.

Since peaking at around 7 Bcf/d in 2008, Mexico’s gross gas production has fallen by 2.9 Bcf/d, and it could continue dropping for another four to six years, according to a November presentation by OPIS PointLogic analyst Warren Waite.

Imports via pipeline from the United States, meanwhile, have hit record highs this year and are projected to continue growing through 2020, according to the Energy Information Administration.

With bid rounds on hold, a secondary market for already awarded contracts is likely to emerge, Monroy said. He pointed to the recently announced acquisition of Mexican independent driller Sierra Oil & Gas by Germany’s DEA Group.

However, Monroy said, the government should be aware that for companies considering entering Mexico, suspending the rounds “is not a good sign, because what they are seeing is that the Mexican government, regardless of the administration, is not a reliable partner. With a new administration, they can change the rules under which they were operating.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |