Markets | NGI All News Access | NGI Data

Futures Jump Following Thin NatGas Storage Gains

August futures gained ground following a report Thursday by the Energy Information Administration (EIA) showing a storage injection that was significantly less than the market was expecting.

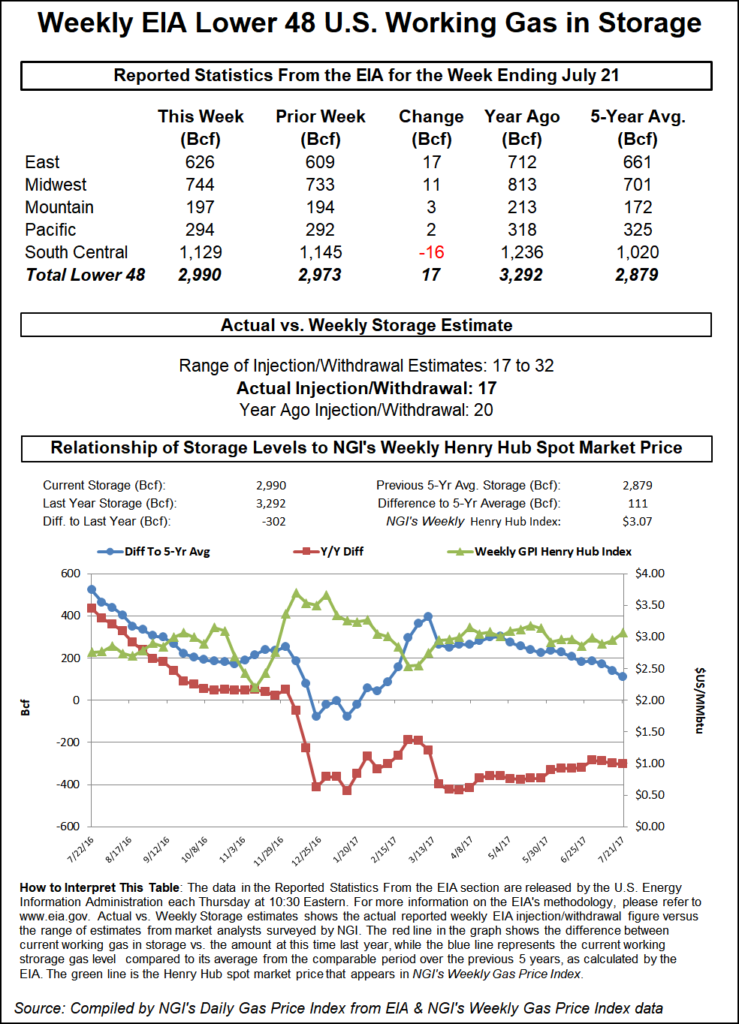

The EIA reported a storage injection of 17 Bcf, about 7 Bcf less than consensus estimates. When the number hit trading desks, the expiring August futures rose to $2.998, but at 10:45 a.m. August was trading at $2.970, up 4.6 cents from Wednesday’s settlement. The soon-to-be-spot September contract had risen 6.3 cents from Wednesday to $2.977.

Before the report was released, traders were looking for a storage build far higher than the actual figures. Last year 20 Bcf was injected and the five-year average stands at 47 Bcf.

ION Energy calculated a 21 Bcf injection, and Raymond James and Associates estimated a 32 Bcf build. A Reuters survey of 24 traders and analysts showed an average 24 Bcf with a range of +17 Bcf to +32 Bcf.

“All of a sudden the market popped it up,” said a New York floor trader. “I think you had some shorts in the market against recent lows that were hanging on because there was [only] sideways movement that were spooked out because of the number. If the market can’t make new highs it will slip back, and if it gets under $2.97, traders will push it back to the lows.”

Tim Evans of Citi Futures Perspective said, “This was a second consecutive bullish miss relative to consensus expectations and supportive relative to the 47 Bcf five-year average for the week ended July 21. While the report doesn’t provide background fundamental data on supply or demand factors, our guess is that this represents a higher rate of power sector consumption than anticipated.”

Wells Fargo Securities LLC analysts said the report was bullish.

“Based on current weather forecasts as well as elevated power burn levels thus far in July (35.8 Bcf/d month to date), our model projects a 48 Bcf cumulative storage build over the next two weeks. This would be substantially below the five-year average of 100 Bcf and would reduce the storage surplus to just 66 Bcf by the first week of August.”

Inventories now stand at 2,990 Bcf and are 302 Bcf less than last year and 111 Bcf above the five-year average.

In the East Region 17 Bcf was injected, and the Midwest Region saw inventories rise by 11 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was up by 2 Bcf. The South Central Region fell by 16 Bcf.

Salt storage fell by 12 Bcf to 318 and non-salt storage decreased 4 Bcf to 812 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |