Shale Daily | Coronavirus | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

E&Ps Reining in Capex, Considering Shut-ins as Oil Prices, Demand Collapse

Apache Corp. is dropping all of its Permian Basin rigs and slicing its dividend by 90%, joining a growing list of oil and natural gas operators responding to the collapse in oil prices and the devastating coronavirus, which is gripping the country.

Along with Apache announcing sharp cutbacks Thursday, U.S. exploration and production (E&P) operators including Contango Oil & Gas Co., Devon Energy Corp., Murphy Oil Corp., Ovintiv Inc. and PDC Energy Inc. have tossed their original 2020 capital programs. The parade of pullbacks began Monday, with a number of E&Ps since announcing they have retrenched.

The pullback is likely to continue as analysts calculate the impact on global fuel markets because of reduced travel. Rystad Energy’s team on Thursday made updates to most of its estimates, indicating its forecast for global oil demand now projects a decrease of 0.6%, or 600,000 b/d year/year.

“Our estimates show that total oil demand in 2019 was approximately 99.8 million b/d, which is now projected to decline to 99.2 million b/d in 2020,” Rystad analysts said. “This is a severe downgrade compared to previous estimates and takes into account the quarantine lockdown in Italy, massive cancellations of flights by airlines,” as well as the travel ban between Europe and the United States announced by President Trump late Wednesday.

For E&Ps, the writing is on the wall.

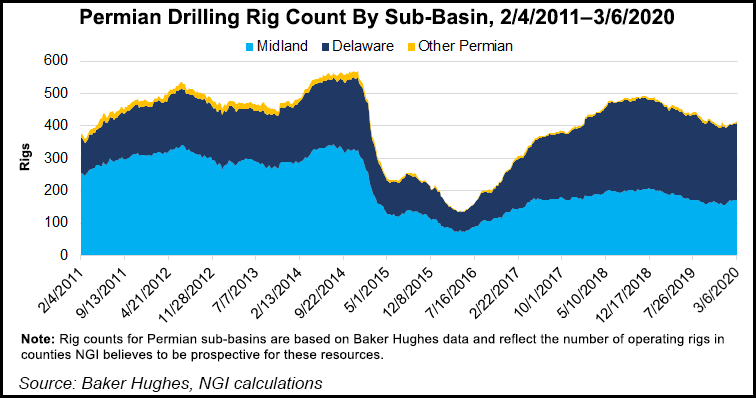

Houston-based Apache is cutting 2020 capital expenditures (capex) to $1-1.2 billion from $1.6-1.9 billion. In the coming weeks, “the company will reduce its Permian rig count to zero, limiting exposure to short-cycle oil projects,” management said. Activity reductions are also planned in Egypt and the North Sea, while a Suriname exploration prospect remains on tap.

Additionally, the board gave the green light to slap the quarterly dividend to 2.5 cents/share from 25 cents effective Thursday, with the estimated $340 million retained from the annual dividend used to strengthen the bottom line.

“We are significantly reducing our planned rig count and well completions for the remainder of the year, and our capital spending plan will remain flexible based on market conditions,” said Apache CEO John J. Christmann IV. “We are also further reducing operating and overhead costs as we continue to implement our corporate redesign program, which began in the fall of 2019. These decisive actions will benefit Apache as we navigate these challenging market conditions.”

Oklahoma City-based Devon announced an immediate 30% decrease in capital spending of $500 million, with 2020 capex now set at $1.3 billion. The capital reductions would be “diversified across Devon’s portfolio,” with the brunt of the cutbacks in the Powder River Basin and Oklahoma’s Anadarko Basin. Activity this year is now to be centered in the Permian Delaware and Eagle Ford Shale.

“With the challenging industry conditions, we are committed to taking decisive actions to protect our balance sheet and preserve liquidity,” said CEO Dave Hager. “We have substantial flexibility with our service contracts, allowing us to quickly recalibrate activity to balance capital investment with cash flow. This advantage, combined with our high-quality asset base and excellent liquidity, positions Devon as well as anyone in the E&P space to navigate through this period of extreme commodity price volatility.”

Beyond the immediate spending cuts, “Devon is prepared to further tailor capital activity lower throughout the year should commodity prices remain weak to protect its financial strength,” management said.

Denver-based Ovintiiv Inc. (formerly Encana Corp.) also is pulling back, reducing capex by $300 million and full year cash costs by $100 million.

“We are moving quickly and decisively in response to these volatile and challenging times,” CEO Doug Suttles said. “It is imperative to take immediate action and we are dropping roughly two-thirds of our operated rigs and reducing our cash costs by $100 million. Market conditions are changing rapidly, and we have full operational flexibility to further adjust activity to maintain our balance sheet strength.”

Ovintiv is immediately dropping 10 operated drilling rigs and plans to drop an additional six in May. Following the reductions, it would have three working in the Permian, with two each in the Anadarko and Montney.

Denver-based PDC Energy Inc., which works in the Permian and the Wattenberg field of Colorado, is reducing capex by 20-25% from original guidance of $1-1.1 billion. Production is now expected to be flat from 2019.

The updated operating plan is using a West Texas Intermediate oil price average of $35/bbl for 2020 and $40 in 2021. Assumed New York Mercantile Exchange natural gas prices average $2.00/Mcf for 2020 and $2.40 in 2021, with natural gas liquids realizations of $7-9 /bbl through next year.

“We have taken immediate action in response to the current and expected price weakness to prioritize our balance sheet and liquidity,” CEO Bart Brookman said. “We are well prepared for this scenario as the resilience and strength of our assets are on full display as we project to generate free cash flow while maintaining our production base.”

Meanwhile, El Dorado, AR-based Murphy Oil Corp. has reduced 2020 capex by $500 million to $950 million, a 35% reduction from the midpoint of original guidance.

“Under current conditions, we believe this capital reduction program allows for financial flexibility and preservation of our longstanding dividend,” CEO Roger W. Jenkins said. “As always, we will not sacrifice safety in our efforts to reduce costs across all our assets, as it remains a core value within Murphy.”

The revised plan includes delaying some U.S. Gulf of Mexico projects and development wells and postponing the spuds for two operated exploration wells. Murphy also plans to reduce activity in the Eagle Ford, with no operated activity in the last six months of this year, and it plans to defer well completions in the Montney formation in Canada.

“We have persevered through multiple commodity price cycles in our 70 years of corporate history,” Jenkins said, “and want to provide reassurance that we are focused on a strategy that protects the business, the balance sheet and our liquidity, while maintaining optionality for additional adjustments given the unstable environment.”

Houston’s Contango Oil & Gas Co. also is taking actions to preserve its liquidity. It has hedges in place for 72% of forecast 2020 natural gas production at $2.57/Mcf, as well as 54% of 2021 output at $2.51. Hedges also are in place for 71% of expected oil output in 2020 at $55.13/bbl and 67% in 2021 at $51.71.

Contango is now undertaking “an extensive review of all of its producing areas to determine the economic or operational justification for continuing to produce unhedged barrels in this price environment, and where determined not justified, and operationally feasible, evaluate potentially shutting in or curtailing production.”

In addition, management is reevaluating the “economic justification in this price environment for proceeding with the production-enhancing workover program originally scheduled for the first half of 2020.” The limited onshore development drilling planned for 2020 also is being reevaluated.

“This depressed and volatile price environment will be a difficult challenge to many in our industry, including ourselves,” Contango CEO Wilkie S. Colyer said, “but our view is that the price protection we have put in place through our hedging program, our regular, ongoing efforts to reduce costs, and our commitment to justifying every capital investment we make through a rigorous return analysis, positions us better than most to weather this storm.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |