Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton Ready to Play Hardball on Pricing, Says CEO

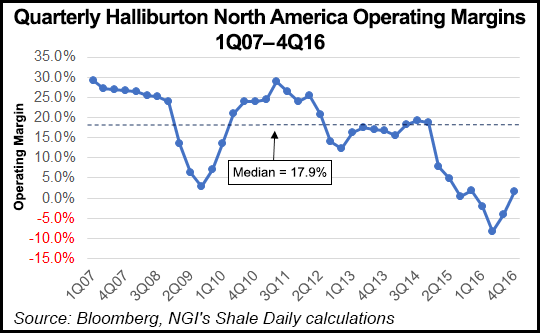

Halliburton Co. returned to operating profitability in North America for the first time in 2016 in the final three months, and equipment is coming off the cold stack and moving back into the onshore, if the price is right, CEO Dave Lesar said Monday.

The management team spent an hour discussing 2016 performance and provided a glimpse of what it sees going forward. In a nutshell, it’s a mixed picture — positive for North America land operations but not so much for the offshore or for overseas.

“Never before in my nearly 40 years in and around the oil and gas industry have I seen a more difficult year for the industry,” Lesar told analysts. “The downcycle in the 1980s was bad, but 2016 represented the sharpest and deepest industry decline in history. However, today I’m really excited about what I see happening. We came through 2016 in pretty good shape…”

North America, the largest segment, also was the best performing during 4Q2016, with revenue increasing 9% sequentially to $1.8 billion and operating margins improving by about 550 basis points. The improving U.S. land rig count drove increased equipment utilization, particularly in the drilling and evaluation product lines. Operating results improved by $94 million from a sequential loss of $66 million to income of $28 million, driven primarily by increased pricing and utilization in U.S. land.

“I believe we had a fantastic quarter in executing our strategy,” Lesar said. “First and foremost…we returned to operating profitability in North America after three quarters of losing money. We achieved incremental margins of 65% in North America. And we continued to clearly gain market share as we outgrew our primary competitor in not only North America, but Latin America and the Eastern Hemisphere.”

Things are looking up for North American land operations, where Halliburton is the No. 1 pressure pumper, but “our world is still a tale of two cycles,” said the CEO. “While the North American market appears to have rounded the corner and on the upswing, the international downswing is still playing out.”

In North America specifically, the “customer animal spirits” have come back. “Last quarter I said that these animal spirits were alive but somewhat caged up. Now, these animal spirits have broken free and they are running. However, not all customers are running in the same direction or as a pack but they are running.” These animal spirits are evident in the “dramatic increase” in merger and acquisition activity, secondary offerings, the significant boost in private equity capital moving into resource plays and the rig count.

“Customers are excited again, and our conversations have changed from being only about cost control to how we can meet their incremental demand,” Lesar said.

Hardball Pricing

The Houston-based oilfield services giant made a strategic choice in the second half of 2016 to not chase market share and erode profits further. That pressured North American revenue, which didn’t grow at the same pace as the rig count, Lesar noted.

However, the high level of market share built during the downturn “gives us what we call the ‘power of choice’ in the recovery. This is the ability to work with the most efficient customers who value what we do, and who reward us for helping them make better wells.”

During the fourth quarter, as demand for equipment increased and availability tightened, Halliburton began to play hardball, Lesar said. Customer discussions revolved around the unsustainable pricing environment and the need for the company to make a return — before it would continue to work for a particular customer or add equipment.

Schlumberger Ltd., which reported its quarterly results on Friday, also said it is pressuring customers on higher pricing.

“If a customer agreed to better pricing, we continued to work for them,” Lesar said. “If not, we took that equipment and used it to fill the incremental demand with a customer that shared our view on how to work together and make better wells. These conversations about the need for a healthy, profitable and viable service industry were sometimes hard, but they needed to happen.”

In effect, the company was able to keep equipment working at a higher price. It may have given up some market share intentionally in the short run, “but we met our goal of returning to operating profitability in North America. We did this because it’s important to keep in mind that above all we are a returns-focused company.”

Now into the first quarter, the company is benefiting from increased demand and is bringing back cold-stacked equipment.

“This newly activated equipment is only being added at a rate that ensures it is profitable. It should also stabilize our market share at above historical levels.”

Considering North American operations in 2017, Lesar said, “I really like how it’s shaping up. I expect as we finalize the execution of our strategy that revenue will meet or exceed rate count growth in 2017. However, we will have to contend with the cost of reactivating fracture spreads and inflation on our inputs. Keep in mind that our suppliers also expect to benefit from our customers’ animal spirits.”

Pricing Brawl Continuing

As to where prices may be headed in North America, operations chief Jeff Miller offered some insight during the call.

“Wild rumors are circulating in the industry about huge price increases. That’s just not a universal fact. Given our position in North America, no one knows more about pricing than we do, and here is what I do know.

“First, I like talking about price increases more than decreases. It’s a nice change. Second, the service price recovery is starting from an extremely low base, in many cases, below variable cash cost. Third, the level of pricing that satisfies a particular service company depends on where they are on the profitability continuum. And finally, even though the industry is starting at different profitability levels, every company will have to march back up the same path to profitability.”

The “pricing brawl” noted earlier this year is continuing, Miller said, as the industry recovers and equipment availability tightens. Pricing at the margin “is ultimately set by whoever is satisfied with the lowest returns…I can tell you, despite what you hear in the market, it’s clearly a bridge too far to skip from negative variable cash to positive operating margin in one step.”

The “industry pricing regression…needs to become a pricing progression. This means that for now, Halliburton will have to compete with companies that are satisfied with lower levels of short-term profitability. But we don’t believe their pricing is sustainable. You can’t have negative margins forever.”

For now, Halliburton plans to focus on execution and service quality to defend its position without sacrificing price, Miller said. “As Dave said, we’re at the point in the cycle where we feel it’s appropriate to bring equipment back into the market…Our stacked equipment was the best in the industry when on the fence, and it’s the best in the industry as we bring it back.”

However, Miller warned that bringing on equipment as needed is going to come at a price.

“Industry estimates for reactivating spreads very widely, and while our efficiency and expertise allow us to be on the lower end of the scale, it doesn’t make it free. Because we immediately expense some of the cost to reactivate the equipment, it will be a drag on our margins for a few quarters. To give you a rule of thumb, we believe on average, it will cost 1 cent/share in the quarter” for every given spread. After absorbing the additional expense, margins are expected to accelerate toward the end of the year.

North American revenue growth in 2017, barring weather disruptions, should “return to perform in line with the U.S. rig count, which is already up 14% against the fourth quarter average,” CFO Mark McCollum said. “Furthermore, we believe our margins will reflect incrementals of 40-45%, as they absorb the impact of adding additional pressure pumping equipment to the market.”

Halliburton during 4Q2016 reported a loss from continuing operations of $149 million (minus 17 cents/share), versus a year-ago loss of $28 million (minus 3 cents). Adjusted income was $35 million (4 cents/share), which beat Wall Street expectations by 2 cents. Total revenue was $4 billion, 5% higher sequentially, but slightly below forecasts. Reported operating income was $53 million.

Total revenue for 2016 came in at $15.9 billion, a 33% decrease (down $7.7 billion) from 2015. Reported operating losses in 2016 totaled $6.8 billion, versus a loss in 2015 of $165 million. Adjusted operating income in 2016 was $690 million, compared with $2.3 billion in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |