Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Global Oil, Natural Gas Prices Fall as Sanctions on Russia Fail to Bite Energy Exports

Global oil and natural gas prices tumbled Friday as sanctions imposed by the United States and its allies excluded Russian energy exports.

After surging by roughly 50% this week, the rally in European natural gas prices stopped Friday.

British and Dutch futures were down across the curve as Russian natural gas deliveries to Europe increased. Mixed signals were also sent after reports emerged that Russia’s government would be open to talks with Ukraine. It wasn’t immediately clear how serious the possibility was as North American Treaty Organization leaders said they would deploy additional military forces to the alliance’s eastern members.

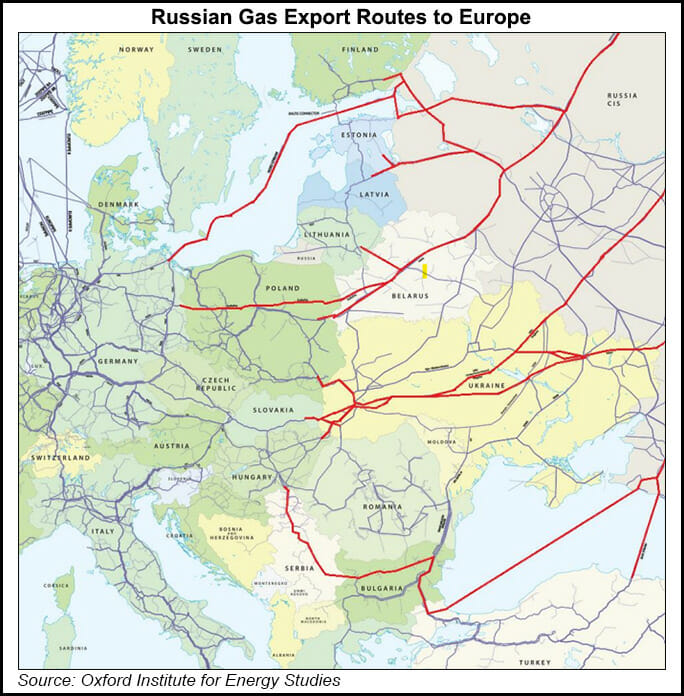

Russian flows via Ukraine increased 38% on Thursday, when panic gripped the market and sent prices higher. They were scheduled to rise another 24% Friday, when Russian forces entered the Ukrainian capital. Russian gas shipments through Poland on the Yamal-Europe pipeline were also booked at auction Friday to flow into Germany for the first time in months.

Anna Milkuska, a nonresident fellow in energy studies at Rice University’s Baker Institute for Public Policy, told NGI that increasing flows hint at state-owned Gazprom PJSC’s willingness to demonstrate that it is both a commercial entity and a reliable supplier of natural gas.

The jump in flows also demonstrates the reliance Europe has on Russia to meet gas demand and reinforces Ukraine’s role as a pathway for the fuel to reach the continent. About 20% of the Russian gas consumed by Europe moved through Ukraine last year.

“Western governments are not imposing the toughest measures because they are not prepared to bear the consequences,” analysts at Engie EnergyScan said in a note Friday.

U.S. oil and natural gas leaders on Thursday pledged to support Ukraine in light of Russia’s unprovoked invasion.

A risk still exists that fighting could interrupt supplies in the event that infrastructure is damaged. Ukraine human rights commissioner Lyudmyla Denisova warned Friday on social media that shelling in the eastern city of Okhtyrka is threatening natural gas pipelines, which she said is “critical civilian infrastructure” protected under international law.

The conflict will help keep natural gas and other commodity prices elevated given the dangers it poses and the threat of further sanctions, Mikulska said.

She added, however, that winter and peak demand are nearing an end, which could help tame some volatility in the near-term. Russia also has other transit routes to move gas to Europe outside of Ukraine. The longer-term concerns for the gas market are likely to shift to winter 2022-2023 if the conflict wears on, she said.

For now, the United States and its allies have blocked major Russian banks and cut the country off from semiconductors and advanced technology. But buying and selling Russian energy supplies is still allowed. Energy-related deals are exempted from the sanctions imposed on Russian banks to exclude a wide-range of commodities including oil, natural gas, liquefied natural gas (LNG), coal and even wood.

“In our sanctions package, we specifically designed energy payments to continue. We are closely monitoring energy supplies for any disruption,” Biden said in an address from the East Room of the White House on Thursday. “We have been coordinating with major oil-producing and consuming countries toward our common interest to secure global energy supplies.”

Sanctions Creating Uncertainty

The shadow of sanctions still has traders on edge. Buyers would need to “take into account the availability of the Russian financial system to facilitate buying” things like crude oil, Mizuho Securities said Thursday. The commodity is already in short supply amid an increase in demand as the global economy rebounds from the outbreak of Covid-19.

Russian oil has traded at a discount to Brent crude this week. “It almost became a toxic asset and traders are afraid to buy it because they’re afraid sanctions could be coming,” Mikulska said.

Bloomberg reported Friday that LNG buyers in Asia are having difficulties securing credit lines from banks in Singapore to purchase Russian cargoes, despite the fact that LNG has been excluded from sanctions. Other international banks were also reportedly restricting financing to buy some Russian commodities.

“Sanctions on their own not only work when they’re imposed, but the fear of sanctions also is a tool that can impact Russia,” Mikulska added.

Asian natural gas prices tumbled along with European benchmarks Friday. NGI data shows it’s currently more profitable to move U.S. LNG to Europe, meaning more American vessels could divert toward the continent in the days ahead, along with those from other suppliers as netbacks are favoring Europe.

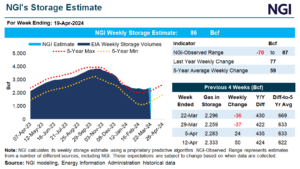

The Dutch Title Transfer Facility for March and April fell from around $44/MMBtu Thursday to around $30 Friday. Asian LNG spot prices for the second half of March shed about $4 to finish around $34. In the United States, milder weather forecasts also sent Henry Hub prices down. The prompt contract shed 17 cents to finish at $4.47.

U.S. prices are also more insulated given strong domestic production and the fact that no more gas can be pulled from the market for LNG exports as terminals are operating near capacity already.

Brent crude prices also traded lower Friday, finishing at $97.93 for April delivery. They were off seven-year highs Thursday, when the prompt contract hit an intraday high of more than $105/bbl. West Texas Intermediate was also down.

Iranian nuclear talks with the United States and other governments are nearing an end, which could lift sanctions on Tehran and allow more oil to reach global markets. That helped ease prices Friday, along with the fact that energy exports have been exempted from sanctions. The oil market is also watching rebounding output in Venezuela, which, however small, is seen helping to fill any void left by the conflict in Ukraine.

Dependence of Russia

Even still, Rystad Energy CEO Jarand Rystad warned this week that war in Ukraine immediately jeopardizes up to 1 million b/d of crude supplies that transit through Ukraine and the Black Sea. Longer-term disruptions, he said, could find oil prices surging to $130/bbl.

The conflict has so far weighed on equity markets and added to rampant inflationary pressures as well.

Wood Mackenzie analysts said Friday that the world’s dependence on Russia for certain commodities “cannot be overstated” and encompasses everything from natural gas and iron ore to oil and metals.

For natural gas, the European Union’s (EU) reliance on Russia was already in question and the invasion has forced the matter under a microscope.

“New supply will take time to materialize and we’ll see higher prices in the medium term,” Wood Mackenzie said. “But LNG players in the U.S., Qatar and beyond are starting to gear up, as are pipe suppliers from Azerbaijan, the East Mediterranean and Norway.”

In a joint letter to President Biden Friday, both LNG Allies and the American Exploration and Production Council urged the administration to “publicly signal” support for domestic natural gas and oil production.

“America’s vast energy resources are a strategic asset that can help keep U.S. prices low while supporting our allies abroad,” the trade groups wrote. “Policies such as pausing leasing on federal lands, preventing new pipeline infrastructure, and discouraging investments across the hydrocarbon value chain hamper U.S. production, thereby driving up prices and making the world more reliant on energy from nations such as Russia.”

The groups also pushed the administration to work more closely with EU leadership to expand the sorts of commercial relationships needed to “green light” more U.S. export capacity, European LNG receiving terminals and pipelines on both sides of the Atlantic. They also called for federal regulators to immediately approve pending U.S. LNG export and pipeline applications.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |