Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

ExxonMobil in ‘Relentless’ Pursuit of Permian, Bakken Efficiencies

ExxonMobil Corp. is pursuing efficiencies across its global operations, with a particular focus in the U.S. onshore on the Permian Basin and Bakken Shale, the investor relations chief said Friday.

During a conference call to discuss 2Q2016 performance, Jeff Woodbury highlighted the “relentless focus” on the U.S. unconventional portfolio. The largest North American natural gas producer has set its gas leaseholds aside for now, working mostly on liquids plays from West Texas through the Midcontinent.

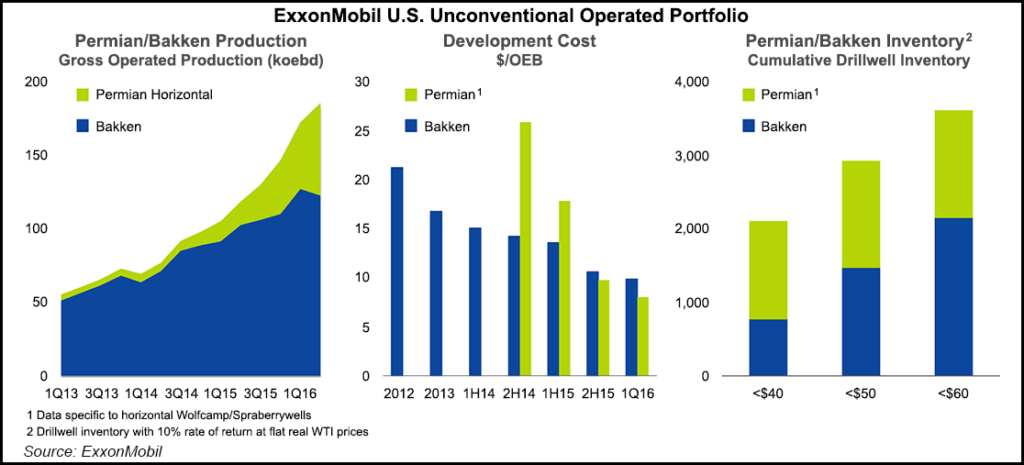

“Since 2013, we have more than tripled our gross operated production from the liquids-rich Permian and Bakken plays,” Woodbury said. “Approximately 85% of this is liquids. We have maintained a relentless focus on reducing costs and improving efficiency while maintaining high operational integrity. We have continued to reduce drilling cost per foot, implement efficiencies and capture market savings to achieve substantial cost reductions.”

With longer lateral lengths and improved completion designs per well, “hydrocarbon recovery has dramatically improved,” he said. Combined with lower D&C costs the high recovery has resulted in a nearly 70% reduction in Permian unit development costs in the past two years.

“Our development cost per barrel is now $8.00 in the Permian and less than $10.00 in the Bakken,” he said. “Additionally, we have successfully reduced cash operating costs to approximately $8/bbl.”

Because of the cost improvements, “a large part of the Permian drill oil inventory is economic at prices around $40/bbl,” Woodbury said. “Over 2,000 drill well locations in the Permian and Bakken yielded 10% rate of return at $40/bbl.” CEO Rex Tillerson had said in March that even at low oil prices, the Permian and Bakken remained competitive (see Shale Daily, March 3).

ExxonMobil’s Permian and Bakken drill well inventory “equates to nine years continuous drilling at 2015 rig levels,” Woodbury said. The company has “the flexibility to progress profitable short-cycle opportunities and adjust activity in response to market conditions…Our economic drill inventory increases significantly as energy demand and prices improved.”

ExxonMobil ran 11 rigs total in the U.S. onshore during 2Q2016, and it’s now at around 10. Woodbury did not delineate where the rigs were working, and when asked, he did not indicate if activity would increase.

“In terms of going forward, we want to be mindful of a number of factors. We generally manage this with a very measured pace, considering a number of factors that would drive how aggressive we want to be in the near-term…One of those things are the market conditions, but also resource maturity, learning curve benefits…We continue to realize significant benefits in our Permian and Bakken drilling activities.

“We don’t want to outrun the headlights, and we don’t want to miss some value opportunities. You need to have the right infrastructure in place. And then there’s obviously, considering the current supply-demand balance. So we’ll manage it as we go forward, depending on those factors.”

Beyond the U.S. onshore, ExxonMobil also is eyeing shale developments in Argentina. A five-well pilot project is underway in the Vaca Muerta formation, “underpinned by the December approval of a 35-year unconventional exportation concession that we were able to secure,” Woodbury said. ExxonMobil entered the unconventional play five years ago (see Shale Daily, Aug. 31, 2011).

“The pilot then will allow us to better assess the full acreage potential,” he said. XTO Energy Inc., the onshore-focused subsidiary, is “stirring that asset as well to bring the U.S. knowledge and expertise into Argentina.”

For a full listing of 2Q2016 industry earnings calls, including links to NGI‘s coverage of both the company and the call, see NGI’s2Q16 Earnings Calls List PDF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |