Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Natural Gas Marketers Report Record High Volumes, Low Prices In July

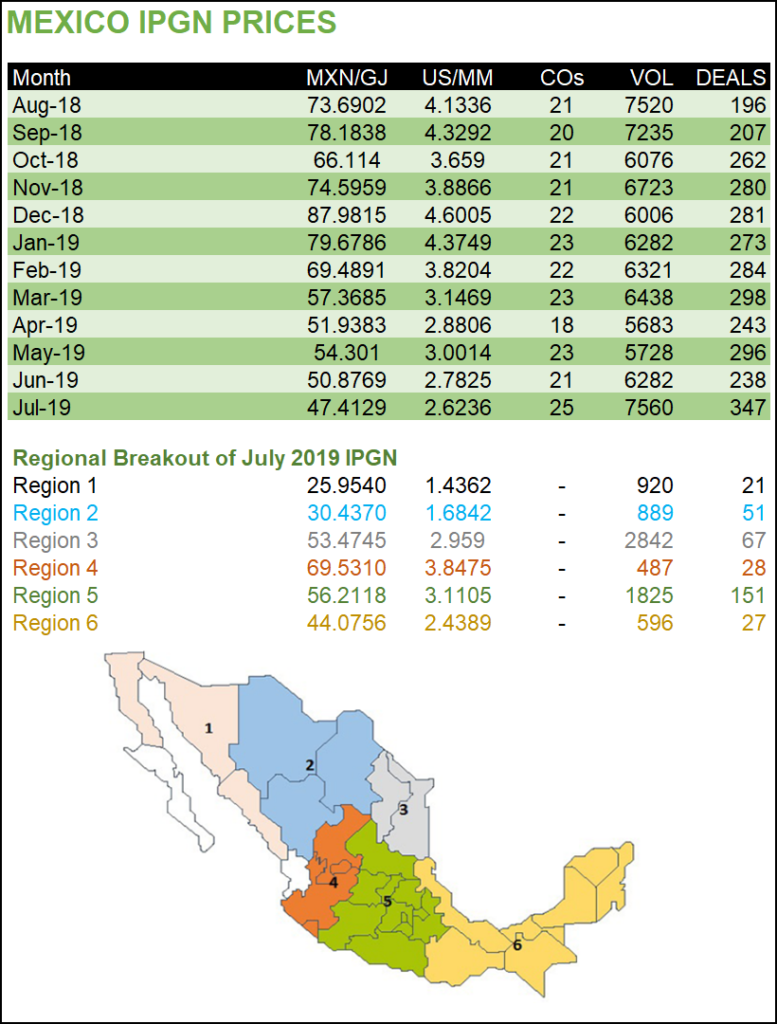

Mexico’s IPGN monthly natural gas price index averaged $2.624/MMBtu in July, the lowest price recorded since the Comisión Reguladora de EnergÃa (CRE) began publishing the index in July 2017.

The July 2019 price was down from an average of $4.090/MMBtu recorded in the same month a year ago.

A total of 25 marketers recorded 347 transactions for an average daily volume of 7.56 Bcf/d in July 2019. All three of these figures are record highs for the index.

They are up from July 2018, when 20 marketers reported 205 transactions for 6.58 Bcf/d.

Traded volumes should increase even more following the commercial startup of the 2.6 Bcf/d Sur de Texas-Tuxpan subsea pipeline. This milestone appears imminent following the resolution of a contractual dispute between the project’s developers and its anchor customer, state-owned utility Comisión Federal de Electricidad (CFE).

The 497-mile conduit will increase Mexico’s natural gas import capacity by 40%, allowing gas production from state oil company Petróleos Mexicanos (Pemex) in southeastern Mexico to reach the gas-starved Yucatán Peninsula.

Wellhead production of natural gas by Pemex averaged 3.74 Bcf/d in July, up from 3.71 Bcf/d in June. The firm is seeking to increase production through the accelerated development of 20 fields in southeastern Mexico, including shallow water and conventional onshore areas.

Dry gas production from Pemex processing centers, meanwhile, rose to 2.368 Bcf/d from 2.238 Bcf/d, a 5.5% increase.

The publication of the July IPGN follows the approval by CRE of new rules meant to ensure operational discipline on the Sistrangas national pipeline grid. The rules seek to reduce the losses incurred by Sistrangas operator Centro Nacional de Control del Gas Natural (Cenagas) as a result of system imbalances.

Without large-scale gas storage capacity, Cenagas must balance the system through purchases of liquefied natural gas.

The IPGN was launched under the previous government as part of a mandate to move toward a liberalized natural gas market. This objective was part of the larger opening of the formerly state-dominated energy sector after Mexico’s 2013 constitutional energy reform.

CRE said at the time that the IPGN would serve as a reference until the market developed enough liquidity and transparency for third-party indexes to emerge.

A majority of natural gas transactions in Mexico are priced using U.S. indexes such as Henry Hub or Houston Ship Channel, plus the cost of transport. Imports accounted for 68.7% of Mexico’s gas supply in June 2019, according to data from energy ministry Sener.

The new administration has generally expressed opposition to the reform, and has stated its intentions to prioritize strengthening Pemex and CFE, as opposed to ensuring a level playing field for all market actors.

However, Mexico’s hydrocarbons law requires the Sistrangas to operate under open access rules.

Cenagas earlier this year allowed firms with firm capacity contracts on the Sistrangas to renew their contracts, in a sign of continuity with the previous regime.

Cenagas general director Elvira Daniel Kabbaz also said last week that Cenagas will continue the previous government’s natural gas storage policy. The goal is to have 10 Bcf of storage capacity by 2021, and 30 Bcf by 2024, Daniel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |