Markets | NGI All News Access | NGI Data

Harvey Forecasts Overshadow On-Target NatGas Storage Stats; September Trades Higher

The potential supply disruption from Tropical Storm Harvey approaching the Texas Gulf Coast Thursday appeared to overshadow the market’s response to a 10:30 a.m. EDT natural gas storage report from the Energy Information Administration (EIA) that was in line with estimates.

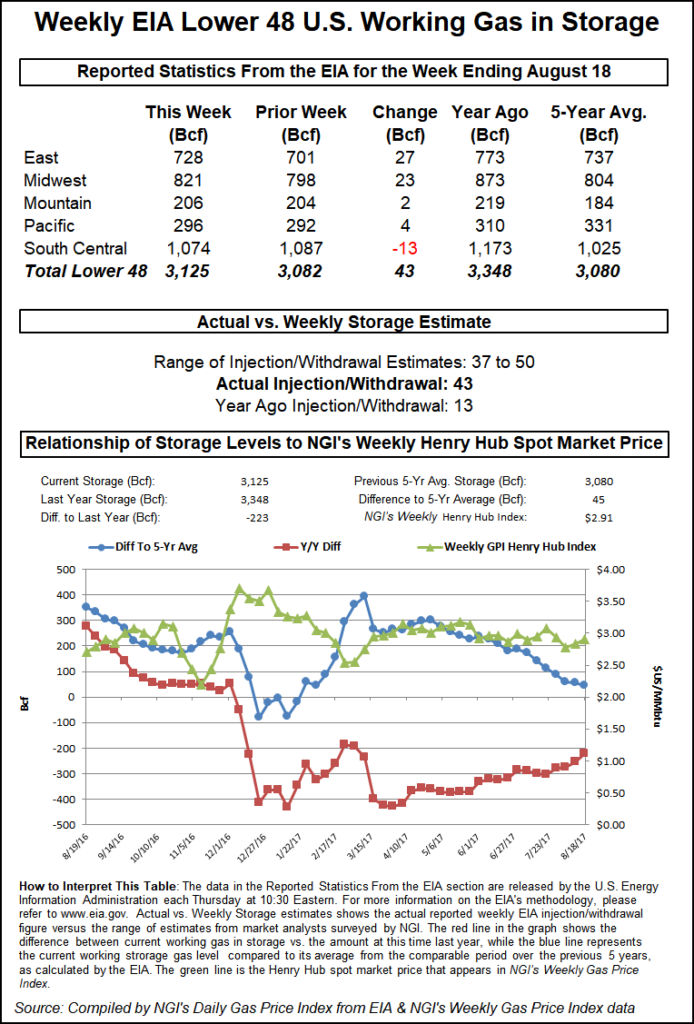

The EIA reported a build of 43 Bcf for the week ended Aug. 18, slightly below the 45 Bcf build called for by a Reuters poll of analysts. The figure compares to 53 Bcf injected in the prior week and 12 Bcf injected a year ago. Total working gas now stands at 3,125 Bcf, slightly above the five-year average inventory of 3,080 Bcf but below year-ago stocks of 3,348 Bcf. The year-over-five-year surplus shrank by 10 Bcf during the report week, according to NGI calculations.

Citi Futures’ Tim Evans called the weekly EIA inventory figure “a constructive outcome. The data suggests a minor tightening of the background supply/demand balance that may carry over into the weeks to follow.”

The September Henry Hub contract had already climbed nearly 4 cents day/day to $2.974 by the time the inventory report released at 10:30 a.m. As morning forecasts showed Harvey intensifying as it beared down on the Texas coast, threatening heavy rainfall and flooding, the potential supply disruption seemed to have grabbed traders’ attention more so than EIA’s on-target storage stats.

In the minutes following the EIA report, the September contract fell to $2.949 before recovering to $2.963 by 11 a.m. EDT.

David Thompson, vice president of Powerhouse, said the 3-4 cent gain Thursday morning was a fair reflection of the potential production impact from Harvey and a slightly leaner-than-expected storage build.

But given that the market has been range-bound for a while now, “the bigger question is does anything on the bullish side get you above $3.10 on the prompt month, and for the winter, above $3.40? Until that happens, it’s just back and forth and choppiness, which is a function of a market where supply is in balance with demand,” Thompson said.

For now, the market appears to be waiting for “a definitive new breakout, either bullish or bearish,” he said.

By region, the South Central saw a withdrawal of 13 Bcf, including 9 Bcf withdrawn from salt storage and 4 Bcf withdrawn from nonsalt. The East saw an injection of 27 Bcf for the week, while the Midwest region injected 23 Bcf week/week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |