May WTI Sheds 35 Cents Despite Historic OPEC Supply Agreement

U.S. oil prices reacted tepidly on Monday to an agreement by the Organization of the Petroleum Exporting Countries (OPEC) and its allies to slash output by an unprecedented 9.7 million b/d during May and June, illustrating the formidable challenge posed to the market by the Covid-19 pandemic.

The May West Texas Intermediate futures contract lost 35 cents to settle at $22.41/bbl, despite the historic deal and a Monday morning tweet from President Trump suggesting that the so-called OPEC-plus alliance was actually considering a 20 million b/d curtailment.

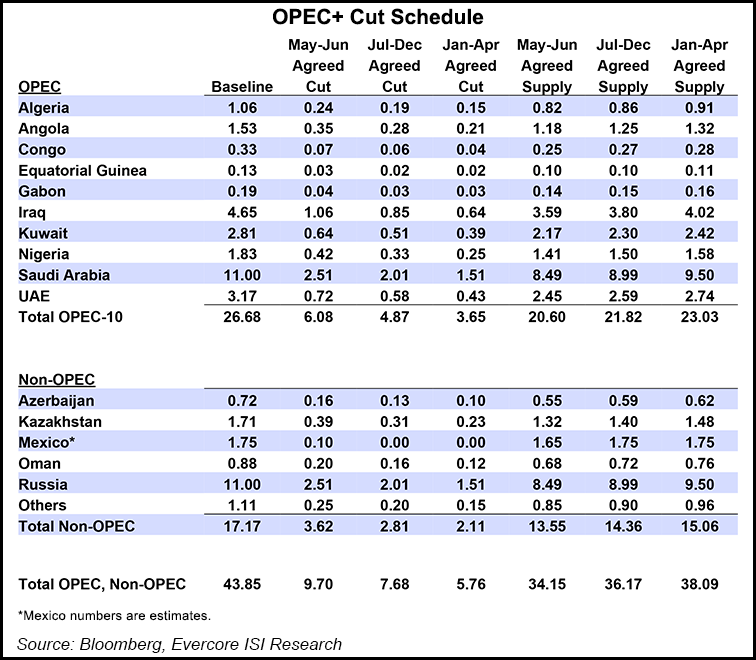

“After a four-day marathon of global meetings and arduous and sometimes frustrating negotiations involving the U.S., Mexican, and Russian presidents as well as the Crown Prince of Saudi Arabia, the OPEC-plus group agreed to collectively cut production in May and June by 9.7 million b/d, and to return to market management by committing to a series of cuts through April 2022 to manage the post Covid-19 cycle and the inventory overhang in the next two years,” said IHS Markit’s Roger Diwan, vice president of financial services, in a Monday note.

The agreed cuts, along with expected market-driven curtailments in the United States, Canada, and a few other countries, “promise to remove up to 14 million b/d in May and June,” amid an expected global supply overhang of 20 million b/d, Diwan said.

The muted response of oil prices in Monday trading reflected pre-meeting enthusiasm that was “not justified by fundamentals, as the supply-demand imbalance was so large, that normally prices should have been much lower,” said the Rystad Energy oil markets team, adding that the 9.7 million b/d amount is “not enough to bring back healthier price levels and…only sufficient to maintain prices largely unchanged.”

On the other hand, if the Group of 20 (G-20) countries can supply additional cuts of up to 10 million b/d, “then we can expect a relative price recovery,” Rystad analysts said.

The agreement “is a critically needed relief in the face of declines in crude demand estimated at around 20 million b/d,” Diwan said. “Stepping away from a destructive price war, the return to market management by Saudi Arabia and Russia and backed by the United States and a very involved President Trump, marks a physical and psychological inflection point for the oil market.”

With OPEC-plus member Mexico refusing to agree to the 400,000 b/d supply cut assigned to it by the cartel and instead pledging to only curtail 100,000 b/d, Trump reportedly pressured OPEC to make an exception for Mexico in the interest of getting a deal done.

Trump said during a press briefing on Friday the United States would “help Mexico along” with supply cuts “and they’ll reimburse us sometime at a later date when they are prepared to do so.” It was unclear how the United States would do this, given that the private sector supplies 100% of U.S oil and gas output.

In any event, Trump’s involvement in the deal “is the most unusual aspect of it and reflects his visible concern for U.S. shale producers,” Diwan said. “A catastrophic price scenario would have wiped out a large number of producers in the United States, but this improved scenario will not change the fact that the production decline unfolding in the United States will be in the same range as the forced shut-ins or cuts agreed today by Russia and Saudi Arabia.”

The Evercore ISI energy research team led by Douglas Terreson called the agreement “constructive,” citing that in addition to the agreed upon cut, supply reductions of about 5 million b/d combined are expected from the United States, Canada, Brazil and Norway.

Nonetheless, the Evercore team expects global crude storage to approach full effective utilization before the cuts begin in May. As a result, “Brent crude oil prices will likely trade near variable production costs for marginal producers ($25/bbl) again during the next quarter or so,” analysts said.

“The key investment question is whether energy companies can survive oil prices near $35/bbl for one-to-two years, and if not what happens next.” One answer could be the Big Oil energy companies “will likely become cash flow neutral on 20-30% reductions in capital and operating costs, borrowings, and the elimination of share repurchase plans.”

In a note to clients issued Sunday, Goldman Sachs analysts called the voluntary cuts “too little and too late to avoid breaching storage capacity, ensuring that low oil prices force all producers to contribute to the market rebalancing.

“Ultimately, this simply reflects that no voluntary cuts could be large enough to offset the 19 million b/d average April-May demand loss due to the coronavirus.” Goldman is therefore expecting WTI pricing to decline further, “with downside risks to our short-term $20/bbl forecast.”

The three-member Railroad Commission of Texas was set to discuss on Tuesday (April 14) the possibility of prorationing, i.e. state-mandated production shut-ins to help rebalance the market.

However, Commissioner Ryan Sitton, who has floated prorationing as a possible tool to boost prices, revised his tune on Monday. “While I have been public about my thoughts that Texas should take a lead role in this conversation, I still have many reservations, and I will be examining heavily if and how proration could be done.”

He said while none of the commissioners likes the idea of government interference with private enterprise, “we also acknowledge that these unprecedented times require us to consider all options to bring stability to the industry that we regulate.”

Last month Texas Oil and Gas Association (TXOGA) President Todd Staples said proration would “likely result in other producers replacing curtailed Texas volumes…Proration is not a remedy TXOGA members are seeking, as it would disadvantage Texas, its producers, mineral owners and taxing entities.”

American Petroleum Institute CEO Mike Sommers on Sunday applauded OPEC-plus’s decision to voluntarily cut production. “We welcome today’s announcement of an agreement by other producing nations to follow the lead of the global marketplace — and U.S. producers — to reduce supply to align with lower energy demand as a result of the pandemic…

“While the U.S. today leads the world in daily oil production, oil is produced, refined, used and traded across the globe, and most of the world’s oil is produced by foreign government owned entities – some of whom announced oil production increases last month just as global energy use was decreasing due to the pandemic.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |