Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

In Alberta, Natural Gas Doesn’t Pay Like It Used To

The former government revenue star in Canada’s chief producing jurisdiction — the Alberta natural gas royalty — is all but vanishing as prices stay down on glutted North American markets.

In first quarter accounts for the government fiscal year that started April 1, Finance Minister Joe Ceci predicts the provincial treasury will net only C$392 million (US$297 million) in 2015-2016.

The new forecast is down by 60% from the government’s gas take of C$989 million (US$752 million) in fiscal 2014-2015. In Alberta the gas royalty includes the government share of revenue for liquid byproducts, which have fallen with oil.

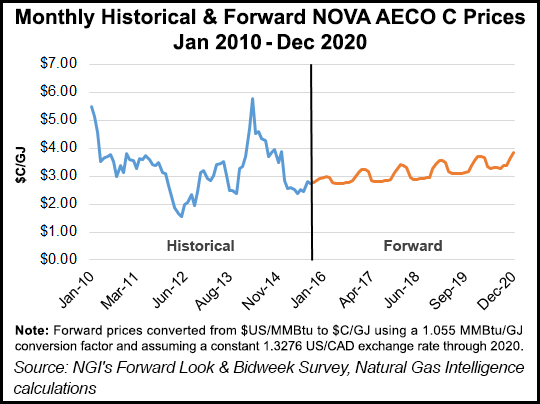

For 2015-2016 the province predicts its gas reference price, the weighted average of actual production used to compute royalties, will be a hard-times C$2.60/gigajoule (GJ) (US$2.07/MMBtu).

Based on actual realized and forward prices, NGI estimates that the fiscal 2015-2016 price may be more like C$2.74/GJ, which suggests the Alberta provincial government may be a bit more pessimistic than the overall market over the next seven months.

The current outlook is a drastic comedown. During the first 10 years of the 21st century, annual Alberta government gas royalties averaged C$5.4 billion (US$4.1 billion). Collections hit peaks of C$7.2 billion (US$5.5 billion) in 2000-20001 and C$8.3 billion (US$6.3 billion) in 2005-20006, the all-time high.

The provincial gas royalty hit the skids in the 2009-2010 fiscal year, dropping to C$1.7 billion (US$1.3 billion) under double blows from global economic recession and the first wave of the shale gas supply flood across North America. Collections never recovered and have continued on a downward path ever since.

As a treasury cash cow gas has fallen far below the Alberta government’s revenues from its wholesale liquor warehouses, lotteries and gambling machines, which are forecast to hit a combined C$2.4 billion (US$1.8 billion) in fiscal 2015-2016.

A formal review of oil, gas and bitumen royalties began as Ceci released the province’s first-quarter statements. But the inquiry panel made no promises to refill the treasury, saying only that it will seek “opportunities for adjustment” that emerge from a realistic assessment of turbulent fossil fuel markets. The current royalty regime will remain unchanged until 2017, the government added.

Alberta’s former prominent role as a national and international gas supplier continues to shrink. Prospects of production, revenue or price lifts from Canada’s 27-entry lineup of liquefied natural gas export terminal projects remain too remote to brighten the official outlook.

The Alberta Energy Regulator, in its current annual reserves and production review, forecasts out-of-province sales will decay to 2.2 billion cubic feet per day as of 2024 — 58% less than the 2014 average of 5.3 Bcf/d and down by 80% from 11 Bcf/d in 2001.

The retreat from national and export markets is attributed partly to rising Ontario and Quebec imports of shale supplies from the United States, and especially to Alberta’s own gas use by still-growing thermal oilsands plants.

Consumption at mammoth northern operations in bitumen mining and in-situ underground extraction with steam is forecast to reach 5.1 Bcf/d as of 2024, up by nearly 66% from the 2014 average of 3.1 Bcf/d. Work continues on new projects and additions to old ones that began before the current oil price slump.

The mines use an average of 0.69 Mcf of gas per barrel of oil production, while in situ sites consume 1.1-1.2 Mcf/bbl depending on the type of steam injection employed. Total bitumen output is expected to nearly double to four million b/d as of 2024, with in-situ operations growing faster than the mines.

Counting replacement of coal with gas at thermal power stations, Alberta’s use of its own production is projected to climb to 6.6 Bcf/d or 75% of capacity as of 2024 from the 2014 average of 4.9 Bcf/d or 48%.

The oilsands operations, while bruised by fallen prices, are efficient enough to keep on spinning off government income despite their “net-profit” royalty regime that levies its rates only on revenues after production costs plus a deemed fair return.

Barring a prolonged spell of sub-US$55/bbl prices, the provincial treasury expects to net C$2.2 billion (US$1.7 billion) on the oilsands in fiscal 2015-2016 — down by 56% from C$5 billion (US$3.8 billion) in 2014-2015 but nearly six times more than the gutted gas take the government is resigned to accepting this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |