Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Higher Storage to Pressure ‘Very Resilient’ Natural Gas Market This Winter, NGSA Says

Even in the face of growing exports, lower weather-driven demand and higher stockpiles should apply downward pressure on natural gas prices during the 2019/20 winter, the Natural Gas Supply Association (NGSA) said Thursday.

Speaking in Washington, DC, BP Energy Co. CEO Orlando Alvarez presented the NGSA’s annual outlook for the rapidly evolving natural gas supply/demand landscape heading into the November-March heating season.

Winter 2019/20 will see the United States export more gas than ever before, but after another year of continued production growth, uncertainty remains over whether demand can keep up enough to match the $3.33/MMBtu average Henry Hub price from 2018/19.

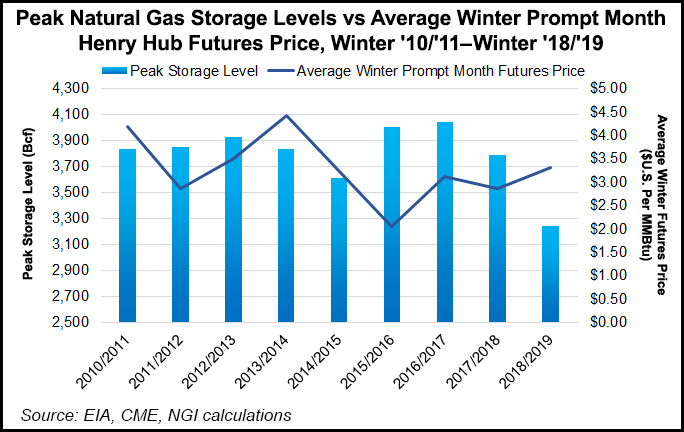

This year the industry enters the winter with significantly more in storage compared to the roughly 3.2 Tcf end-of-October inventories that produced more than a little excitability in the futures market last winter.

Still, Alvarez noted that ultimately the market managed the demand even at those lower inventory levels; with a projected 3.7 Tcf at the end of injections this year, the extra cushion should put downward pressure on prices, he said.

“Last year we came in at 3.2 Tcf. We had a cold November, really cold November. We had a colder than normal winter” overall, Alvarez said. “Average prices went to $3.33. That’s a signal of the resiliency of the market. We were able to sustain that with those storage levels.

“So now we’re coming into this winter at 3.7 Tcf, which is, I would say, a really good position to be in.”

A big reason why the market has refilled storage to near-average levels this year is the continued growth in Lower 48 production. But compared to a roughly 10 Bcf/d jump in production year/year between the 2017/18 winter and 2018/19, the growth for the 2019/20 winter should prove more modest at around 4 Bcf/d year/year, according to Alvarez.

“We don’t see the increased production” for the 2019/20 winter creating the same “huge” downward pressure on prices, he said.

Growth in production has reduced overall price volatility, but the risk for localized price spikes remains, Alvarez noted.

“The market has been very resilient” in the face of severe weather events, he said. “I don’t think anyone can sit here and say we’re not going to have cold spurts where you’re going to see cash prices spike” regionally in areas like New England.

“If you get some extremely cold weather in certain parts of the country you’re still going to see” temporary price spikes. “But for the most part” the market has been “pretty consistent over the last five years” at keeping prices below $5 and generally in the $2-4 range. It’s a “very different market, more resilient market than we’ve had.”

The big drivers of production growth have been the usual suspects, namely the Northeast and Texas. The Permian Basin, which also underlies both West Texas and Southeast New Mexico, has grown output to 11 Bcf/d, Alvarez said. The start-up of Gulf Coast Express has been a boon for producers, and Alvarez estimated that the intrastate pipe was flowing maximum volumes of 2 Bcf/d as of Thursday.

Higher exports in 2019/20 will go a long way to soaking up some of the incremental supply. NGSA expects pipeline exports to Mexico, boosted by the start of service on the Sur de Texas-Tuxpan marine pipeline, to grow by 1.0 Bcf/d winter/winter.

Meanwhile, liquefied natural gas (LNG) exports should reach 8.3 Bcf/d this winter (up from recent levels of around 6.0 Bcf/d), driven by new capacity at the Cameron, Corpus Christi and Freeport facilities.

“The arb is open,” Alvarez said, adding that this 8.3 Bcf/d of LNG exports is “based on what the market is telling us today.”

In total, NGSA projects exports to rise to 14.1 Bcf/d for winter 2019/20, up from 9.3 Bcf/d in 2018/19.

Still, in terms of price impact, NGSA sees the overall winter 2019/20 demand picture as neutral year/year. The group expects a decrease in total heating degree days (HDD) for this winter compared to last, dropping from 3,620 HDDs in 2018/19 to a forecast 3,469 HDD for 2019/20. But Alvarez cautioned that weather remains a wild card, as always.

Potentially helping to offset the weaker residential/commercial demand that would accompany a milder winter, NGSA expects power burns to grow year/year from 25.7 Bcf/d to 27.0 Bcf/d on a combination of structural changes and economic switching.

Industrial demand, meanwhile, is expected to remain roughly flat to last winter at around 24.8 Bcf/d. Manufacturing has contracted over the past year in the United States. This comes as the Trump Administration’s tariffs have created uncertainty over trade, and the ripple effects could spill over into the natural gas markets, Alvarez said

“What happens next?” Alvarez said. “If this trade uncertainty continues, what’s the effect? This actually started 18 months ago. It started with steel, went to LNG, then to gas. It’s producing a mixed bag. If you’re a steel manufacturer in the U.S. your prices are going up. If you’re an automaker, it’s hurting. If you’re an oil and gas producer you’ve got to buy steel. It’s a mixed bag.

“It’s affecting a number of industries…could it impact natural gas prices? Sure it could.”

Looking beyond just the 2019/20 winter, regulatory efforts to address climate change make it imperative for the natural gas industry to assert how it fits into a lower carbon future, according to Alvarez.

“There’s a lot of regulatory policy out there around renewables and the role of natural gas in the lower carbon future,” he said. “The only message we want to send as NGSA is we strongly believe natural gas has a role in that lower carbon future. We would say we don’t see” natural gas “in that conversation enough. We’re not here to bash any fuel. Every fuel has its own merit, its own attributes. But we feel natural gas needs to be in the conversation.

“Talking renewables? We can help. That’s the approach we’re taking.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |