M&A | Infrastructure | NGI All News Access

Love’s Travel Stops to Buy Trillium CNG

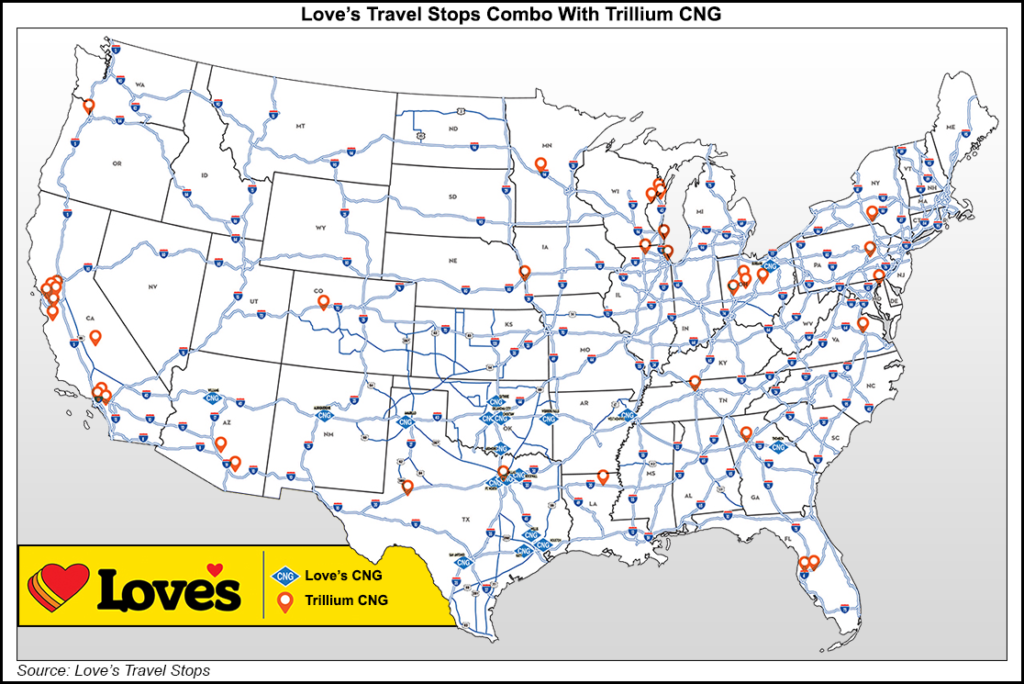

Oklahoma City-based Love’s Travel Stops plans to purchase Chicago-based compressed natural gas (CNG) provider Trillium CNG from WEC Energy Group, adding 37 public-access CNG locations to its natural gas vehicle (NGV) fueling network.

After closing, Love’s would have 65 CNG fueling locations nationwide.

“The acquisition of Trillium CNG provides Love’s with a great opportunity to leverage the very best of two companies,” said Frank Love, co-CEO of Love’s. “Trillium’s established network of CNG locations and its deep expertise within the industry will also allow Love’s to serve new types of customers in new markets while expanding reach to existing, mostly fleet-operating customers.”

Milwaukee-based WEC Energy said last fall it planned to sell the CNG fueling company it acquired as part of its acquisition of Chicago-based gas utility holding company Integrys Energy (see Daily GPI, Sept. 29, 2015).

Trillium CNG provides fuel for thousands of natural gas vehicles daily and delivers more than 55 million gallons of CNG annually.

Historically, Love’s has provided fueling services for heavy- and light-duty fleets. Love’s would add Trillium’s client base, which includes transit authorities, school districts, airport fleets, as well as the motoring public. Love’s existing customers will have the option to fill with CNG at any of the Trillium locations.

Another national CNG fueling station developer, TruStar Energy, said it has completed 41 stations for public and private use, almost doubling the number of CNG stations from 2014, and bringing its total completed stations to 120.

According to TruStar officials, the demand for public and private CNG-fueling stations by fleet owners and operators nationwide continues to increase because the fuel delivers more stable pricing, is cleaner than diesel and provides an attractive return on investment for certain applications.

They caution that the lack of a nationwide CNG fueling infrastructure remains a challenge to wider adoption of CNG in the trucking industry.

“Despite the low price of oil, the transition to CNG still makes environmental and financial sense for many fleet owners,” said TruStar President Adam Comora. “We are seeing strong demand for CNG-fueled vehicles and fueling stations in the refuse industry because of the financial benefits and by municipalities where sustainability is of paramount importance.

“With the right application, larger corporations that operate their own fleets are beginning to shift to CNG because the economics can still be supported and the abundant, domestically produced fuel shields them from the volatility of diesel prices.” Comora said CNG is insulated somewhat from diesel and gasoline, which come from volatile global sources.

Yet another national fuel and fueling station provider, Newport Beach, CA-based Clean Energy Fuels Corp., is touting new options for fleet operators that want to more closely monitor the fuel consumption of individual vehicles using time-fill CNG applications.

Fleet managers wrestle with tracking vehicle mileage efficiency, although the time-fill technology offers options for vehicles parked overnight at the same location by requiring smaller compression equipment, fewer fuelers, simultaneous fueling and fuller fills.

This quandary particularly applies to refuse fleets that make up the bulk of Clean Energy’s CNG business, a company spokesperson said.

Clean Energy said that it becomes cost prohibitive to monitor the fuel dispensed to each vehicle with one meter costing $2,500, but its engineers have come up with several options that the company is offering fleet managers. One is a fuel-tracking system, which was deployed last year at the Salt Lake County CNG station in Utah, involving a wireless monitoring device on each vehicle.

This can all lead to more efficient management of fleets overall, according to Clean Energy.

In another niche in the NGV fueling space, United Technologies Research Center (UTRC) and New Jersey-based Adsorbed Natural Gas Products Inc. (ANGP) last Thursday unveiled an exclusive licensing agreement giving ANGP use of United Technologies’ patent-pending technology for adsorbed natural gas (ANG) low-pressure fueling.

ANGP bids to develop and produce what it called the world’s first commercially viable conformable adsorbent-based low-pressure ANG storage tank for NGVs, using the UTRC technology. The license applies to nonmetal composite tanks containing activated carbon adsorbents at operating pressures up to 1,000 psi, the companies said.

At the end of last year, a technology advance for the use of ANG fuel tanks in NGVs was installed in a commercial fleet van by California-based Cenergy Solutions (see Daily GPI, Dec. 30, 2015). A fleet customer sent a 2001 Dodge Ram B2500 van with a 5.2-liter V-8 engine to Cenergy for modification to use the ANG fueling tank system, according to Fremont, CA-based Cenergy COO Gary Fanger, who said the vehicle was originally made by Chrysler to run on CNG.

Also in California, the state energy commission has designated $2 million for fuel-saving and greenhouse gas emission-reducing technologies at ports for NGV development. It is part of a clean vehicle program for medium- and heavy-duty vehicles — both on- and off-road technologies. A dozen ports in the state are eligible for the $17.8 million in funding.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |