NGI The Weekly Gas Market Report | E&P | Markets | NGI All News Access

ExxonMobil Profits Plunge 60%; Chevron Posts Third Straight Quarterly Loss

The second quarter proved to be no better than the first three months of the year for the two largest U.S. oil and gas operators, with No. 1 ExxonMobil Corp. recording a 60% slump in year/year profits and Chevron Corp. recording its third straight loss in a row, this time for $1.5 billion.

ExxonMobil CEO Rex Tillerson summed up the company’s dour results simply. They “reflect a volatile industry environment,” he said. However, there’s no panic in Irving, TX headquarters, as the supermajor is sticking to its knitting by remaining “focused on business fundamentals, cost discipline and advancing selective new investments.” The CEO also stressed how the integrated business model has proved its worth through the downturn by offering “financial flexibility to invest in attractive opportunities…”

ExxonMobil earned $1.7 billion (41 cents/share) in 2Q2016, versus profits in the year-ago period of $4.18 billion ($1.00). The latest results were far short of Wall Street’s forecast, which had expected profits to average 64 cents/share.

Revenue fell 22% to $57.69 billion. Operational cash flow was $5.5 billion, including proceeds associated with asset sales of $1 billion. The decline in upstream profits told the tale, with earnings down by $1.7 billion year/year to $294 million. U.S. upstream losses widened from 2Q2015 to $514 billion from $47 million. Lower liquids and natural gas realizations decreased earnings by $2.2 billion, while volume and mix effects improved profits by $50 million.

Capital/exploratory spending fell 38% from a year ago to $5.2 billion. U.S. upstream spending slumped to $914 million from $2.1 billion. Total global upstream spending fell sharply to $3.92 billion from $6.75 billion. Total global production volumes essentially were unchanged from a year ago, coming in at 4 million boe/d, with liquids up 1.7% to 2.3 million b/d and gas down 3.6% at 9.8 Bcf/d.

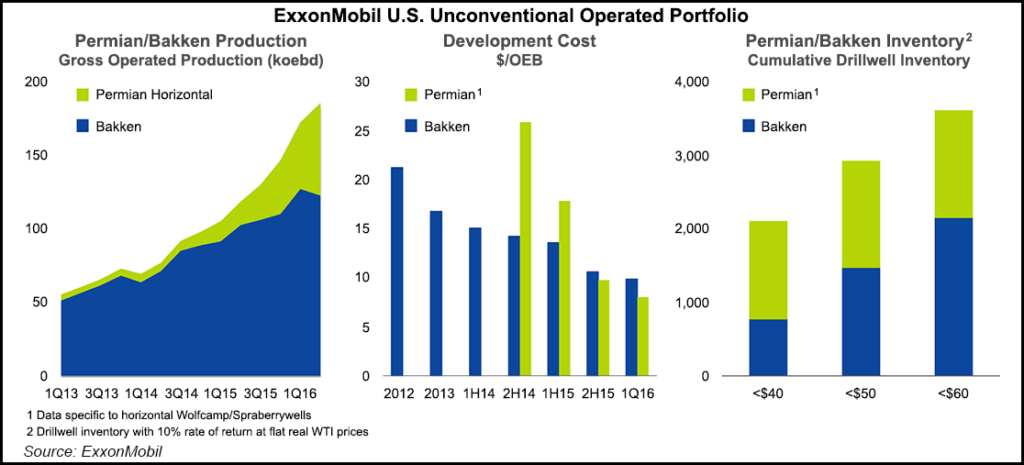

Lifted by the Gulf of Mexico and two power plays in the U.S. onshore — the Permian Basin and Bakken Shale — U.S. oil and liquids production climbed to 495,000 b/d from 468,000 b/d. However, the largest U.S. natural gas producer saw volumes decline year/year to 3.097 Bcf/d from 3.153 Bcf/d.

The corporation also distributed $3.1 billion in dividends to shareholders, with dividends increasing 2.7% from 2Q2015.

For San Ramon-CA-based Chevron, the quarterly performance was its worst since 2001. The $1.5 billion loss (minus 78 cents/share) in 2Q2015, compared with profits a year ago of $571 million (30 cents). Impairments and one-time charges totaled $2.8 billion, partially offsetting $420 million in gains from asset sales. Sales and other operating revenue totaled $28 billion, compared with $37 billion in 2Q2015.

Chevron, the No. 2 U.S.-based producer, posted its first loss in 14 years during 4Q2015 of $588 million and repeated with a $725 million loss in 1Q2016 (see Daily GPI, April 29). Global upstream losses mounted from a year ago to $2.46 billion from $2.22 billion. U.S. upstream operations lost $1.11 billion, versus a year-ago loss of $1.04 billion.

“The second quarter results reflected lower oil prices and our ongoing adjustment to a lower oil price world,” CEO John Watson said. “In our upstream business, we recorded impairment and other charges on certain assets where revenue from expected oil and gas production is expected to be insufficient to recover costs. Our downstream business continued to perform well.

“We continue to make progress toward our goal of getting cash balanced,” a goal that the company expects to reach in 2017. As an example, he pointed to operating expenses and capital spending, which fell by more than $6 billion from the first six months of 2015.

One big thorn in Chevron’s financial backside has been the capital costs to ramp up a plethora of global projects, including liquefied natural gas export start-ups at Gorgon in Australia and Angola, as well as a third train at the Chuandongbei Project in China.

“As these projects continue to ramp up, they are expected to increase net cash generation in future quarters,” Watson said.

In the upstream, worldwide production fell from a year ago to 2.53 million boe/d net, versus 2.60 million boe/d net. Production increases came from project ramp-ups in the United States, particularly the Permian Basin, along with increased volumes from Angola and Canada.

Chevron’s average sales price for crude oil and natural gas liquids was $36/bbl, down from $50 a year ago. Average natural gas sales prices fell to $1.21/Mcf from $1.92.

In the United States, net production fell by 48,000 boe/d to 682,000 boe/d. Rising volumes from the Permian, Marcellus Shale and from the Gulf of Mexico “were more than offset by the effect of asset sales, maintenance-related downtime, and normal field declines,” the producer said. U.S. liquids output decreased 2% to 501,000 boe/d net, while net natural gas production decreased 17% to 1.09 Bcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |