EIA’s Storage Report Confirms Consensus; Natural Gas Futures Gain

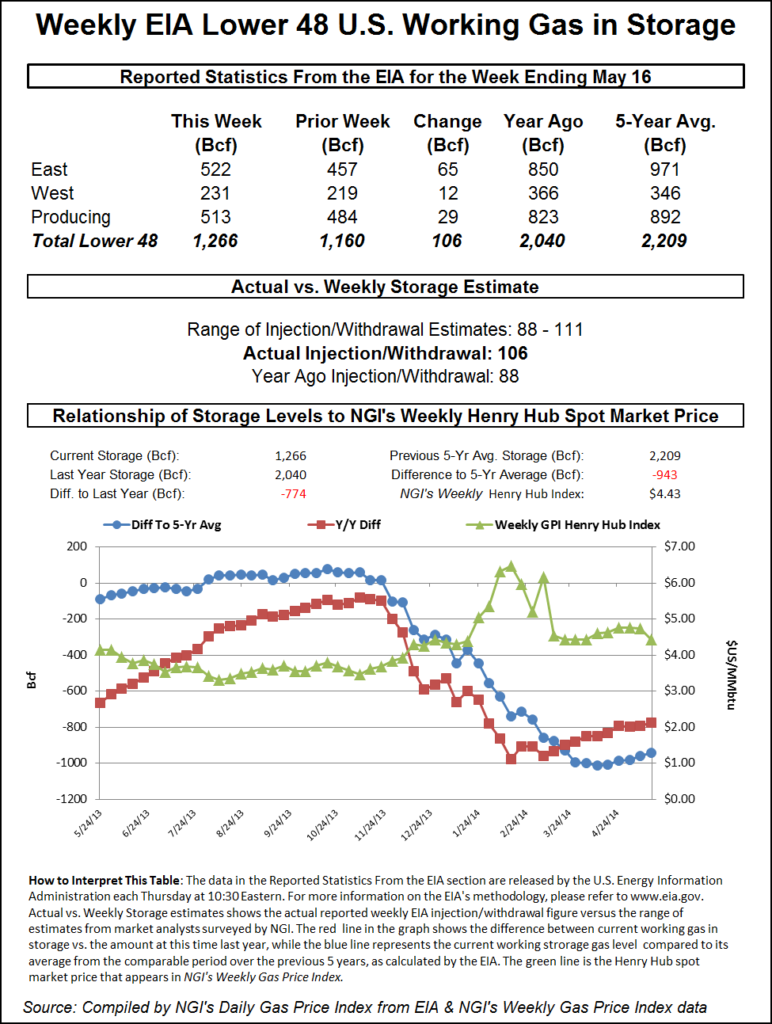

The Energy Information Administration (EIA) on Thursday reported an on-target 106 Bcf weekly injection into U.S. natural gas stocks, and futures gained following the news.

The 106 Bcf figure, covering the week ended May 10, compares with a 104 Bcf build recorded in the year-ago period and a five-year average 89 Bcf injection.

In the hours leading up to the report, the June Nymex futures contract had climbed as high as $2.634 before easing back to around $2.610-2.620 prior to EIA’s 10:30 a.m. ET release. In the minutes after the report crossed trading screens, June quickly added a couple pennies, climbing to as high as $2.626.

By 11 a.m. ET, June was trading around $2.631, up 3.0 cents from Wednesday’s settle, suggesting the bulls felt some measure of relief on confirmation that a bearish surprise was not in store from EIA.

Estimates prior to the report had EIA unveiling a low-triple-digit build in line with the actual number. Major surveys had pointed to a 104 Bcf build, with predictions ranging from 93 Bcf to 125 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 105 Bcf, while NGI’s model predicted a 102 Bcf injection.

Bespoke Weather Services viewed the EIA report as neutral, with the final injection matching the firm’s prediction and generally matching the consensus.

“Balance-wise, this is tighter than last week’s 85 Bcf build,” Bespoke said, estimating that recent balances would put the market on track to end the injection season with 4.0 Tcf in the ground. Still, “weather adjusting can be more difficult in these low demand times of the year. While 4.0 Tcf is probably unrealistic, it shows that we still need to see material improvement in balances to avoid a large storage total heading into winter.”

Focus on this week’s plump report, combined with the market’s inability to break through resistance below $2.67, helped prompt a 5.8-cent sell off in Wednesday’s session, according to EBW Analytics Group CEO Andy Weissman.

“Over the next several weeks, the prospect of five or more triple-digit injections into storage is likely to make it difficult to rally further, and could weigh heavily on cash market prices,” he said.

Similar to this week’s, next week’s reported injection is set to climb into the low-100s Bcf area, Weissman said. “But the last two injections in May are likely to be whoppers — pushing cash market prices down further and creating greater downward pressure on the June contract.”

Total Lower 48 working gas in underground storage stood at 1,653 Bcf as of May 10, 130 Bcf (8.5%) above year-ago levels but 286 Bcf (minus 14.7%) below the five-year average, according to EIA.

By region, the South Central posted the largest weekly injection at 32 Bcf, including 25 Bcf into nonsalt and 6 Bcf into salt stocks. The East injected 31 Bcf, while the Midwest injected 27 Bcf. In the Pacific, EIA recorded a 12 Bcf build, while 4 Bcf was refilled in the Mountain region for the week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |