Background information about the Haynesville Shale

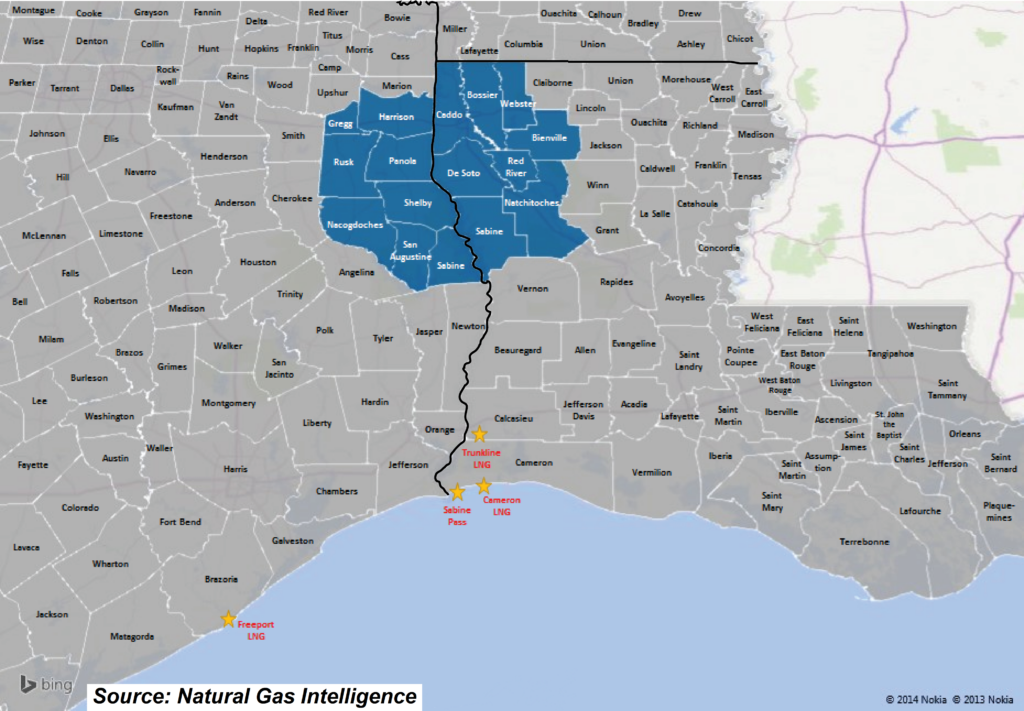

The Haynesville Shale is a massive dry natural gas formation in Northwest Louisiana and East Texas that lies at true vertical depths between 10,000 and 14,000 feet. The play was discovered by Chesapeake Energy in early 2008, and that triggered a substantial wave of leasing activity in the area. Companies have also reported success in developing the Bossier Shale, another gas formation that lies just above the Haynesville. Many operators simply call the area the Haynesville/Bossier Shale, although they are in fact separate producing formations.

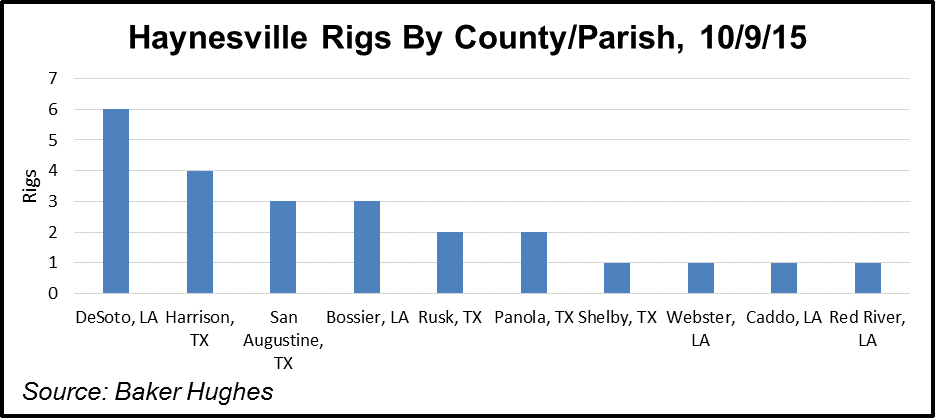

The “sweet spot,” or “core” of the Haynesville is generally considered to be on the Louisiana side of the play, and has been the focus of most horizontal drilling activity by operators thus far. As of Oct. 9, 2015, six of the 24 rigs working the play were in DeSoto Parish, LA. A typical horizontal Haynesville well costs between US$7 million and $8 million to drill and complete, depending mostly on lateral length and the cost of rigs and pressure pumping services. One of the main characteristics of the Haynesville Shale is that it is over-pressurized, which has contributed to some very high initial production rates.

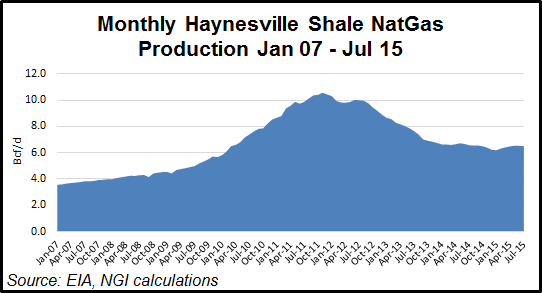

Many early horizontal wells in the Haynesville came on with initial 24-hour production rates in excess of 20 MMcf/d, which are very high by historical standards. That high pressure also helps minimize initial lifting costs in the Haynesville, since those wells do not need to go on pump as quickly. On the other hand, the higher pressure also contributes to extremely high first year decline rates, which can be as much as 85% in the area. Operators believe that choking back initial production rates in the Haynesville helps increase estimated ultimate recoveries (EUR) of those horizontal wells. Dry gas production in the Haynesville went from virtually nothing in January 2008 to a peak of 7.2 Bcf/d in January 2012, but production later fell by 46% to just 3.9 Bcf/d in August 2014. As of October 2015, gas production from the Haynesville was nearly 6.5 Bcf/d, according to the U.S. Energy Information Administration.

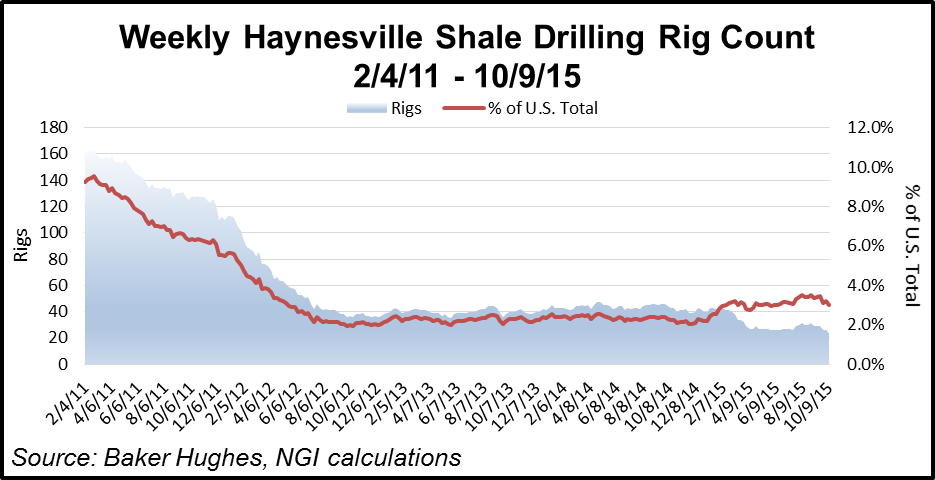

As previously mentioned, the Haynesville rig count was at 24 rigs in early October, a far cry from a mid-2010 peak of 185 rigs. Prior to the commodity price rout of late 2014-2015, the Haynesville rig count was holding around 39-47 rigs since December 2013.

Being a basin that produces dry gas, the Haynesville had fallen out of favor among most producers, who opted instead to pursue liquids-rich plays, which were offering higher netbacks than dry gas, at least before the oil price collapse. Additionally, as an early mover among the shale plays, most acreage in the Haynesville was held by production, so producers were not compelled to drill in order to keep it.

However, beginning late in 2014 and continuing during 2015, some producers again took a shine to dry gas and the Haynesville.

The move back to the Haynesville was led by in part by Comstock Resources Inc., which opted to increase Haynesville activity as low oil prices made Eagle Ford Shale and Tuscaloosa Marine Shale activities less attractive (see Shale Daily, Dec. 18, 2014). Spring of 2015 saw an uptick in drilling activity in the Haynesville (see Shale Daily, April 24, 2015).

The Haynesville is well positioned to capitalize on three emerging trends on the demand side of the industry: growing petrochemical capacity in the Gulf Coast region, the scheduled retirement of coal fired electricity generation in the next several years, and the emergence of LNG export facilities. The Haynesville could become a significant U.S. supply region to the rest of the world by 2020, for the following reasons:

- The formation is located close to the four to five LNG export terminals expected to come to fruition along the Gulf of Mexico.

- Haynesville production is dry gas, so it does not have to be processed before being liquefied.

- Several industry sources estimate there are between 35,000-50,000 wells left to be drilled in the play, so production is scalable.

- There are already plenty of gathering facilities and pipelines in place in the region, so infrastructure bottlenecks are much less likely to be an issue.

- Texas and Louisiana are both “pro-oil and gas” states, so those local governments would likely encourage increased production from the Haynesville.

- BG Group, which is among the largest international LNG trading firms, has a presence in the Haynesville. BG has a 50/50 production joint venture with Exco Resources in the play, and it signed on to be an anchor shipper from Cheniere’s Sabine Pass LNG Export facility, which is expected to be phased into service around the beginning of 2016. BG Group is poised to be acquired by Royal Dutch Shell, however, and commentary around the deal by executives and analysts has made little mention of the company’s shale holdings (see Daily GPI, April 8, 2015).

EXCO Resources said in October it was shutting down Eagle Ford drilling to focus on the Haynesville/Bossier Shale for better returns (see Shale Daily, Oct. 30, 2015).

Supporting the idea that the Haynesville is a prime source of natural gas to be liquefied for export, a study completed in late 2015 said liquefying and shipping gas from the Haynesville to power generators would result in lower emissions than firing power plants with coal (see Daily GPI, Oct. 6, 2015).

The Haynesville is also a prime target for recompletion of existing horizontal wells. As one petroleum engineer explained to NGI in November 2014, not every horizontal well or formation is a candidate for refracks, but several companies have reported “encouraging results” from recompleting existing horizontal wells in the Haynesville. The refrack market in the Haynesville was gathering pace in 2015 and, as predicted by one Houston-based analyst, was on track to exceed $500 million in activity by 2020 (see Shale Daily, Oct. 2, 2015). In early November 2015, Comstock management said refrack programs in the Haynesville as well as the Eagle Ford showed much promise, but refracking activities were put on hold because of low commodity prices.

Well economics estimates for the Haynesville are all over the map, causing responses ranging from “we are excited about the play” to “what we see in the Haynesville Shale play are companies that blindly seek production volumes rather than value, and that care nothing for the interests of their shareholders.” That latter opinion appeared in a recent Forbes op ed piece that pegged breakeven prices in the Haynesville at $6.50 NYMEX. Credit Suisse calculated the breakeven prices for the Haynesville Core and Tier 1 to be about $4.30 and $5.80, respectively, based on NYMEX prices in August 2015. About the best breakeven estimate we have seen for the Haynesville core is $2.50-3.25 from RBC Capital Markets. None of those estimates make the play economic at current prices.

However, we note most of those calculations were likely made using older assumptions that were based on older technology, and therefore could be underestimating the estimated ultimate recovery (EUR) potential of the play. Operators in the Haynesville are catching up with the trend prevalent in other basins to drill longer laterals and use more proppant. As QEP Resources CEO Chuck Stanley said on the company’s 3Q15 conference call, “I think that there has been a fundamental change in Haynesville economics as a result of some operators in who pushed the size of stimulation that we have historically pumped up to in some instances over 3,000 pounds per foot — per lateral foot, 3,000 pounds of proppant per lateral foot, which has made a noticeable difference in early time well performance.”

Stanley also observed that “the lateral length has been increased. When we were actively developing our Haynesville asset our typical lateral length was 4,500 feet or so. And today most operators have moved to roughly 7,500 foot laterals, so they are drilling cross unit wells. And that was a regulatory challenge back in the day when everybody was active, but the state has reacted positively to proposals from other operators.”

Goodrich Petroleum made similar statements on its 3Q15 call. “We are very encouraged by early results for offset operators like our friends at Comstock in the Haynesville who are using a new completion design with a significantly higher proppant concentration. We have drilled or participated in 93 wells in the Haynesville with a typical EUR of approximately 6 Bcf per well from approximately 4,600-foot laterals using the old completion design which is less than half of the proppant currently being pumped. By increasing the proppant from 1,100 pounds per foot to 2,500 or even 3,000 pounds per foot, we are seeing approximately 50% improvement in short lateral EURs, where we are projecting 9 Bcf from 4,600-foot laterals that generate a 25% rate of return at $3 gas.

However, the wells improve as you drill longer laterals. We are projecting 15 Bcf per well from 7,500-foot laterals and a rate of return of approximately 40% at $3 gas. From our analysis which is consistent with what we are seeing from many of the offset operators, we see 1.8 to 2.0 Bcf per thousand feet and ultimately expect to drill up to 10,000-foot laterals which at 2 Bcf per 1,000 foot would equate to 20 Bcf wells. With the longer laterals, you will see better rates of return as we believe EUR per foot is linear, and drill and complete costs decrease per foot for extended reach laterals.”

Counties/Parishes

Louisiana: Bienville, Bossier, Caddo, DeSoto, Natchitoches, Red River, Sabine, Webster

Texas: Gregg, Harrison, Nacogdoches, Panola, Rusk, Sabine, San Augustine, Shelby

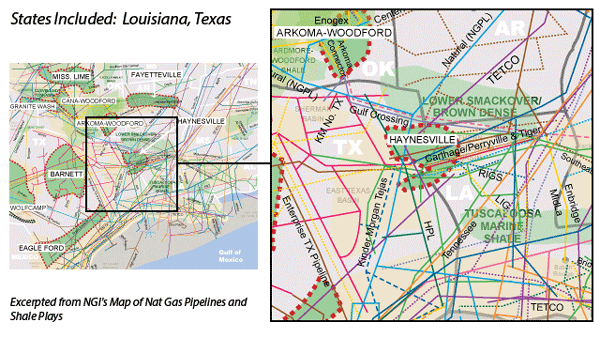

Local Major Pipelines

Natural Gas: Acadia Gas Pipeline, Atmos, Carthage Hub, CenterPoint Energy, Enterprise Products, Gulf South, HPL, KM Tejas, Louisiana Intrastate Gas, Mississippi River Transmission, NGPL, RIGS, Southern Natural, Tennessee, Texas Eastern Transmission, Texas Gas Transmission, Tiger Pipelin

Crude Oil*: Arklatex (Plains Pipeline), BKEP Pipeline, BP Pipelines, ExxonMobil, Mid Valley Pipeline, North Louisiana System (ExxonMobil), Paline Pipeline, Plains, Sunoco Pipeline, SXL, West Texas Gulf (Sunoco)

NGLs*: ATEX, Black Lake Pipeline, DCP Midstream, Enable Ethane System, Enbridge, Enterprise Products, Markwest Carthage System, San Jacinto Pipeline, Sterling I, Sterling II, Sterling III (Propsed), TEPPCO

*: The Haynesville tends to be mostly natural gas production, and dry gas production at that. These pipelines traverse the counties that contain the E TX Haynesville, and are included for completeness. NGLs from this area are more likely to come from more liquids rich gas plays, such as the Cotton Valley.

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily