May’s Permian Prices Go Negative Amid Downturn in Gas Forward Markets

In the throes of the shoulder season, natural gas forward prices sank further during the March 28-April 3 period amid a healthy supply picture, mild weather and storage inventories that were seen as easily being replenished this summer. May, June and balance-of-summer (May-October) prices slid an average 5 cents, while Permian Basin forward prices joined their cash counterparts in negative territory, according to NGI’s Forward Look.

The losses across most of the country were reflective of the futures market, where the Nymex May gas contract dropped 3.5 cents to $2.677, June fell 4.6 cents to $2.715 and the balance of summer slipped a nickel to $2.78.

Aside from the potential for a returning blast of chilly air later this month, temperatures last week rose to comfortable levels that were likely to persist for the next few days, squashing demand along the way. Highs from Chicago to New York City were expected to reach the 50s and 60s, locally 70s, according to NatGasWeather. The southern United States was forecast to be warm with highs in the 70s and 80s, while slightly cooler exceptions were forecast over the West and portions of the Tennessee Valley.

The latest weather data was slightly warmer trending for the April 11-17 period, adding a few heating degree days (HDD) as a steady barrage of weather systems moves across the northern United States, NatGasWeather said. The modestly warmer outlooks follows several days of cooler trends that had added more than 20 HDDs, or 35 Bcf in demand, the firm said.

“Yet, the natural gas markets have shown little concern for cooler trends and associated added demand” as May prices through Thursday sank to lows for the week and neared lows of the year.

Part of the market’s apparent disregard for the coming cold snap was because of production that had returned to near record levels following an extended period of freeze-off-related output reductions. Another factor was at play: an early start to the traditional storage injection season that arrived in grand fashion Thursday after the Energy Information Administration (EIA) reported a 23 Bcf injection into inventories for the week ending March 29.

The reported build surprised well to the upside as the majority of estimates pegged the number closer to 10 Bcf. Even high-side projections were around 15 Bcf. Even though inventories continued to lag well below the five-year average, the recent data reflected a very loose supply/demand balance for the week reported and put the market on track to make up the storage deficit versus last year during the next three weeks, according to Bespoke Weather Services.

“Data…continues to look quite loose as well, although with prices heading lower, we suspect that balances can finally begin to improve over the next several days,” Bespoke chief meteorologist Brian Lovern said following the EIA’s report.

The Nymex May contract, which settled relatively flat on Wednesday and continued to hold steady ahead of the EIA report’s release, went on to settle Thursday at $2.643, down 3.4 cents. June dropped 2.9 cents to $2.686.

The South Central region surprised to the upside as the region reported a 35 Bcf build, including 19 Bcf into salt facilities and 18 Bcf into nonsalt, according to EIA. Several analysts had noted ahead of the report that the South Central region, in particular the salt facilities, held the most risk week/week.

“Texas, Louisiana and Mississippi have a ton of intrastate storage that you can’t see, so there is a huge variance to estimates if the interstates and intrastates do something different,” said IAF Advisors’ Kyle Cooper.

Meanwhile, weak pricing in the Permian Basin, where cash prices have recently set new lows, will likely incentivize larger builds. “Buying negative gas certainly makes a storage operator happy. The massively discounted prices started this week, so that will be reflected next week,” Cooper said on Enelyst, an energy chat room hosted by The Desk. “Negative Permian prices are going to do some interesting things.”

Outside of the South Central region, the East withdrew 17 Bcf out of storage, while the Midwest pulled 7 Bcf. The Pacific injected 9 Bcf, and the Mountain region added 2 Bcf, according to EIA. As of March 29, working gas in storage stood at 1,130 Bcf, 228 Bcf below last year and 505 Bcf below the five-year average of 1,635 Bcf, EIA said.

The structural oversupply picture has narrowed since the beginning of winter, and the injection season is beginning with storage at the second-lowest level of the past decade, according to EBW Analytics Group. Since November, structural natural gas oversupply has dwindled, in part because of slower production gains during the winter from a year ago, as well as growing liquefied natural gas (LNG) exports.

“Last year, production added 4.2 Bcf/d from November to March; this winter, by contrast, growth was only about 2.0 Bcf/d, less than half the pace,” EBW CEO Andy Weissman said. “Similarly, LNG export demand rose by 1.7 Bcf/d from November 2018 to March 2019, substantially faster than last year’s 0.2 Bcf/d.”

EBW said the year/year storage deficit may be erased after the next four EIA reports. By late May, early summer weather forecasts could hold increasing sway over the market. “Our most likely weather forecast calls for May-September cooling demand of 191 cooling degree days (CDD) above the 30-year normal, and yet still a startling 175 CDDs below the same period last year.”

As the injection season wears on, the market will grapple with increasingly complex conditions, growing risk factors and greater uncertainty than in the past that require a more flexible and probabilistic-based approach, EBW said. The firm expects the market to target end-of-October storage inventories at around 3.5 Tcf, which would set up an end-of-March 2020 storage target of 1.300 Tcf, “sufficient to absorb a modest rise in winter weather-driven demand and LNG export facilities anticipated to enter service in 4Q2019.”

Cash prices in the Permian have been snagging headlines for the past two weeks as a perfect storm of bearish factors — primarily record production and a lack of takeaway capacity — sent prices to record lows. Last Wednesday, Waha spot gas traded at a record low of minus $9 before going on to average minus $5.75, a drop of $2 on the day. Thursday bought about a substantial rebound in cash prices of more than $5, but next-day gas still averaged below zero, Daily GPI data show.

The bump followed the lifting of a force majeure that had been in place since mid-March on a portion of Kinder Morgan Inc.’s El Paso Natural Gas Pipeline in New Mexico. Although the return to service provided some relief to cash prices, price weakness was likely to continue as the region remains starved for incremental takeaway capacity.

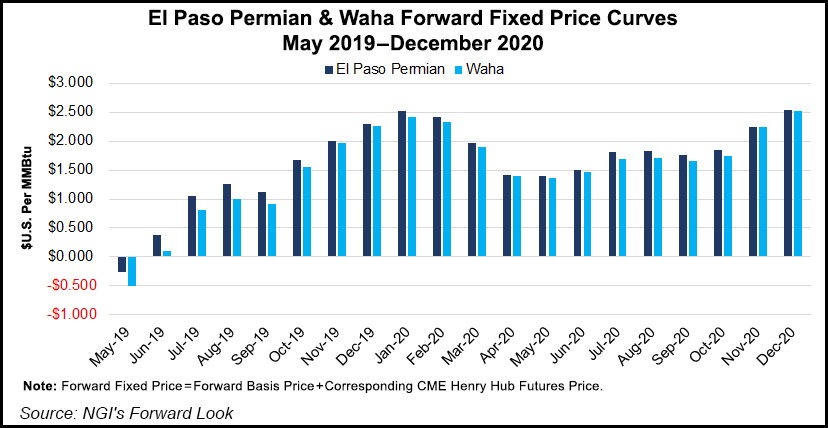

The shift into negative territory finally bled into the forwards markets, when Waha May prices dropped to minus 26.1 cents last Tuesday. The prompt month fell even further on Wednesday, down to minus 50 cents, a loss of 62 cents during the March 28-April 3 period, according to Forward Look.

“Following a trajectory that resembles a jet airliner that has lost engine power, Waha prompt-month forward prices have finally broken into negative territory in fixed-price terms,” said NGI’s Nate Harrison, markets analyst. “While prices remain in positive territory so far for June, the second-month contract hangs by a thread and could also drop into the negatives as well.”

Waha June settled Wednesday at just 10.4 cents, a drop of 41 cents from March 28, according to Forward Look.

Harrison pointed to “three moving pieces” that are influencing the pricing dynamics in the Permian. The first is continued strong production with limited pipeline takeaway. At the same time, crude prices have been comfortably above $60/bbl, and last Thursday briefly soared above $70.

“The higher the price of oil, the more tolerable negative gas prices become,” Harrison said.

The third factor at play that could put downward pressure on Waha forwards is potential weakness for Nymex Henry Hub futures, according to Harrison. “Even if Waha basis remained flat, a sharp decline in futures could push/keep prices negative at least into June.”

States primarily focused on oil-directed drilling added 5.4 Bcf/d of associated gas production in 2018, according to EBW. This trend is poised to accelerate in 2019 because of constructive oil prices, surging output and an oil-to-gas output ratio that should become gassier over time, providing a tailwind to gas output totals.

“Even if Appalachian gains nosedive toward 1.0 Bcf/d — balancing out legacy declines in other states — and strong 2018 gains in the Haynesville and Gulf of Mexico stagnate in 2019, dry gas output may rise by more than 5 Bcf/d again in 2019 as associated gas continues higher,” EBW’s Weissman said.

Outside of the Permian, Western Canada forward prices were reflective of many of the same trends such as rampant production and lack of takeaway capacity. NOVA/AECO May prices dropped 12 cents from March 28-April 3 to reach 93.7 cents, and June fell 6 cents to $72.5 cents, Forward Look data show. The balance of summer was down a nickel to 86 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |