NGI The Weekly Gas Market Report | Infrastructure | LNG | LNG Insight | NGI All News Access

FortisBC Seeking Approval for LNG Storage, Shipping Terminal on BC Coast

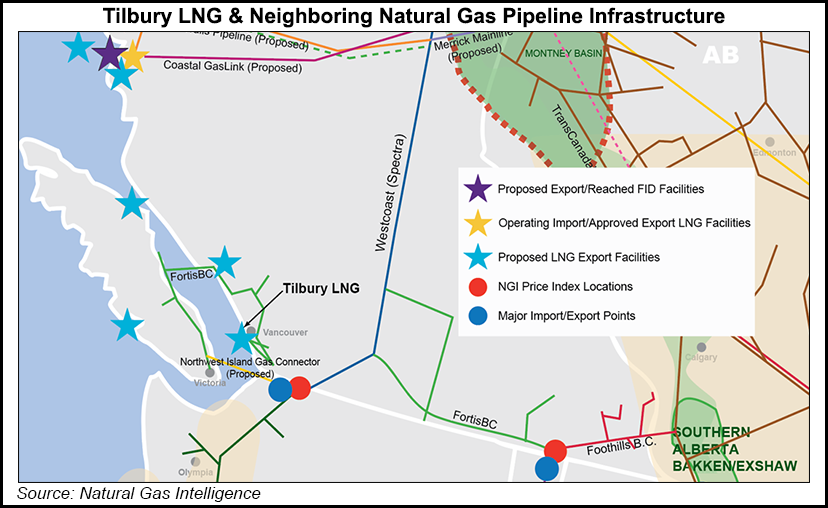

Supply security, raised marine fuel standards and export ambitions are propelling a new growth program for a liquefied natural gas (LNG) refrigeration, storage and shipping complex on the southern Pacific coast of British Columbia.

FortisBC, a gas distributor with 1.1 million customers in the region, has filed a C$3 billion ($2.3 billion) LNG expansion plan with the BC Environmental Assessment Office (BCEAO) and the Impact Assessment Agency of Canada (IAAC).

The project would install new capacity for 3.5 million metric tons/year (mmty) of LNG per year, or about 455 MMcf/d, by 2028 at a 49-year-old FortisBC waterfront gas plant called Tilbury in Delta, a Vancouver suburb studded with industrial sites.

“In late fall of 2018 the region experienced a significant natural gas supply disruption,” explain the FortisBC regulatory applications.

The statement refers to a rupture, explosion and fire that cut in half 2 Bcf/d that flows to the B.C. and United States Pacific coast on Enbridge Inc.’s Westcoast Energy pipeline from northern gas production fields.

The interruption caused prolonged supply shortages and steep price hikes that prompted a review of “resiliency and operational flexibility within our system,” says FortisBC.

“Additional local area storage is needed to prevent widespread outages of short duration and/or allow planned curtailment to avoid a system-wide collapse.”

A C$400 million ($300 million) capacity addition, planned by FortisBC for regional gas demand growth before the Westcoast blast, is already underway. A companion plan by WesPac Midstream LLC for a new Tilbury LNG wharf awaits regulatory approval.

The new FortisBC project goes beyond responding to local market conditions and pipeline accident risks by anticipating large-scale increases in ocean shipping need for clean fuel and overseas LNG consumption.

While the current Tilbury facilities additions only use established gas pipeline service from northern BC, the new growth program may require expansion by Enbridge’s Westcoast network.

“Vancouver is well positioned to be an LNG marine bunkering hub as ship owners are increasingly moving to LNG-powered ships in order to meet stringent International Marine Organization emission regulations that came into force in 2020,” says FortisBC.

“Availability, price, quality, and infrastructure are all critical to creating this cleaner fueling hub that will allow additional coastal vessels and trans-Pacific shipping companies to commit to securing new vessels powered by LNG instead of bunker or diesel oil.”

The expectations for fueling seagoing ships are built on early local successes. “Marine operators including BC Ferries and Seaspan Ferries currently operate LNG fueled vessels and are planning to expand their fleets,” reports the expansion proposal to the BCEAO and IAAC.

“FortisBC is also providing LNG and compressed natural gas as fuel for on road transportation customers including trucking fleets, waste haulers and bus fleets, helping them transition to a lower emission fuel.”

FortisBC has also had an early taste of export success by supplying LNG container shipments to True North Energy, a trading firm that made its first delivery last December to a Chinese industrial niche market that is switching fuels to gas from coal.

“Demand for cleaner burning fuels is growing globally as new emission regulations come into force,” says FortisBC. “Countries like China are shifting their fuel mix away from coal and oil in order to reduce their GHG emissions and to improve their air quality and health outcomes.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |