E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Diamondback’s Tie-Up with Energen to Build Permian Blockbuster

Diamondback Energy Inc. late Tuesday moved into large-cap territory and set itself up as one of the biggest operators in the Permian Basin in an all-stock deal to take over Energen Corp. for an estimated $9.2 billion.

Diamondback agreed to trade 0.6442 shares of common stock for each share of Energen, representing an implied value for Energen of $84.95/share. Diamondback also agreed to take on Energen’s debt, estimated at $830 million. When completed Diamondback shareholders would own around 62% of the company, with Energen’s shareholders owning the remainder.

The monster tie-up comes only days after Diamondback agreed to pay an estimated $1.2 billion for Permian Midland sub-basin acreage from Ajax Resources LLC. The Energen deal is a massive leap beyond the bolt-on, CEO Travis Stice told analysts during an early Wednesday morning conference call with his management team.

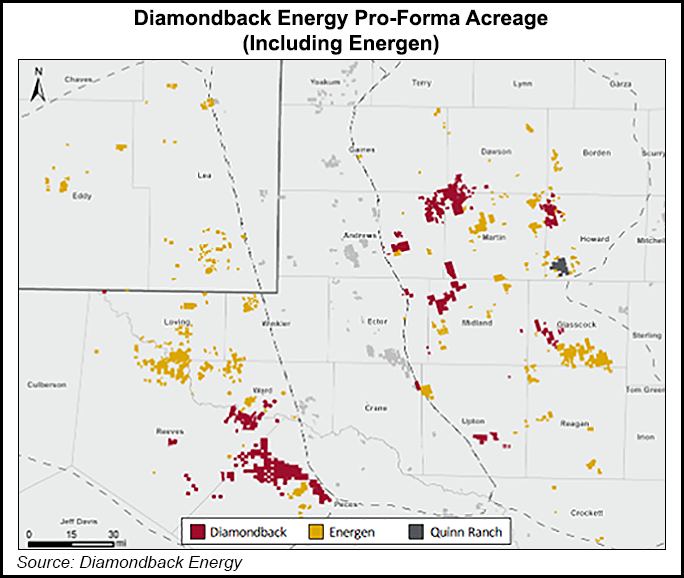

“This transaction represents a transformational moment for both Diamondback and Energen shareholders,” creating a “premier large cap Permian independent oil and gas company,” Stice said. The combined entity would own 390,000 net acres, essentially split evenly between the Midland and Delaware sub-basins.

As the second big Permian exploration and production combination this year, “this transaction is likely to increase urgency for other Permian players looking to add scale as one less target is on the block, and Permian peers likely outperform on the news,” said Wells Fargo Securities LLC analysts.

Permian big shot Concho Resources Inc. in March clinched an all-stock transaction that was similarly valued at $9.5 billion to take over RSP Permian Inc., creating a pure-play with close to 640,000 net acres. The transaction was considered the largest U.S. upstream merger and acquisition deal since 2012 and at the time was the largest “purely Permian deal ever,” according to Wood Mackenzie.

Energen’s portfolio provides Diamondback with an opportunity to high grade the portfolio and focus on longer laterals and efficient pad development.

“Our industry has transformed into a manufacturing business, and the operator that converts resource into cash flow at the lowest cost will win in the long run,” said the CEO.

Using Diamondback’s current drilling and completion costs in the expanded portfolio also should reduce costs by more than $200/lateral foot in the Midland sub-basin alone, he said.

“Over the course of our pro-forma Midland Basin drilling program, which is increasing by 2,000 net wells, this synergy will deliver over $1.5 billion of net present value to our shareholders.”

Once completed, Diamondback would hold 390,000 net acres across the Midland and Delaware sub-basins, an 85% increase from its 211,000 net acres at the end of June. The Energen acreage has more than 7,000 estimated net horizontal locations, which would be a 120% gain in Diamondback’s current estimated locations, pro forma for the Ajax transaction.

Combined pro forma, Diamondback’s 2Q2018 production would have been 222,000 boe/d, 67% weighted to oil, making it the third-largest production for a Permian pure-play.

“This transaction is the outcome of a comprehensive strategic review by Energen’s board with the assistance of our outside advisers,” said Energen CEO James McManus.

Energen’s major shareholders had been pushing for the company to divest its Permian holdings. The strategic process “examined our business plan, competitive positioning and strategic alternatives,” McManus said. “We believe this all-stock transaction with Diamondback is the best path forward for our company and provides Energen shareholders with an excellent value for their investment, now and in the future.”

For now, no ramp up in activity or the rig count is expected across the combined territory.

It’s “reasonable to assume we’ll just continue activities that both companies are currently running as you look into 2019,” Stice said. “The driver next year is going to be the same driver it’s been for the last couple of years. We’re going to look at cash flow, and we’re going to allocate capital, including dividend to match that cash flow. That’s been a pretty consistent message of ours.”

Static Rig Count

Pro forma, the combined company initially would be running around 23 rigs across the Permian leasehold.

“Certainly, we want to put some more rigs on some of their areas…so I think it’s safe to assume high 20s…from a max rig count perspective,” Stice said. “But we’re going to take our time getting there given we want to make sure we integrate and realize these synergies right away.”

Diamondback today drills almost twice the number of wells a year in the Midland versus the Delaware. It also has a bigger Midland inventory, which should remain the strategy over the short term, Stice said. With Energen, the company is gaining inventory in the twin Midland-Delaware sub-basins, along with some acreage in the Central Basin Platform.

The plan is to “put all the locations in our capital allocation decision bucket” and then consider monetizing the ones that aren’t a good fit, Stice said. “We certainly aren’t at a stage where we want to signal the magnitude of what any future divestitures are going to be. But it is part of our overall capital allocation, because as we talked about earlier, proceeds from divestitures can be used in a number of ways, increasing the dividend, getting and returning it to shareholders or accelerating a program or more likely, probably a combination of all of those things.”

The options are plentiful but the plan is to keep focused on delivering synergies, he said.

“Granted, this is a lot bigger asset than we’ve ever acquired, but if you go back in our history, every acquisition we’ve done, we’ve turned around and executed better than what we had in our acquisition model,” the CEO said.

Getting Under The Hood

Stice took issue with some analysts who have perceived that Diamondback needed a deal because it lacked inventory depth. “We’ve never felt that we’ve had a lack of inventory depth. But that being said, this type of transaction of this size and scale, all it really does is it allows us to increase the runway of premium locations, Tier One locations.

“And when you put additional locations in Diamondback has and you put the operating metrics and execution efficiencies on those new assets, you’ve really extended the time of which you’re going to continue to do the things that we have articulated to the market over the last couple of years…”

Energen’s Delaware portfolio is as good as any Diamondback management had seen on a boe basis, he told analysts. Energen has “some stuff there that’s well in excess of 200 barrels of oil per foot, and even higher in some of the recent wells that they’ve done. So, we were really impressed.

“Once we got under the hood at some of the recent results they’ve had in the Delaware Basin, those obviously race to the top of the combined portfolios and inventory allocation.”

He pointed to Energen’s progress in West Texas, including in Glasscock County where well results continue to improve. In addition, “we knew the quality that’s in Howard County…the quiet superstar of the Permian counties…” Energen has “a nice chunk in Midland County as well…

“So, overall, I think you’re going to see an uptick in the Delaware Basin pro forma inventory. And I think you’re seeing more of the same and in a positive laying on in the Midland Basin side of the asset.”

Reducing Drilling, Completion Costs

Diamondback and Energen use similar hydraulically fracturing (fracking) techniques, which also should help to reduce overall drilling costs.

“If you just look at the frack recipe between the two companies, it’s essentially similar,” Stice said. “I think we have a definite advantage on the Midland Basin side because all three of our frack spreads are using locally provided sand. That translates into real dollars per foot.”

Diamondback also “stands in pretty rare company” when it comes to reaching total depth (TD) quickly on its wells. “And when you get the TD faster, you end up saving money on the daily spread rate, and you get to drill more wells in a year. So those are the two really primary things that make up that $200 a foot.”

COO Mike Hollis, who shared a microphone during the conference call, said using local sand has essentially saved Diamondback around $50/lateral foot on the completion side in the first six months of this year.

“The real benefit is on the drilling side,” Hollis said, as Diamondback reaches TD quickly. If there is a spread rate of $70,000 a day “and you’re saving three or four days per well, that’s real money.”

On the well spacing side, the two operators “think pretty much alike on the majority of the zones that we care about, both the Midland and the Delaware basins,” Hollis said. “I don’t think Energen was putting their thumb on the scale when it came to locations. And I think they’re conservatively spaced, as are we…We’re going to continue to test some downspacing in some areas if it’s proven that it works. But otherwise, we’re pretty happy with a conservative inventory count.”

Energen was an early mover in the Permian to deploy large multi-well pads, something that Diamondback plans to accelerate as it transitions beyond four-well pads and into multi-zones.

Pro forma, general and administrative costs should decline by $30-40 million a year, with the transaction eventually “set to save us between $25 million and $50 million annually,” Stice said.

Overall, Diamondback expects to deliver about $2 billion in value from the synergies beginning in 2019, and over time, management expects to deliver another $1 billion related to “secondary synergies,” with savings on drilling and completion activities, improved lease operating expenses, benefits of overlapping and adjacent acreage in multiple counties, and a high graded portfolio.

“With this acquisition, we will also implement a ”grow and prune’ strategy where long-dated inventory can be divested and reinvested into higher return near-term projects,” said Stice. “The resulting benefits from our increased scale, improved capital productivity, operations and development optimization cannot be overstated.”

Pipeline Capacity

Current tight pipeline capacity in the Permian shouldn’t be an issue with the takeover, according to Stice, as most of Energen’s oil “already is on the pipe, so I don’t think we’re going to spend the money to rebuild a system that we would own…”

Energen already has “really good deals in place, with first purchasers and midstream providers in the basin that we want to keep in place through this period of tightness over the next six to 12 months in the Permian. But from an asset level perspective, I don’t think we’re going to have to spend a lot of money like we have in the Delaware Basin today on building new systems because of the capacity that’s there today.”

Energen’s existing midstream infrastructure also should benefit from Diamondback’s majority ownership in Viper Energy Partners LP, Stice said.

Energen has multi-year term purchasing deals in place for most of its large positions with “well capitalized purchasers,” which gives it “a lot of spare pipe capacity today…”

In addition, Stice said Permian differentials “have started to look a little better…You’ve actually seen some of the pipelines announced that they’re going to come on earlier than expected, which is very rare in our industry…”

Stice doesn’t expect Energen’s “large buyers” to break their existing agreements. In addition, Energen has protection via hedging, which “gives us a lot of confidence as well.”

Biggest Challenge: People

To Stice, the most challenging aspect of the deal could be in integrating the workforce. Energen is headquartered in Alabama, while Diamondback makes its home in one of the biggest West Texas towns, Midland, but it’s not Houston.

Diamondback’s board and executive team are to remain unchanged, and the company is going to remain headquartered in Midland, where office space already was tight, along with a lot of things, as growth in the Permian has reduced available housing. The labor force overall is tight too.

“This is the biggest trade we’ve ever done, and even more importantly this is the first trade that we’ve done that really comes with people, and so it’s going to be a challenge for the organization to integrate these synergies,” Stice said. “I’m imminently confident that we’ll be able to do that. But I think any time you’re dealing with the human element of a trade of this size, whatever you think is going to be difficult probably gets more difficult in the near-term and then better over time.”

Diamondback has a “culture,” and “we’re going to be inviting a lot of Energen employees to come embrace that culture. But that’s going to take some time.”

Shareholders of both companies still need to approve the transaction, but Stice was confident the deal could be completed by year’s end.

Reaction Mixed

Financial analysts who cover Permian players were mixed in their reactions to the mega-deal.

BMO Capital Markets analysts said the “not-so-cheap price” paid for Energen and the expected synergies and potential productivity gains needed to “better showcase any value proposition moves us to the sideline….This event puts our focus back on the company itself where value creation may not necessarily be achieved through acquisition alone.”

BMO said it estimated the leasehold price at $32,000/acre and $1.5 million/location net of proved developed producing reserves and without ascribing value to any other assets.

“Considering that certain leasehold and locations should be deemed noncore, the measures work out to an even more expensive $50,000/acre and $2.0 million/location on our assumptions.”

Jefferies LLC’s analyst team said the deal value, assuming $40,000/blowing boe/d for Energen’s 2Q2018 production, implies a cost of $35,000/acre, or $55,000/acre using Diamondback’s Tier 1 acreage count disclosure estimated at 96,000 net acres.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |