Infrastructure | LNG | Mexico | NGI Mexico GPI | NGI The Weekly Gas Market Report

Kinder’s NatGas Transport Grows on Mexico, LNG Exports; Permian Expansions Planned

Demand pull from exports to Mexico and from liquefied natural gas (LNG) terminals on the Gulf Coast has bolstered Kinder Morgan Inc.’s (KMI) outlook for its natural gas transportation business, as volumes rose during the second quarter. Expansions targeting Permian Basin output also are on the horizon.

KMI’s gas transportation volumes were up 3% year/year during 2Q2017 on the strength of higher exports to Mexico (up 8% year/year) and LNG exports pulling from its pipes, management for the Houston-based midstreamer said during a conference call with analysts late Wednesday.

KMI continues to firm up customer support for its proposed Permian-to-Agua Dulce Gulf Coast Express project, said CEO Steve Kean.

“We’re not putting it in our backlog at this point, but we’ve got a good offering to the market, and we’re progressing our commercial discussions toward firm commitments,” he said. “We also continue to see interest in our Permian capacity on” the El Paso Natural Gas Pipeline Co. (EPNG) system, “which has some very economic — that is, low-capital — expansion opportunities to get more gas to Waha.”

Kean said Gulf Coast Express plans to complement EPNG upgrades to bring more Permian gas to the Waha hub in West Texas.

“The EPNG expansions are about getting gas to Waha, and what Gulf Coast Express is about is getting gas away from Waha to the premium market that is now in East Texas. So they’re very complementary,” Kean said. “In terms of the capital on EPNG, we’ve got some fairly significant volume opportunities” of about 500 MMcf/d where “there isn’t a significant amount of capital required, things like being able to direct more gas to Waha by installing backpressure valves and additional meters and the like.

“…EPNG has a nice network in the Permian, and to the extent we can feed additional gas to Waha…that provides a good supply end for Gulf Coast Express,” Kean said. “And on the market end, we think we’ve got an excellent Texas intrastate system that’s tied in with Mexico, LNG, petrochemical demand, power demand, Houston Ship Channel, industrial and utility demand in the greater Houston area.

“It’s a great network with great connectivity.” Agua Dulce, in a rural area of South Texas near Corpus Christi, “used to be in the middle of nowhere. Now you can get to Agua Dulce and you can get to Houston, which is all of a sudden really somewhere in terms of value for the gas molecule.”

In late May, KMI spun off its Canadian assets via an initial public offering (IPO), forming Kinder Morgan Canada Ltd. (KML), which includes its Trans Mountain Pipeline serving the Canadian oilsands. As part of the completion of the IPO, KML made a final investment decision for its planned expansion of the Trans Mountain system.

Kean said all 708,000 bbl of the Trans Mountain expansion remains under long-term contract and that KML has secured financing for the C$7.4 billion project. The expansion has received environmental approval from British Columbia and is on track to begin construction in September.

“As we are moving into project execution, we’re finalizing rates with contractors, we’re ordering materials readying for construction to start in September. We’re doing that with substantial First Nation support, support from the federal government on a project of vital national interest, support from the Alberta government and with our BC environmental order in hand, and with significant financing sources already secured,” Kean said.

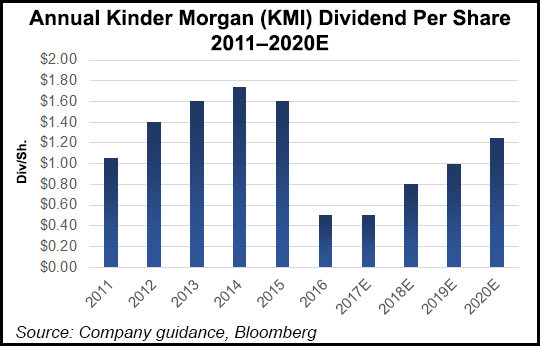

The strong prospects for the gas business come as KMI management looks to return value to its shareholders through a series of dividends and a $2 billion share buyback program implemented over the next few years.

“At the end of 2015, we made a very difficult decision to reduce our dividend for the first and only time in KMI’s history,” Executive Chairman Richard Kinder said. “We said we would work hard to strengthen our balance sheet and fund our growth” capital expenditures “from our internally generated cash flow without having to issue equity or additional debt and that when we had made sufficient progress on those goals, we would begin to return additional value to our shareholders.”

The company has since cut around $5.8 billion in debt while funding its operations through cash flow, said the CEO.

KMI plans to increase its dividend by 60% in 2018 and by 25%/year for 2019 and 2020. The $2 billion share buyback program is expected to start in 2018.

KMI reported 28,187 billion Btu/d in natural gas transport volumes during the quarter, up from 27,414 in the year-ago period. Gas gathering volumes declined year/year to 2,673 billion Btu/d from 2,993 billion Btu/d in 2Q2016. Throughput on the Trans Mountain mainline was 27.5 million bbl during the quarter, down from 28.7 million bbl in the year-ago quarter.

KMI reported a quarterly net income of $337 million (15 cents/share), compared with a net income in 2Q2016 of $333 million (15 cents). Revenue totaled $3.368 billion, up from $3.144 billion in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9966 | ISSN © 1532-1266 |