Hercules Prepares for Chapter 11; Another E&P Begins Restructuring

Houston-based jack-up contractor Hercules Offshore Inc., whose fleet is concentrated in the shallow waters of the Gulf of Mexico (GOM), is handing over ownership to creditors through a financial restructuring that would lead to a Chapter 11 filing in early July.

Two-thirds of Hercules debt holders agreed to a plan to convert $1.2 billion in senior debt into new equity, giving them almost 97% of the company’s shares. Existing shareholders would receive about 3%. A bankruptcy court has to okay the plan once Hercules files for voluntary protection, which is expected in July.

Under the agreement, creditors would backstop $450 million in capital to pay for Hercules Highlander, a new drilling rig, among other things. No contracts would be broken, and operations would continue as usual.

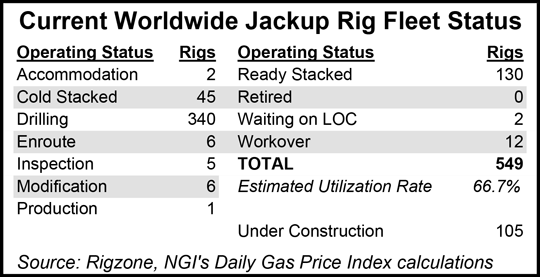

“Once our financial restructuring is completed, the new capital structure will provide a better foundation for Hercules to meet the challenges in the global offshore drilling market due to the downcycle in crude oil prices and expected influx of newbuild jackup rigs over the coming years,” Hercules CEO John Rynd said.

Hercules is the second U.S. oilfield services operator that would file for protection since the start of the year after Houston’s Cal Dive International Inc. (see Daily GPI, March 4). Hercules already has reduced its workforce of 1,800 by 40% since the start of the year and has cold stacked 11 of 20 GOM rigs.

Tudor, Pickering, Holt & Co. said the Hercules deal with creditors “reflects the depressing state” of the jackup markets “coupled with a highly levered…balance sheet.” Moody’s Investors Service in March had lowered the Hercules liquidity rating to SGL-4, its lowest rating on a scale of 1-4, from SGL-2. The SGL is a short-term rating system for speculative grade issuers that are by definition “not prime.”

Analysts with Raymond James & Associates Inc. said the Hercules news “does not come as a surprise,” because the “high amount of leverage and weaker macro conditions have weighed on the company’s financial health…”

Evercore analysts noted that Hercules was able to avoid restructuring after the 2010 Macondo well blowout in the GOM shut down offshore operations for about half a year. “This downturn, however, is proving to be too severe to escape and Hercules’ rigs are at a serious disadvantage in the current very oversupplied offshore market,” analysts said.

Meanwhile, junior independent Saratoga Resources Inc., also based in Houston, filed for Chapter 11 on Thursday in U.S. Bankruptcy Court for the Western District of Louisiana in Lafayette. Saratoga’s principal holdings cover around 52,000 net acres, mostly held by production, in the transitional coastline and protected in-bay environment on parish and state leases of South Louisiana and in the shallow GOM shelf.

The company joins a list of exploration and production operators based in North America that have fallen into bankruptcy since the start of the year as a result of the commodity price crunch.

Saratoga “intends to continue to operate” as debtors in possession (DIP), management said. The company should have “sufficient cash to operate its businesses in the immediate term” without need for DIP financing.

The bankruptcy filing “follows earlier challenges relating to the company’s field operations coupled with the precipitous decline in oil and gas prices, which resulted in lower than projected revenues and profitability and an unexpected arbitration award against the company” by privately held Harvest Operating LLC, management said. “Exhaustive initiatives” were undertaken in field operations also, but it’s not been enough.

“As a result of the steep decline in commodity prices during the second half of 2014 and continuing into 2015, compounded by production declines associated with run time issues in early 2014, which have subsequently been addressed, we have been operating in a cash-constrained environment,” CEO Thomas F. Cook said.

“We have been working closely with our secured lenders to try to address liquidity issues with a view to either restructure or repay existing debt and preserve collateral from hostile action arising from the outstanding arbitration award and have retained advisers to assist in the evaluation of potential alternatives to either restructure or repay the existing secured debt,” Cook said.

Saratoga is pursuing legal claims against Harvest, which won an arbitration award of $3.7 million, but without an “acceptable resolution of the arbitration award, our management and our principal lenders determined that a court administered reorganization would offer the best means of addressing the arbitration claim and the company’s existing debt structure and realizing the anticipated benefits of our drilling, workover and recompletion program.”

The Chapter 11 process is being used to “avert adverse action” by Harvest and to restructure.

Saratoga management intends “to continue doing business while we complete the processes before us and expect that a vast majority of our suppliers, vendors and business associates will see no disruption in our business. We believe that our long-term prospects remain solid, that we continue to have substantial untapped reserves and that our development program will continue to increase daily production.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |