Marcellus | E&P | NGI All News Access | Utica Shale

Eclipse Decides Against JV Partner; Riding It Out With Lower Capex

After three months of negotiations with several undisclosed parties, Eclipse Resources Corp. has ruled out a joint venture (JV). The company said Wednesday it has sufficient liquidity to develop its assets alone and will defer a partnership until commodity prices improve.

Eclipse said that a $434 million private equity placement with EnCap Investments LP in December and a $125 million undrawn credit revolver would be enough to fund this year’s capital budget.

“While there was significant interest in forming such a venture from numerous parties, we have concluded that the more accretive course of action is not to enter into a drilling joint venture…until commodity prices recover,” CEO Benjamin Hulburt said.

The announcement comes in contrast to the company’s fourth quarter earnings call, during which management was bullish on the idea of a JV (see Shale Daily, March 5). Formed in 2011, Eclipse went public last June, and it’s year-end production increased significantly from 2013 (see Shale Daily, June 23, 2014). But even with liquidity intact heading into 2015, management expressed concern about maintaining momentum in the current commodity price environment and said last month a JV would help reduce its capital spending this year.

At the time, Hulburt refused to share details because negotiations were ongoing. The company has nearly 130,000 net acres in the Utica and Marcellus shales of Ohio, where it controls about 80% of its acreage. Its operating partners include Antero Resources Corp. and Magnum Hunter Resources Corp.

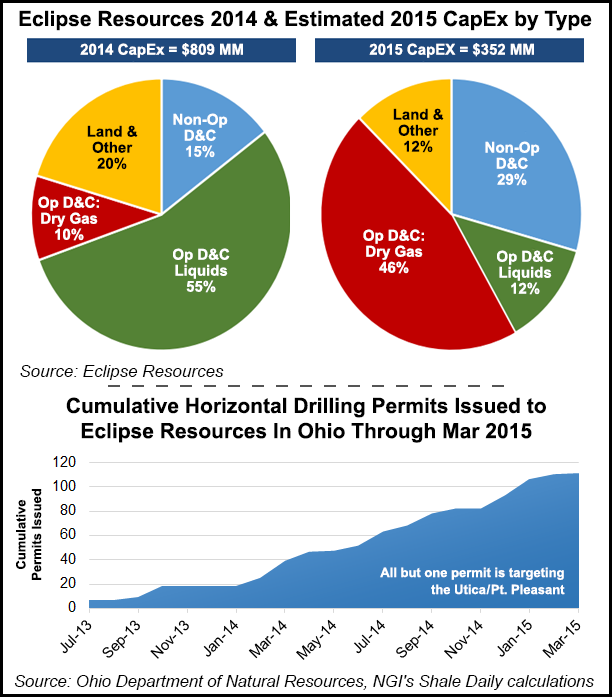

In December the company announced a 2015 capital budget of $640 million, but it said Tuesday it would cut that nearly in half to $352 million, down 57% from 2014 spending (see Shale Daily, Dec. 29, 2014). Initially, the company had planned to turn inline 58 net operated and non-operated wells this year, but with a reduction in spending it said that plan now calls for 29 net operated and non-operated wells to be completed and turned to sales.

Thirteen of those were turned to sales in the first quarter. Eclipse estimates that it produced 160 MMcfe/d during the period, up 29% from the fourth quarter and 316% from the year-ago period. The company also updated its full-year production guidance on Tuesday, saying that it expects to produce 180-190 MMcfe/d, which at the midpoint would be a roughly 150% increase from 2014 production of 73.5 MMcfe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |