Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Helmerich & Payne’s Lower 48 Rig Margins Rising but ‘Tempered’ Activity by E&Ps

Tulsa-based Helmerich & Payne Inc. (H&P), with a fleet of 350 U.S. land rigs, said Lower 48 rig margins in the first three months of the year increased by more than $450/day on average, up 2% sequentially, with rig margins climbing by $900/day or 8% higher.

The oilfield services operator issued its fiscal 2Q2019 results late Wednesday followed by a conference call Thursday morning. CEO John Lindsay noted that the quarter was bumpy, and it may continue to be so through midyear.

“From the outset, this was a quarter challenged by industry uncertainty, so I am pleased to report that the company not only stayed on target and delivered sequentially improved net income, but also achieved two significant milestones,” Lindsay said. “Concern over crude oil prices persisted from the prior quarter, which softened demand for incremental super-spec rigs, but H&P completed the planned upgrades already in its pipeline,” bringing its total super-spec FlexRig count to 230 at the end of March.

The U.S. land rig utilization rate was 67% between January and March, flat sequentially but up from 59% a year earlier.

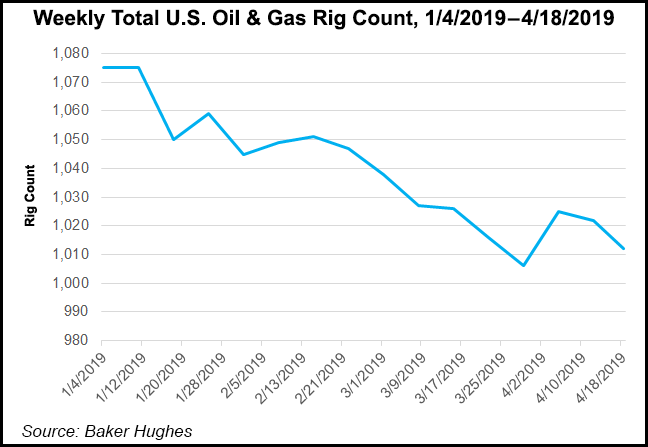

“Based on trends we are seeing in rig releases and current demand, we believe the company’s active rig count will bottom-out early during this quarter with super-spec utilization in the 90%-plus range,” Lindsay said. “This should be supportive of the current pricing environment.”

Since the start of the year, crude prices have risen about 40%, he noted, and in past cycles, this would have led to higher exploration and production (E&P) activity.

“However, we have seen a tempered response and even reductions in activity by some in the industry. Clearly, customer behavior is changing, and their movement is toward prioritization of cash flows and returns. An additional emphasis is placed on disciplined spending and determining where value can be added to improve performance and long-term cash flows.”

H&P has an advantage, said the CEO, as the FlexRig fleet is designed for drilling unconventional wells with a digital technology platform that when deployed can improve well economics.

H&P also laid the groundwork for future growth opportunities by commercializing its AutoSlide drilling automation technology, CFO Mark Smith said. AutoSlide already is being deployed in the Permian Basin’s Midland formation, and earlier this month was deployed into the Eagle Ford Shale.

In addition, H&P has a letter of intent for a FlexRig to be used in Argentina by an undisclosed customer, allowing the company to build its opportunities into growing markets.

“The company’s previously reduced cadence for super-spec upgrades remains unchanged for the balance of our fiscal year, as does our capital allocation strategy,” Smith said. “As we look ahead, we are confident in the cash flow generation potential of our upgraded super-spec FlexRig fleet.”

U.S. land activity during fiscal 3Q2019 is expected to decline sequentially with revenue days off 4-6%, representing a roughly 5-7% decline in the average number of rigs. H&P expects to end June with 215-225 active rigs in the Lower 48. Rig revenue/day in the Lower 48 is expected to be relatively flat at $25,500-$26,000/day, excluding any impact from early termination revenue. Rig expenses are expected to average $14,250-$14,750/day.

For the Lower 48 business, H&P expects to upgrade up to three FlexRigs through June “to walking super-spec capabilities.”

Following the recent deployment of AutoSlide in the Eagle Ford, H&P expects to introduce the technology in Oklahoma’s myriad stacked formations over the next three months. However, management warned that the “recent moderation of industry rig demand has the potential to slow the rate of adoption of our new technologies.”

H&P still expects capital expenditures to be $500-530 million this year, with about 35% earmarked for super-spec upgrades, 33-38% for maintenance and 27-32% for continued reactiviations and other bulk purchases. In addition to its Lower 48 fleet, H&P has 32 international land rigs and eight offshore platform rigs.

“A pivotal long-term objective has been to translate H&P’s position of drilling leadership in U.S. unconventional basins to key international markets, where super-spec FlexRigs and…software solutions, including AutoSlide, can add significant value to the customer,” Lindsay said.

“That has started coming to fruition with the signing of a letter of intent to deploy our first super-spec FlexRig from the U.S. to Argentina later this quarter. We see this as a significant milestone and are excited about this opportunity and what it portends for H&P’s Latin America business, as well as other international markets.”

Net income for the period ending in March was $61 million (55 cents/share) from operating revenue of $721 million, versus a year-ago loss of almost $12 million (minus 12 cents) from operating revenue of $577 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |