Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Europe Emerging as Marginal Player in Global LNG Market, Says Societe Generale

While China is expected to remain the major growth engine for liquefied natural gas (LNG) through 2025, Europe is becoming an integral part of the global market as well, with imports reaching record levels in December, according to Societe Generale.

Europe’s emergence as a marginal player in the global LNG market has been because of the country’s shift toward decarbonization of its fuel mix, as well as its need to backfill declining domestic gas production and for supply security, Societe Generale natural gas analyst Breanne Dougherty said Monday during a conference call to discuss the firm’s global gas market overview.

Europe imported 7 million metric tons (mmt) of LNG in December as reduced Asian demand from a mild winter and the return of five Japanese nuclear generation units meant more cargoes were available on the market. The shift signaled a loosening of previously tight conditions, a trend the analyst expects to continue during the next 18 months.

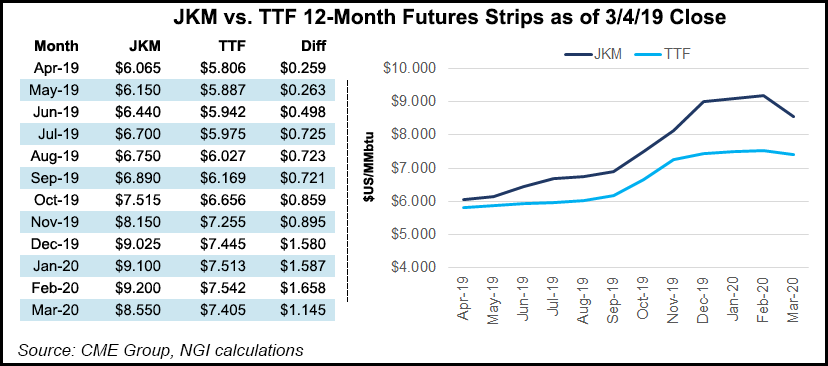

As the global market has loosened, Platts Japan Korea Marker (JKM) prices, the benchmark for spot LNG cargoes, have softened considerably, which has effectively lowered the ceiling for Dutch Title Transfer Facility (TTF) prices, the European benchmark, Dougherty said. The firm expects TTF prices to continue moving toward a coal/carbon floor in 2019, but it does not expect a sustained break through that floor until possibly summer 2020.

The lower TTF prices also means that prices will tighten relative to U.S. benchmark Henry Hub. “We see an increased relationship between global gas price points,” Dougherty said. “Liquidity in the TTF has improved in the last five years, and we expect to see JKM liquidity improve as well.”

Going forward, the firm’s analysts also expect to see an increase in speculative trading at some of those pricing points, with “an influx of new types of market participants” getting involved in the global gas market. The firm is also monitoring the shape of LNG contracts and the expected increase in flexibility that “will create a very dynamic global gas market long term.”

![]()

Like Royal Dutch Shell plc noted in its annual LNG Outlook, Societe Generale’s team said LNG contracts signed in 2018 shifted back to a more traditional, long-term basis and reflected higher volumes. And while 70% of those contracts were indexed to oil, there is “strong demand in the global gas market to move to gas indexation.

“Is that pure to a gas point or to a hybrid? Or some level of oil indexation as a hedge? These are questions we have and what we’ll be looking at closely as projects move to final investment decision (FID),” Dougherty said.

Huge investments were made in upstream LNG development from 2011-2015, particularly in the United States. Those investments were evident last year as U.S. exports kicked into high gear once Dominion Energy’s Cove Point began exporting and as Train 5 at Cheniere Energy Inc.’s Sabine Pass went into service. Cheniere has been exporting LNG from Sabine Pass since 2016. The company also sent a commissioning cargo from Train 1 at its Corpus Christi facility this past fall; on Friday, it was cleared by federal regulators to start service.

But upstream investment stalled in 2016-2017, leaving the 2022-2025 period vulnerable to supply shortages even as a slight oversupply situation is expected through 2020, the firm said. Delays for projects nearing FID could increase that risk.

“Post 2021, we believe there is strong potential for tightening of the global gas market. Once the market gets tight, it tends to do so quickly and aggressively,” Dougherty said, adding that such conditions could lead to increased price volatility, “which can be pronounced.”

“Gas remains one of the most vulnerable to weather variance; a cold winter against an already structurally tightening supply/demand backdrop would trigger tremendous spot price upside,” according to the firm.

The United States is set to increase LNG supply by 58 mmt by 2025, followed by Mozambique with 21 mmt, Russia with 16 mmt and Qatar with 15 mmt, based on announced projects. Canada is expected to boost supplies by 11 mmt, with Australia up by 9 mmt.

The United States’ growing role as a global LNG supplier was made clear last month when the Federal Energy Regulatory Commission said it had “reached an agreement that may provide a path forward” for considering more LNG export terminals, quickly applying the new approach to approve Venture Global’s 10 mmty Calcasieu Pass export project in Cameron Parish, LA.

In January, NGI launched the U.S. LNG Export Tracker, and accompanying Natural Gas Volumes historical chart, to provide a more comprehensive view of the burgeoning market. The new tracker is designed to enable readers to get a headstart on when various LNG trains enter commissioning and commercial operation stages, as well as show any significant changes in feed gas deliveries from factors like planned maintenance or unplanned outages.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |