Marcellus | E&P | NGI All News Access | Utica Shale

Lawsuits, Downturn Could Cause More Delays For Embattled Mariner East Pipeline Project

Legal challenges against Sunoco Logistics Partners LP’s proposed Mariner East (ME) pipelines are mounting, as Pennsylvania landowners and an environmental advocacy group are fighting against a subsidiary’s efforts to condemn property for the project’s path. The court battles could combine with the commodities downturn to delay the project further.

Five condemnation cases in five different counties have already been decided, while others are pending in Lebanon, Cumberland, Washington and Westmoreland counties. Three state courts have dismissed landowner complaints, ruling in favor of Sunoco and deciding it has eminent domain powers as a regulated public utility under state law. But two others have ruled against the company, deeming its ME project an interstate system and finding that as a result it does not have such rights.

The Philadelphia County Common Pleas Court this month certified two landowners and the Clean Air Council to proceed with their lawsuit against Sunoco subsidiary Sunoco Pipeline LP (see Shale Daily, Feb. 16). The judge ruled state courts have jurisdiction in the matter because, among other things, landowner rights under the state constitution are at issue with the threat of property condemnation for ME, opening a new chapter in the proceedings that could set a precedent when it comes to pipeline development in the state.

“What we’re alleging here is Sunoco doesn’t have the right to use eminent domain,” said the Clean Air Council’s senior litigation attorney, Alex Bomstein. “If Sunoco wants to try to put this pipeline in another way, it can do that, but it can’t take people’s private property for its private purpose.

“Sunoco has never expressed to us that, you know, ‘if we can go for this reroute, then let’s do that,'” he added. “We have no idea what their alternate plans would be if they can’t use eminent domain, and we’re not going to speculate on that. I have no clue.”

Project Scope

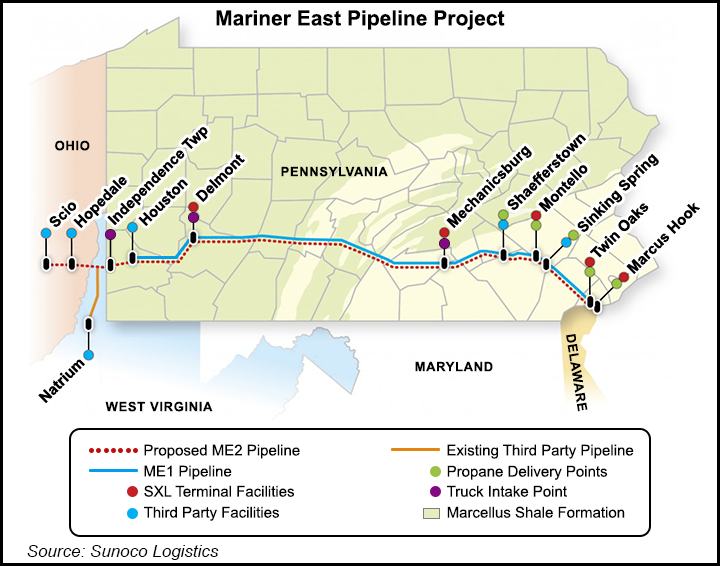

The ME project would transport ethane, butane and propane from processing and fractionation complexes in Eastern Ohio, Western Pennsylvania and West Virginia to the Marcus Hook Industrial Complex, a former oil refinery near Philadelphia that’s being repurposed for natural gas liquids (NGL) storage, processing and distribution to domestic and international markets (see Shale Daily, Dec. 5, 2013). ME 1 is already fully operational, delivering ethane and propane within the state from Western Pennsylvania to Marcus Hook. But the company’s 350-mile ME 2 project has been in development since 2014, and it’s faced the most resistance from landowners (see Shale Daily, April 28, 2014).

An open season for a third pipeline, called Mariner East 2X, that would run parallel to ME 2 and be constructed at roughly the same time is still ongoing, Sunoco spokesman Jeffrey Shields said (see Shale Daily, Sept. 14, 2015). The company launched the open season last year, saying shippers had indicated they could use the additional capacity. All three pipelines, combined with Mariner West, which moves Marcellus Shale ethane to Michigan and the Canadian border, would have a capacity of up to 800,000 b/d. Despite the current commodities downturn that finds Appalachian producers more focused on dry natural gas production, the ME system has been billed as a welcome solution to getting more of the basin’s liquids to market.

“Mariner East 1, together with Mariner East 2 as expanded, would offer superior reliability and tremendous flexibility with multiple lines in service, multiple tankage for each grade of service, a world class terminal and the use of the idled refinery at Marcus Hook for manufacturing growth into the petrochemical sector,” said CEO Mike Hennigan on Thursday, during the company’s year-end earnings call with financial analysts. “The Mariner East system also has a decided logistical advantage over the Gulf Coast for both the local and international markets. Locally, there’s a seasonal premium in the Northeast market…From a waterborne perspective, it’s approximately 1,500 miles closer to Europe with no restrictions or congestion as seen in the Houston ship channel.”

Competing Claims

Sunoco has claimed in court that it has a right to condemn property because of its status as a regulated public utility under state law. At trial, it has produced a number of orders and certificates of public convenience (CPC) relating to ME. Its lawyers also have argued that the project would have a $4.2 billion impact on Pennsylvania and create 30,000 jobs during construction (see Shale Daily, Feb. 6, 2015).

The company has indicated that it won’t have to come up with an alternate solution if it’s unable to take land through eminent domain. Shields told NGI’s Shale Daily that the company has not publicly released how much of ME 2’s path has been secured with easements, but he said eminent domain is a “last resort” that represents a small portion of what’s needed to build the pipeline. In 2014, the company announced a successful open season for ME 2 (see Shale Daily, Nov. 6, 2014).

“The thing that is most clear from the [Pennsylvania Public Utility Commission (PUC)] is that we have certificates of public convenience in each county that we pass through, which is required,” Shields said. “That basically acknowledges that the service is for the public benefit. The one new area we had never been in before was Washington County, so we needed a new CPC there, and the PUC speaks broadly in that about why the project is for the public. Even though it’s in Washington County, the certificate really speaks to the whole line.”

To be sure, the system has already experienced limited delays that weren’t entirely unexpected. In 2012, Range Resources Corp. signed a 15-year agreement to become an anchor shipper on ME 1 (seeShale Daily, Sept. 28, 2012). At the time, the company said propane deliveries were expected to begin in the second half of 2014. Ethane deliveries to Marcus Hook were expected to begin in the first half of 2015.

Propane was commissioned on the system in late 2014 and limited deliveries started last year. Sunoco said Thursday that full refrigeration for propane and ethane is now online at Marcus Hook, enabling full operations on ME 1 and faster loading of ships.

But more recently, Sunoco said ethane deliveries would begin at the end of 2015 and that ethane exports were expected to start around the same time (see Shale Daily, June 17, 2015). Hennigan said on Thursday that ethane was introduced into the pipeline for the first time earlier this month.

“We expect to be loading the first ethane ship in a few days,” he said during the earnings call.

When Range became the anchor shipper, the company hailed the system as one that would “enhance the economics of our core wet gas production and future resource potential value.” But the company did not comment when it was asked if ethane delays on the system had affected it more recently.

Antero Resources Corp. management said during its earnings call on Thursday that it would begin to look at alternatives for moving its Appalachian liquids production to overseas and domestic markets, especially if the ME system is delayed longer. The company didn’t specify on those alternatives, but said a number of confidential projects are in the works to get more liquids out of the basin

Until Thursday, Sunoco had said it would begin construction on ME 2 by June and have it in service by the end of the year.

“Our latest estimate for timing to obtain all necessary permits suggest a first half 2017 start-up,” Hennigan said. “We haven’t delayed for capital reasons as we would like to get it completed as soon as possible, but we are certainly benefiting indirectly from the capital timing.”

Shields said Sunoco is waiting for its permits from the state Department of Environmental Protection to construct the pipeline. He added that the company hopes to have those within the first half of this year, but noted that the time frame is out of the company’s control.

Public Convenience

With nearly split legal decisions about the project’s public utility status from across the state, the matter is likely to be decided by a higher court. Some of the cases have already been appealed, and Sunoco has until March to appeal the Philadelphia County decision.

“That’s a hard question to answer directly because we’re already working on a case where we’re contending that [Sunoco] doesn’t have a right to do this and we’re expecting the courts to handle that before the end of the year,” Bomstein said when asked if his organization would try to delay the project if Sunoco moves forward before its lawsuit is resolved. “We have to see what happens at what point to see what reaction we would make next.”

David Brooman, a land-use and environmental law attorney at High Swartz LLP in Montgomery County, PA, who is not involved with the cases but has followed them, said Sunoco’s status as a public utility would likely be decided on appeal. If that happens, he added that a resolution isn’t likely until the end of the year.

In most cases, plaintiffs have argued that Sunoco shouldn’t be allowed to use eminent domain to build the ME pipelines because they’ve been designed as interstate systems to primarily serve overseas and out-of-state markets that wouldn’t benefit the state. Sunoco also has argued that the PUC should decide on the matter and not the state courts.

“Those certificates have nothing to do with certificating Mariner East,” Bomstein said. “What Sunoco has is by acquisition from companies that had [CPC’s] for the public service of delivering petroleum products from the Philadelphia region westward and northward. Those certificates relate to that public service and not Mariner East.”

After it acquired the Sun Pipe Line Co. and the Atlantic Pipeline Corp., Sunoco received a CPC in 2002 related to the transportation assets of those companies across the state. Sunoco later received a CPC for ME in Washington County in which the PUC said the project would benefit the public and acknowledged its mixed intrastate and interstate nature.

“We believe granting Sunoco authority to commence intrastate transportation of propane in Washington County will enhance delivery options for the transport of natural gas and [NGLs] in Pennsylvania,” the CPC order said. “In the wake of the propane shortage experienced in 2014, Sunoco’s proposed service will increase the supply of propane in markets with a demand for these resources, including in Pennsylvania.”

The PUC also said ME 2 would increase takeaway capacity from the Marcellus and “enable Sunoco to provide additional on-loading and off-loading points within Pennsylvania for both intrastate and interstate propane shipments.”

Three courts have thus far ruled that the project would benefit the public, finding that Sunoco has not abused the power of eminent domain. The company can not go to FERC because its project would deliver NGLs and not natural gas.

“It may be that the plaintiffs’ confusion arises from the fact that the Mariner East 2 pipeline would provide both interstate and intrastate transportation of petroleum products,” Washington County Judge William Nalitz said in a January ruling favoring Sunoco. “Interstate transportation is regulated by the Federal Energy Regulatory Commission; intrastate transportation is regulated by the PUC. Nothing prevents interstate and intrastate shipments in the same pipeline.”

Precedent Setting?

While it didn’t rule on the validity of Sunoco’s certificates, the Philadelphia County court recognized that the courts should decide if Sunoco can condemn private property for its project. Plaintiffs in the Clean Air Council case are seeking “relief from uncertainty and insecurity with respect to rights,” under Article I, Section 27 of the state’s constitution, a rare environmental rights amendment. The Philadelphia County judge reasoned that the courts must decide when it comes to state constitutional rights.

The judgecited the state supreme court’s ruling in 2013 that struck down parts of Pennsylvania’s omnibus oil and gas law and gave municipalities and residents more say in oil and gas development (see Shale Daily, Dec. 20, 2013; Dec. 27, 2013). That ruling hinged largely on a reading of the environmental rights amendment, which says in part that residents have a right “to clean air, pure water, and to the preservation of the natural, scenic, historic and esthetic values of the environment.”

The Clean Air Council brought the environmental rights count against ME in its lawsuit because it believes no significant environmental impact analysis has been done for the project, Bomstein said

“There’s a process that has to be in place for a project like this to go ahead,” he said. “In this case, we don’t believe that there ever was a consideration of the environment during the entirety of the process from start to finish by the state. The state needs to do so if it’s going to authorize eminent domain.”

Since the high court’s ruling, the environmental rights amendment has consistently been invoked by industry opponents in Pennsylvania (see Shale Daily, Dec. 1, 2014). While the argument has mostly been unsuccessful, its use has primarily been related to upstream projects involving the zoning of oil and gas wells (see Shale Daily, Nov. 25, 2015). If a reading of the amendment is somehow included in a decision that would bar Sunoco from using eminent domain, it’s unclear how that would affect pipeline siting in the state.

If that were to happen, sources agreed that depending on the judicial opinion and subsequent interpretations, a precedent could be set that would slow the development of similar pipeline projects in the state.

“I think these are legitimate lawsuits. And I think the appellate courts need to decide — given the unique nature of this pipeline — whether or not it’s a public utility,” Brooman said. “These lawsuits, at least the Clean Air Council’s lawsuit, does raise some interesting questions under Article I, Section 27, which have not been decided by any court. So, yes, I believe they are legitimate, but I won’t make a prediction as to which way it’ll turn out.”

Industry sources, however, said the legal challenges for ME might not be all that inopportune. NGL prices have plummeted during the commodities downturn, diminishing current demand for the takeaway capacity that ME would offer in Appalachia. If the system is delayed, it could buy producers time to earn more for their products if prices rebound.

“I would tell you that there is still quite a bit of interest, but as you know, the current commodity environment is making everybody a little cautious,” Hennigan said on Thursday when asked about contracting and counterparty interest in ME 2 and ME 2X.

“We have been saying to everybody that we would be starting the ME 2 construction period sometime in the early part of this year. Right now, we’re thinking it’ll move back a little bit…and that gives us a little bit more time. People are hopeful that we’re seeing the bottom of the cycle, and if we start to come back up, I think you’re going to see a lot more interest.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |