Gastar Deals West Edmund Package to Direct More Funding to STACK

Midcontinent pure-play Gastar Exploration Inc. has reached an agreement to sell a big package of its Oklahoma assets to direct more funding to other stacked reservoirs in the state.

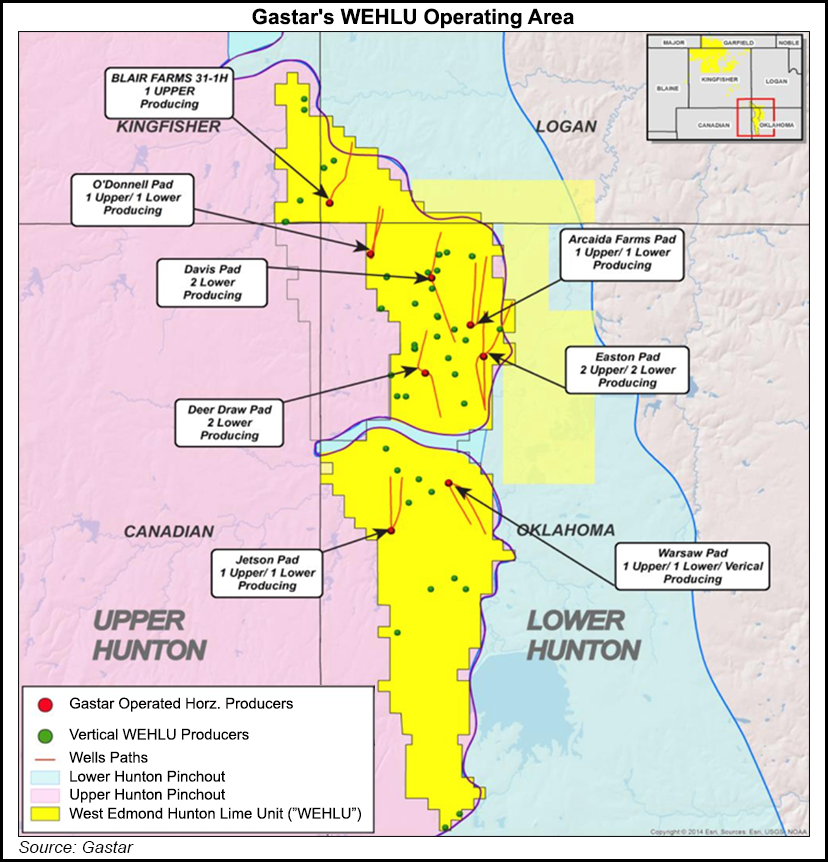

The West Edmund Lime Unit (WELU), which straddles Oklahoma and Logan counties, is being sold for $107.5 million to an unidentified buyer; the sale is scheduled to be completed by the end of February.

The sale, said CEO J. Russell Porter, would allow the Houston independent to better fund an abundance of prospects in Oklahoma’s STACK, i.e., the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

“Our one-rig drilling program has been re-started and we expect to be able to drill and complete approximately 20 operated wells in 2018 to more fully delineate and develop the Meramec and Osage formations on our 65,200 net surface acres in our core STACK position,” Porter said.

Because of its large contiguous position, “with as many as six potentially productive formations and multiple benches within certain prospective formations, we have a large inventory of undrilled horizontal locations to exploit to create value going forward.”

The buyer paid Gastar a 10% deposit of the purchase price on Thursday (Jan. 25).

During 3Q2017, the WEHLU assets produced about 2,836 boe/d net weighted 52% to oil, 25% to natural gas liquids and 23% to natural gas. The production at the time constituted 46% of Gastar’s total equivalent production.

Williams Capital Group LP analyst Gabriele Sorbara calculated the transaction was worth an estimated $37,906/boe flowing production and $1,371/undeveloped acre.

Tudor, Pickering, Holt & Co. advised on the sale, while Vinson & Elkins LLP served as legal counsel.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |