NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Mexico Energy Secretariat Drops Some NatGas Pipelines, Revises Others in Infrastructure Update

The Mexican government’s energy secretariat on Monday published the first revision of the country’s five-year natural gas transportation and storage system plan, changing some projects and dropping others, while firmly establishing CENAGAS as the national gas pipeline network’s independent system operator.

The initial revision to the National Integrated Natural Gas Transportation and Storage System Five-Year Expansion Plan 2015-2019 appears to have established the Centro Nacional de Control del Gas Natural (CENAGAS) as the independent system operator.

The latest revision is meaningful on three counts.

First, it rearranges priorities to develop strategic and “social coverage” (tied to long-term economic development plans) projects, given developments in both the Mexican energy sector and the international market in the last year.

Second, it marks the launch of CENAGAS as the agency in charge of organizing and managing tenders for the system’s expansion.

Third, it presages the increasing role that private firms will have in developing natural gas infrastructure at their own risk.

Publishing the revised plan is an important milestone in Mexico’s energy reform in general and the natural gas sector in particular. It is the first time that CENAGAS has issued recommendations to implement energy policy. CENAGAS has had two years since its creation to prepare to fulfill its role as independent system operator. The agency seems to be ready to meet its obligations.

In contrast with the energy sector regulatory agencies, which had to hit the ground running, CENAGAS has been able to gradually build up its staff and technical capacities, though work remains to be done before it can prove it is able to manage the operation of the natural gas transportation and storage system efficiently.

In particular, since CENAGAS signed the agreement last October with Mexico’s Petroleos Mexicanos (Pemex) to take over the national oil company’s natural gas pipeline network, Pemex has remained in charge of day-to-day operations. The transition to full CENAGAS responsibility over the network is expected to take place over the next year or so.

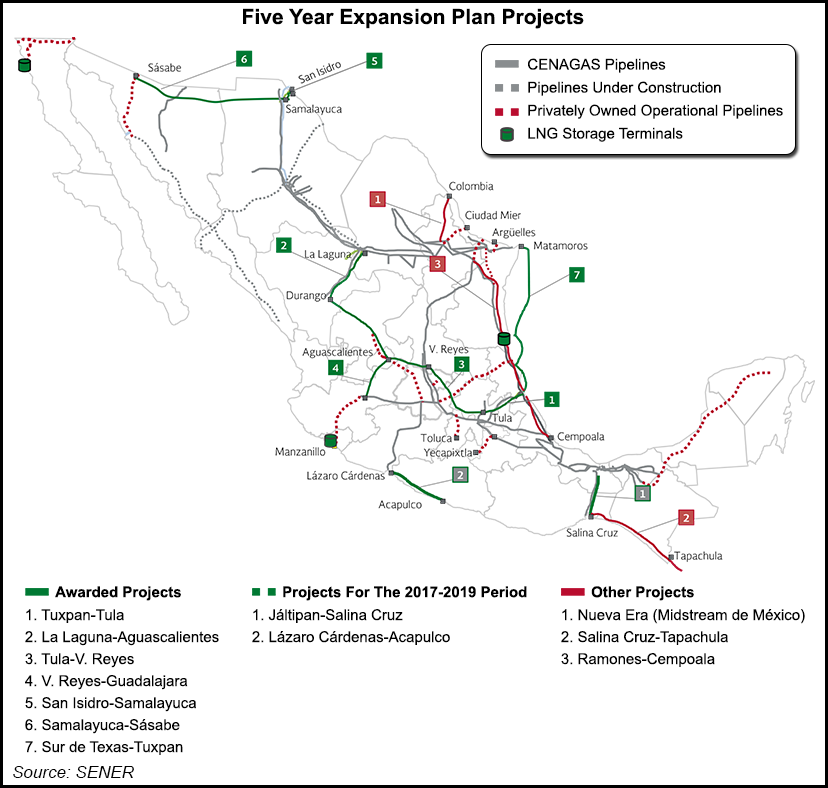

The five-year plan includes 12 pipeline and one compressor station projects, several of which had been considered in the original infrastructure development plan by President Enrique Pena Nieto’s administration.

From December 2014 to June 2015, public power utility Comision Federal de Electricidad (CFE), then in charge of tendering gas pipeline projects, assigned seven of the pipelines, all considered strategic, to private contractors.

The pipeline projects include the San Isidro-Samalayuca (Chihuahua state), Samalayuca-Sásabe (Chihuahua-to-Sonora), Tuxpan-Tula (Veracruz-to-Hidalgo), Tula-Villa de Reyes (Hidalgo-to-San Luis PotosÃ), Villa de Reyes-Guadalajara (San Luis PotosÃ-to-Jalisco), La Laguna-Aguascalientes (Coahuila-Zacatecas-Aguascalientes), and South Texas-Tuxpan (an underwater pipeline running along the Gulf of Mexico coastline).

When all these projects become operational by 2018, Mexico’s gas pipeline infrastructure will have increased by about 3,100 km, with investments reaching $4.6 billion.

Under the current revision of the plan, five pipelines and one compressor station came under review. Three pipelines and the compressor station are strategic, while two are considered under the “social coverage” category.

After consulting with the midstream regulatory agency Comision Reguladora de Energia (CRE), CENAGAS submitted to the the Secretaria de Energia (SENER) its opinion based on expected supply and demand conditions and subject to constraints to minimize delivery interruptions from 2017 to 2019. The recommendations included:

Colombia-Escobedo pipeline. Given the recently agreed-to development by Howard Midstream of the Nueva Era pipeline, running along the same route, the original project should be scrapped.

Jaltipan-Salina Cruz pipeline. The project start date should be pushed back because of transportation capacity reserve requirements and low estimated demand for gas in the southwest.

Los Ramones-Cempoala pipeline. Given development of the underwater pipeline from South Texas to Tuxpan, which runs on a parallel route to this project, CENAGAS proposes postponing project evaluation to the 2020-2024 horizon.

Lazaro Cardenas-Acapulco and Salina Cruz-Tapachula “social coverage” pipelines: Because of ongoing discussions between Mexico’s SENER and the finance secretariats over development plans for the southern region, CENAGAS proposes postponing project evaluation and launch to 2018. However, TAG Pipelines has expressed interest in developing the Salina Cruz-Tapachula pipeline separately.

El Cabrito compressor station. Based on CRE simulations, the compressor station is deemed unnecessary, given expected capacity inclusions once the Ojinaga-El Encino-La Laguna (Chihuahua, Coahuila and Durango states) pipelines come online.

In the revised plan, SENER agreed to CENAGAS’s proposals, which would mean only two pipelines, Jaltipan-Salina Cruz and Lazaro Cardenas-Acapulco would be considered for tendering from 2017 to 2019, while the Nueva Era and the Salina Cruz-Tapachula pipelines would be developed independently.

SENER’s decision to allow the substitution of privately developed projects for ones planned and managed by the federal government is a harbinger of the increasingly important role private firms will play in building the country’s natural gas infrastructure and in the creation of a competitive energy market.

Nevertheless, the risks companies run in developing these projects is correlated with prospects for economic growth, particularly in manufacturing, in the service areas. In this respect, the Nueva Era project could be a profitable investment, while the commercial success of the Salina Cruz-Tapachula pipeline is uncertain.

For implementing Mexico’s energy reform, the revised plan is a sign that the federal government may be capable of learning from experience and adjusting its expectations to an unpredictable, international energy market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |