Regulatory | Infrastructure | NGI The Weekly Gas Market Report

FERC Timing on Rover Decision Could Have Big Impact as Deadline to Avoid Delay Nears

FERC needs to approve the Rover Pipeline Project this week in order to avoid delays, project backers told the Commission in a filing earlier this month.

And with 3.25 Bcf/d of east-to-west takeaway capacity hanging in the balance, the risk of Rover’s in-service date being pushed from 2017 to 2018 could mean “a tense few days for a lot of folks” eagerly awaiting start-up of the project, RBN Energy LLC said in a note published Monday.

As Rover developer Energy Transfer Partners LP told the Federal Energy Regulatory Commission, the issue centers around the developer’s commitment to work within an approved seasonal window for tree-clearing to avoid harming two protected species of bats along the project route. That window closes at the end of March and won’t restart until the fall. According to Rover, this means FERC needs to issue a certificate by the end of 2016 or else the project “very likely will be delayed up to a full year.”

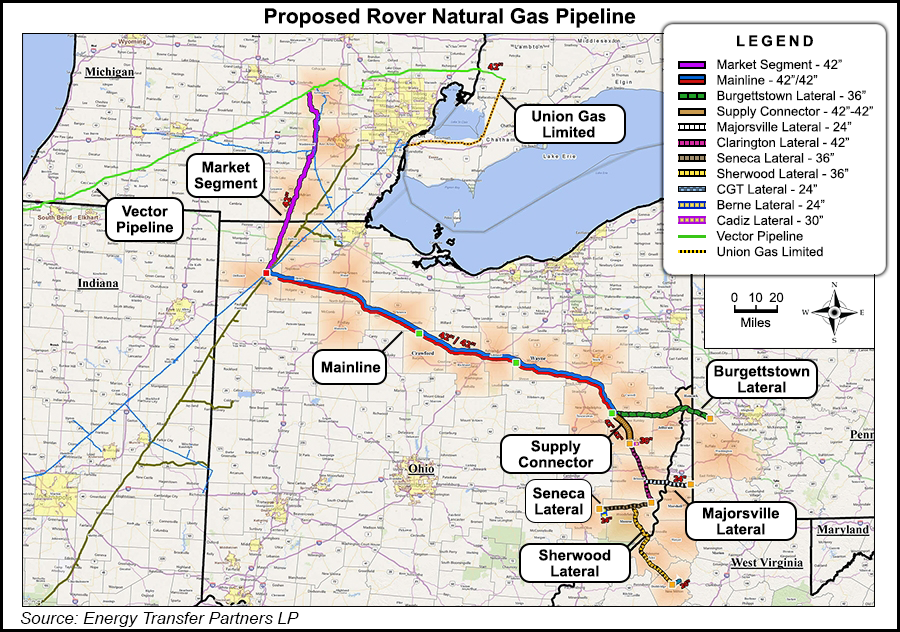

The 710-mile, 3.25 Bcf/d Rover would connect Marcellus and Utica shale gas to the Midwest Hub in Defiance, OH, and to an interconnection with the Vector Pipeline in Michigan, giving Appalachian producers access to points such as the Dawn Hub in Ontario.

As RBN said, “If Rover gets final FERC approval within the next few days, the developers’ expectation is that they can clear the trees along Rover’s route by the end of March, finish the portion of the line from the production areas to Defiance, OH (in the northwestern part of the state) by June 2017, and complete the rest of the pipeline into southeastern Michigan by November 2017. A delay of even a few weeks in getting that FERC certificate, though, some tree clearing would likely need to wait until the fall and winter of 2017-18…

“We can’t handicap the chances that Rover’s developers will get what they need from FERC as quickly as they say they need it — predicting the timing of federal action on pretty much anything is a fool’s errand. But if Rover’s timetable is delayed to 2018, there could be a number of significant effects.”

RBN said production growth in the Marcellus and Utica shales could be harmed, given the 1.55 Bcf/d producers are hoping to begin flowing on the pipe by June 2017 and the 1.6 Bcf/d scheduled to begin flowing in November. A delay could also lead producer-shippers to push for “changes in their committed capacity volumes or in how much they pay for that capacity.”

Meanwhile, Western Canadian producers could stand to benefit from another winter heating season to sell into the Upper Midwest and Ontario without additional competition out of the Appalachian Basin, RBN said.

BTU Analytics LLC energy analyst Marissa Anderson told NGI’s Shale Daily Tuesday that the window for Rover to get the needed certificate is “certainly getting tight. They put out pretty blatantly in that letter their timeline. The fact that it if they don’t get it by the end of the year it puts them at risk for a delay, it doesn’t bode well for them to stay on schedule.”

Anderson noted risk factors that point to a certificate decision coming after Rover’s stated deadline, including FERC’s scrutiny of Rover’s demolition of a historic home in Ohio without consulting the Commission beforehand. Holiday downtime could further impede FERC’s progress on a final order, she said.

“If they’re looking to get it by the end of the year, from the nature of the process…any additional steps that need to be taken, that slows things down,” Anderson said.

NGI Director of Strategy and Research Patrick Rau said that “if Rover is delayed by a significant amount of time, then it will delay the pace of new drilling and DUC [drilled but uncompleted wells] completion.” Rau noted Antero’s 800 MMcf/d commitment to Rover as an example. The Denver-based operator has indicated they plan to ramp-up Utica activity “once Rover starts construction, since it will take 6-9 months for new wells to reach sales,” Rau said.

According to RBN, Ascent Resources has committed the most to Rover at 1.1 Bcf/d, with Range Resources, Southwestern Energy, Gulfport Energy, Eclipse Resources and Rice Energy also committing volumes to the project.

Rau said a delay for Rover could also help Nexus Gas Transmission LLC, a similarly-routed westbound Appalachian Basin takeaway project also targeting the Upper Midwest/Ontario region.

“Another possible outcome from a lengthy delay is it could help fill the remainder of Nexus. That line is 60% contracted” compared to about 95% for Rover. Nexus backer “Spectra Energy Corp. expressed confidence on its 3Q16 call that there is enough producer interest to help fill the remainder. If Rover is significantly delayed and Nexus still has its 4Q17 in-service date, some producers may take some of that capacity,” Rau said.

Nexus received its final EIS from FERC in late November.

A delay for Rover would mean prolonging some of the constraints and depressed prices that have affected the Appalachian Basin in recent years, Anderson said. But no matter the project’s timing, she said, BTU’s outlook still shows a need for Marcellus/Utica drillers to continue increasing activity in order to maintain production.

“I think that we have seen activity start to come back to the region. Our outlook has always been that these projects are likely to get delayed, but even with that, we’ve anticipated that with this excess backlog that’s coming off, we still need producers to continue to ramp,” Anderson said. “If they were anticipating a June start-up, the beginning of January is when we would need to see additional activity above and beyond, really, to continue to fill those pipelines.

“Even without that, we’re still estimating that there does need to be a material ramp in activity, because you’re running out of excess backlog. Just even maintaining flat production you still need drilling activity to increase in the region.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |