Shale Daily | Coronavirus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

E&P Capex Slumps to ’05 Levels, with ‘Modest’ Uplift Seen if WTI Prices Improve

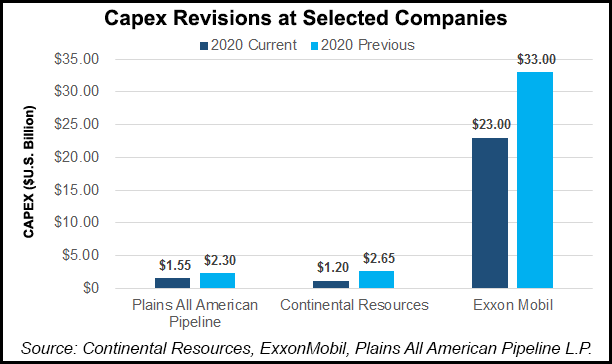

Capital spending by global oil and natural gas explorers has collapsed to levels not seen in 15 years and could decline on average by 27% in 2020, a 3,000 basis point turnaround from the 2% increase predicted in December, according to a new survey.

Evercore ISI’s mid-year exploration and production (E&P) spending outlook updated one completed in December. The latest survey’s results revealed the end of three straight years of modest growth in capital expenditures (capex), analysts said.

“Expectations for a fourth year of modest improvement in 2020 has completely reversed course, and we now forecast global E&P spending to establish new lows that are 16% below the 2016 trough and 55% below the 2017 peak.” This year now is tracking to be the second worst in the survey’s 35-plus year history, “behind only 2016’s 32% decline,” which followed the oil price collapse in late 2014 that led E&Ps to curtail capex and activity for almost two years.

Evercore initially surveyed around 255 global oil and gas companies, and analysts continued this year to monitor respondents as oil prices collapsed, supplementing their reviews with financial and strategic documents, as well as a “multitude of meetings and discussions with E&P decision makers” to gauge the spending trajectory. The second wave of data gathering was completed at the end of May.

“While it is likely too late to make up for the carnage of recent months, 2020 may end up being ”less bad’ than we currently envision in our mid-year update,” the Evercore analysts said. “The final outcome may end up being somewhat better, with select U.S. operators showing an eagerness to ramp up spending with corresponding increases in the oil price. Service companies will be all too ready to assist with 60% of our survey respondents anticipating further pricing concessions in the second half.”

In the Evercore survey, E&Ps based their 2020 spending assumptions using a price deck average of $32/bbl West Texas Intermediate (WTI), $38 Brent and $1.95/MMcf Henry Hub.

“Operators would increase capex at average WTI $48 and HH $2.80, but cut at $26 WTI and $1.80 Henry Hub,” the analysts said.

“However, we expect positive revisions to be modest, given the continued focus on capital discipline, particularly given the uncertain impact of the global pandemic on oil demand.”

Most of the preliminary 2021 capex plans now center around an average WTI price of $40, with Henry averaging $2.25.

“The ”Tale of Two Markets’ has come to an abrupt halt, as the global pandemic spared no geographic region and international spending shifted from an anticipated third consecutive year of positive growth to a 22% contraction,” analysts said.

No geographic regions are spared from capex reductions, with every exploration area of the globe expected to see double-digit contraction this year.

North American (NAM) capex has gone from “less bad” at a 6% decline from 2019, to a 42% cut for this year. U.S. E&Ps are set to slash spending by 43%, while Canadian operators on average have signaled 36% cuts. The Federal Reserve Bank of Dallas last month said its survey of U.S. E&Ps found capex would decline by at least 35% sequentially in the second quarter.

This year’s spending in NAM “is now down to 1996 levels, with the U.S. accounting for 80% of all NAM activity,” Evercore analysts said.

Africa is leading the international capex lower at 43%, followed by a second-place tie of a 30% cut by Russia/Former Soviet Union and Europe. Capex is also falling significantly in Latin America, down 24%, while spending in Asia and the Middle East are experiencing “relatively modest capex cuts in the midteens range.”

Survey respondents said they are getting a good break on oilfield service (OFS) costs this year, with 60% expecting to see even further pricing concessions in the second half of 2020. Pricing mostly has fallen for pressure pumping equipment and consumables, while more than one-quarter (28%) have seen pricing decline across all OFS product lines.

“OFS companies have poor visibility for the second half of the year,” analysts said. “We continue to believe that the recovery will be ”W’ shaped; meaning after activity levels bottom out in the second quarter, there will then be a small recovery in 3Q2020 before budgets are exhausted and activity levels decline again into year-end.”

North American unconventional activity “remains a fragmented and commoditized business. There still remain too many assets, companies, management teams and debt. This downturn will accelerate the restructuring and consolidation cycle that is required as the U.S. land market will be smaller on the other side of this downturn.”

Some positive signs are emerging, and while the path forward is expected to “still be challenging…a little stability off the bottom will help.”

Evercore updated the U.S. land rig forecast based on the capex spending survey.

“We now expect the U.S. land rig count to decline by 58% in 2020 compared to our previous forecast of minus 56%,” analysts said. “This was driven by the rig count declines in the second quarter that were steeper than we previously expected. We are also lowering our 2021 rig count expectations, now expecting it to decline 38% compared to our previous 29% drop.”

The 2022 rig count assumptions indicate a 12% growth rate, with the U.S. land rig count averaging 272, 85% below the 2014 average and 73% below the 2018 average.

“It might take until 2023 for the rig count to get back over 400 again, which is a far cry from the prior peaks,” said analysts. “The industry was built for a 2,000 rig market rather than a new peak that might be closer to 500-600 rigs.”

Meanwhile, Rystad Energy on Thursday estimated global spending this year would reach $383 billion, a “staggering 29% decrease of $156 billion compared to 2019.” Spending is expected to be largely flat again in 2021, “landing only marginally higher than 2020 at $386 billion.”

Before the pandemic, Rystad had forecast total upstream investment would maintain last year’s levels in 2020 and 2021.

“We expect shale and tight oil investments will take the biggest hit, now forecast to fall by 52.2% year/year to $67.3 billion,” Rystad analysts said. “Oilsands investments will follow, with a decline of 44% to $5.1 billion. Other onshore investments are forecast to fall by 23.4% to $182.4 billion this year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |