Markets | NGI All News Access | NGI Data

EIA Reports Near-Target 46 Bcf Injection; September Natural Gas Trades Sideways

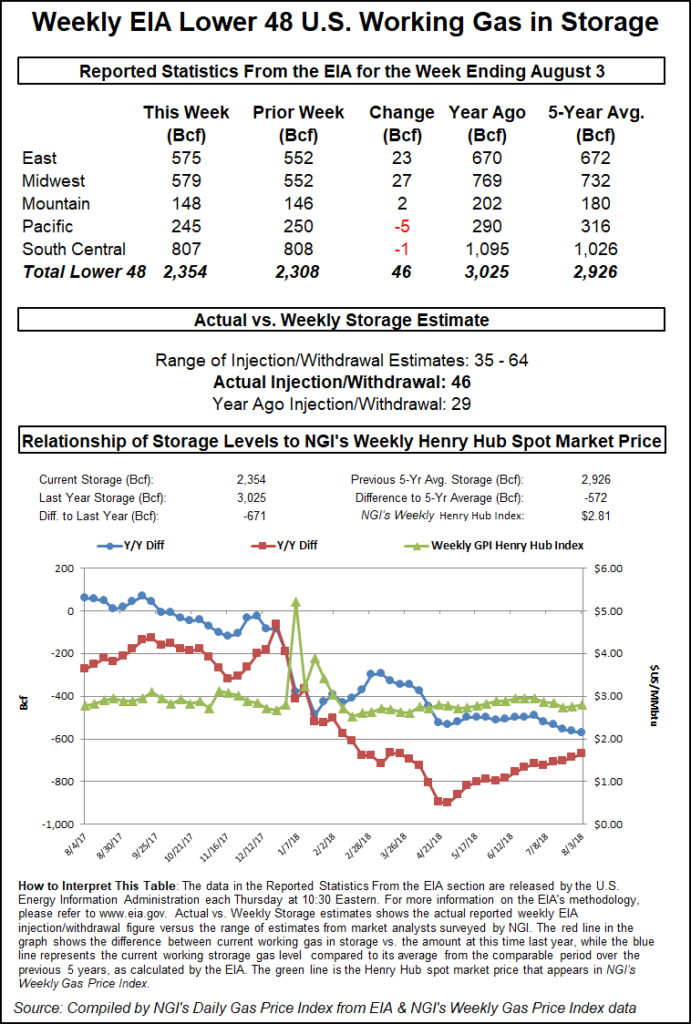

The Energy Information Administration (EIA) reported a 46 Bcf build into storage inventories for the week ending Aug. 3, lifting stocks to 2,354 Bcf.

Nymex futures had a muted reaction to the reported build, trading fractionally lower just ahead of the report’s 10:30 a.m. ET release and then moving up to trade flat on the day in the minutes after the report. After briefly moving into positive territory, the September contract reversed course and was trading one-tenth of a cent lower at $2.948 just before 11 a.m. ET.

Traders were perplexed at September’s move into the red after five straight weeks of tight injections and as several regions currently sit below five-year minimum storage levels. But Bespoke Weather Services said the South Central region, which has taken the market by surprise with hefty withdrawals in recent weeks, reflected a draw of only 1 Bcf for the week ending Aug. 3, “meeting expectations and keeping the print from missing as bullish as other recent ones.

“We see the print as slightly bullish compared to our expectations, indicating that the market was correct to bounce earlier in the week. Yet the initial selling off the print seems to indicate what we had expected, which was that only a true bullish miss could break us above $3 and that if our 50 Bcf had printed, we would have fallen significantly,” Bespoke chief meteorologist Jacob Meisel said.

Estimates for this week’s report were wide ranging given the recent string of substantial misses, in the mid-30s Bcf to mid-60s Bcf, with the average pointing to a build in the high 40s Bcf. Kyle Cooper of IAF Advisors projected a 47 Bcf build, EBW Analytics expected a 48 Bcf build, Genscape Inc. estimated a 50 Bcf build and a Bloomberg survey had a range of 35 Bcf to 64 Bcf, with a median 47 Bcf injection. The IntercontinentalExchange settled at a 48 Bcf build.

Genscape said power burns were estimated to have averaged 35.6 Bcf/d, helping maintain this summer’s spot as the five-year leader of power burns this summer-to-date. Mexican exports averaged 4.8 Bcf/d (including a 5 Bcf/d day) and liquefied natural gas sendout averaged 3.3 Bcf/d.

Broken down by region, 23 Bcf was injected in the East, 27 Bcf in the Midwest and 2 Bcf in the Mountain. The Pacific region reported a draw of 5 Bcf, while the South Central saw a draw of 1 Bcf.

Hot temperatures and regional withdrawals from the South Central and Pacific regions have dominated coverage of the EIA’s weekly storage report. In the South Central region in particular, extremely hot temperatures and year/year coal retirements have strengthened power sector gas demand faster than analysts have projected, resulting in the repeated bullish storage injections, according to EBW Analytics.

“As summer temperatures ease in the South Central, however, we expect power sector demand to similarly wane faster than many may now expect,” EBW CEO Andy Weissman said.

At 2,354 Bcf, inventories are 671 Bcf below last year and 572 Bcf below the five-year average. The deficit to year-ago levels shrank by 17 Bcf, while the deficit to the five-year average grew by 7 Bcf.

As for price action during the rest of Thursday’s session, Bespoke said risks are mixed, “as the market is a touch tighter than we had expected, but not overly so.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |