Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Eclipse Brings Six ‘Encouraging’ Wells Online in Utica Shale

Eclipse Resources Corp. brought six new operated wells in the Utica Shale online between the end of 3Q2014 and Nov. 30. The wells had “very encouraging” initial results that were within the company’s type curve expectations, Eclipse said.

State College, PA-based Eclipse did not identify the wells or disclose their locations. The company did say its initial estimate of production for November was approximately 130 MMcfe/d, a 52% increase over its daily production in 3Q2014, which was 85.8 MMcfe/d. Eclipse also estimated that its current production is about 148 MMcfe/d, a 72% increase from its average daily production in 3Q2014.

“Eclipse is continuing to methodically execute on our plan,” said CEO Benjamin Hulburt. “Our team is efficiently developing our acreage and meeting our timeline, cost and production objectives. We continue to be pleased with the initial performance of our liquids/condensate type area wells using our restricted choke production method, and we are very encouraged with our Utica dry gas acreage…”

Hulburt said Eclipse was continuing to monitor the performance of its two Shroyer wells, which are in eastern Monroe County, OH (see Shale Daily, Sept. 5). According to Hulburt, the wells were continuing to produce at a combined rate of approximately 41 MMcf/d after 100 days online.

“During the month of December, we expect to bring an additional five net wells online and continue to believe our average daily production in 4Q2014 will trend towards the high end of our previously issued guidance,” Hulburt said. He added that in 2015, “given our acreage position spanning across both the core liquids and core dry gas areas of the Utica play, I believe we are in a unique position to adjust our drilling plans to maximize returns in this volatile commodity price environment.”

In a note Thursday, David Tameron, senior analyst with Wells Fargo Securities LLC, said the brief operations update was a positive development. He rates Eclipse shares “outperform.”

“Management believes 4Q2014 production will trend towards the higher end of 4Q2014 guidance of 125-135 MMcfe/d,” Tameron said, adding that Wells Fargo estimates production will total 131 MMcfe/d. He later added that Eclipse “last indicated during its 3Q2014 call that it is currently evaluating 2015 capital and operational plans, but anticipates starting 2015 with three operated rigs and drilling to concentrate in condensate and rich gas type curve areas throughout the year.”

Eclipse’s acreage position is concentrated entirely in Ohio, where it’s primarily focused on 99,300 net acres in Noble, Guernsey, Monroe, Belmont and Harrison counties (see Shale Daily, May 9). The company holds additional acreage that’s prospective for the Marcellus Shale and the Utica’s oil window.

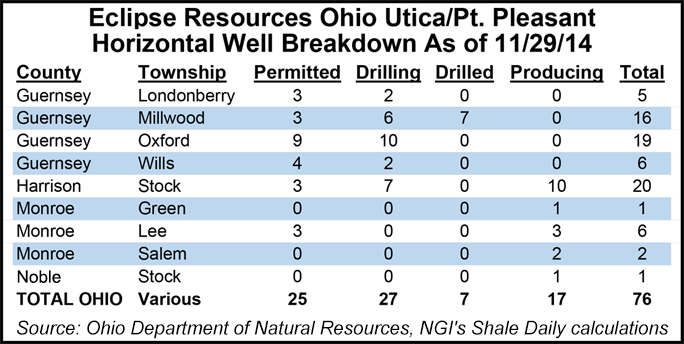

Although Eclipse did not reveal the locations of its new wells, the most recent data from the Ohio Department of Natural Resources (ODNR) offers a few clues. According to the ODNR data through Nov. 29, Eclipse had a total of 76 horizontal wells in some stage of development, ranging from permitted to producing. Seventeen of those wells were in the latter category, but of those, all but two were originally permitted before 2014. The latest permit date for the other two wells occurred on March 21. That suggests that the six new Eclipse wells that came online were more likely in the drilling or drilled category. Eclipse had seven wells that were drilled but not completed in the latest ODNR data, and all of those wells were in Millwood Township in Guernsey County.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |