Shale Daily | Bakken Shale | Coronavirus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower 48 E&Ps to Feel Effects of Coronavirus, Says North Dakota Regulator

North Dakota’s chief oil and gas regulator last Friday predicted that the indirect impact of the coronavirus on global oil prices and demand could be felt for the rest of this year by U.S. operators.

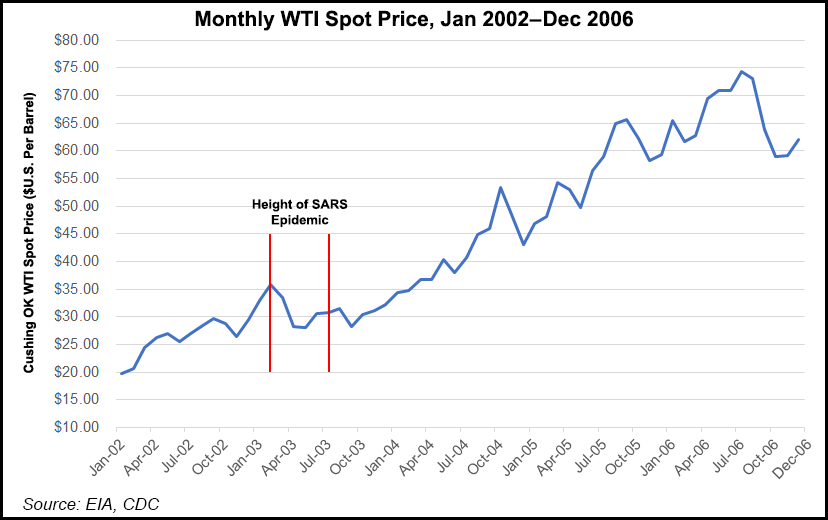

Comparing it to the impact on the U.S. energy sector from SARS, i.e. severe acute respiratory syndrome that struck Asia 17 years ago, Department of Mineral Resources director Lynn Helms referenced the coronavirus epidemic during the monthly report on the state’s oil and gas production.

The “serious oil price drop” this month was almost all because of the coronavirus, he claimed, citing a report issued Friday by global energy watchdog, the International Energy Agency (IEA), which for the first time in nearly a decade lowered oil demand estimates in the Monthly Oil Market Report for February.

“We had a solid decade of oil demand going up every quarter,” he said, but IEA now sees 2Q2020 going down,” Helms said. “It seems remarkable, but when you consider the amount of goods going to and from China, all shipments powered by crude oil, and the impact on global manufacturing, it is a pretty enormous impact.”

During the SARS epidemic, crude prices remained $5-7/bbl lower for more than a year, he said.

“The indications are the impacts from the coronavirus that are beginning to peak now could take the rest of this year to work their way out of the oil markets,” said Helms.

The Organization of the Petroleum Exporting Countries and its allies also may cut global oil output because of the epidemic, which could have a “big, big impact” on U.S. production, said Helms. He urged exploration and production (E&P) companies to “batten down the hatches.”

Daily oil production in the state during December fell by 3% month/month, while gas output was down 2%.

Crude production totaled 45.7 million bbl (1.47 million b/d) from 45.5 million bbl (I.51 million b/d) in November. Gas output was 94.8 Bcf (3.05 Bcf/d), versus 94.0 Bcf (3.13 Bcf/d) the month before.

The inactive well count increased for the month to 200, or slightly more than 10%.

Progress was made in natural gas capture by E&Ps, with December at a 84% capture rate, compared with 83% in November. The state-mandated goal of 88% increases to 91% in November.

Continuing growth in U.S. liquefied natural gas exports could help resolve the flaring issue in the Bakken Shale, but near-term most of the exported gas will come from Appalachia to the Gulf Coast, so North Dakota needs to find a West Coast outlet to Asia, Helms said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |