NGI The Weekly Gas Market Report | E&P | NGI All News Access

Dos Bocas Refinery Almost Certain To ‘Destroy Value’ For Pemex, Think Tank Says

The Dos Bocas refinery under development by Mexican state oil company Petróleos Mexicanos (Pemex) has a 2% chance of success and should be scrapped in order to free up capital for exploration and production (E&P), according to a new study by local think tank Instituto Mexicano para la Competitividad (IMCO).

President Andrés Manuel López Obrador, who campaigned on a platform of “energy sovereignty” and “rescuing” Pemex, announced the Dos Bocas project in his home state of Tabasco shortly after taking office last December. His administration has said it will cost an estimated $8 billion and take four years to complete.

However, recent experience in Latin America and elsewhere shows that major delays and cost overruns are practically synonymous with refinery projects, IMCO said.

Given the precarious state of Pemex’s finances and its steadily declining hydrocarbon output, IMCO is proposing instead that Pemex cancel Dos Bocas in order to focus on the much more profitable E&P segment, and on improving the efficiency and profitability of its six existing refineries, researchers said.

Pemex’s production of natural gas, of crucial importance for the country’s power generation and manufacturing sectors, has fallen by 42% since 2009.

For the study, IMCO created a financial model for Dos Bocas, then submitted that model to a Monte Carlo simulation to study 30,000 different scenarios for the project’s development. The variables modified under each scenario include refining margins, total investment, construction time and operating costs.

The analysis concluded that in 98% of the scenarios, the refinery would generate more costs than benefits, IMCO said Tuesday. “That is to say, it destroys value for Pemex.”

Pemex’s existing refineries averaged an all-time low utilization rate of 49.6% in 2017.

This “indicates that currently there is sufficient installed capacity to increase production of refined products, however, underinvestment in the last 18 years in the national refining system infrastructure has caused the current refineries to not have the necessary productivity levels to make them profitable,” researchers said.

Citing refining as the least profitable segment of the oil and gas value chain, the report said that a refinery of this magnitude has not been built in North America since 1977.

Researchers also highlighted that other national oil companies, such as Brazil’s Petróleo Brasileiro S.A. (Petrobras) and Saudi Arabia’s Saudi Aramco, as well as international majors such as Exxon Mobil Corp. and BP plc, are increasingly slowing down or divesting from refining activity due to its low margins and a projected slowdown in global demand for oil projects over the coming years.

“Pemex has a limited capacity of resources to invest,” researchers said. “Committing a significant amount of resources to a refinery, even if it were profitable, limits the capacity to invest in much more profitable and indispensable activities such as exploration and production.”

The report continued, “Pemex is on the edge of the abyss and its performance is intimately related to the country’s public finances. It is urgent that the decisions with respect to this company be taken based on evidence and criteria of profitability, not political agendas.”

Fitch Ratings also cited the refinery as one of the driving factors in its January decision to downgrade Pemex’s bonds by two notches, to just above junk.

BBVA Bancomer, the local unit of Spanish bank BBVA, expressed concern this week about Pemex’s increased allocation of capital to the refining segment, which BBVA said has generated annual losses of around 100 billion pesos ($5.3 billion) for the state-owned producer.

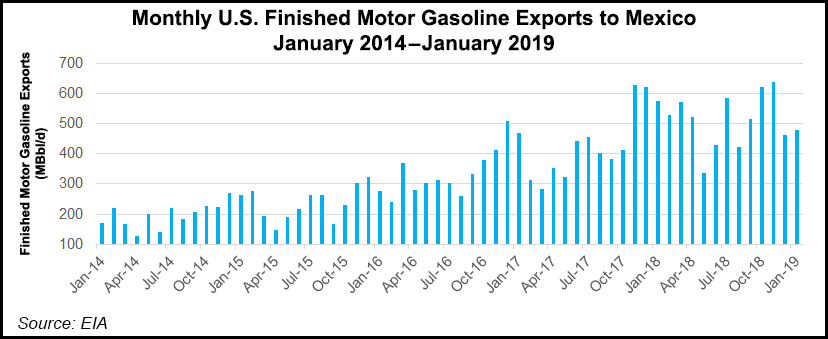

Mexico imported 78% of its gasoline and 76% of its diesel demand in December, according to data from energy ministry Sener.

Mexico’s crude oil production has averaged a yearly decline of 2.63% over the last 18 years, researchers said, adding that if this trend continues, Pemex would have to import crude to supply the new refinery.

Mexico’s 2019 federal budget allocates 50 billion pesos ($2.65 billion) for development of Dos Bocas, for which Pemex has yet to present economic feasibility or environmental impact studies.

Energy minister RocÃo Nahle announced in March that engineering, procurement and construction (EPC) works would be awarded via a closed tender open to four pre-selected parties: two consortiums and two companies.

The consortiums comprise Bechtel Corp.-Techint and WorleyParsons Limited-Jacobs Engineering Group Inc.. The individual companies are TechnipFMC and KBR Inc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |