Permian Basin | NGI All News Access

Diamondback Anticipating Acquisition Opportunities Amid Downturn

In a lower-for-longer commodity price environment, Diamondback Energy Inc. management said Wednesday the Midland, TX-based Permian operator could be looking for potential mergers and acquisitions (M&A) should the right opportunity present itself.

CEO Travis Stice told analysts during a joint 4Q2015 earnings call for Diamondback and subsidiary Viper Energy Partners LP that a low-price environment “will present opportunities to grow our company. We believe our execution ability and low-cost structure make us a natural consolidator within the basin. However, we will only do deals that are accretive to our stockholders.

“Viper Energy Partners continues to look for accretive mineral opportunities inside and outside the Midland Basin. We also recognize the opportunity for Viper to provide liquidity to distressed sellers through the purchase of their royalty interests.”

Later in the call, Stice clarified that the exploration and production (E&P) company won’t be going out of its way to look for opportunities to grow or acquire additional acreage.

“Diamondback has a long history from the very beginning of being an acquire and exploit company, so we’re not increasing our efforts on the acquisition front. We’re really just continuing what we’ve always done, which is to look for accretive opportunities where we believe we can demonstrate that” the acreage “is worth more in Diamondback’s hands than somebody else’s…Diamondback is committed to doing smart deals that are accretive, and we kind of believe that we’re the right operator, and if we find the right rock, we’ll generate the right kind of returns for it.”

In their 4Q2015 earnings presentation, Diamondback management touted their reductions in drilling costs, reporting that the company’s leading-edge drill, complete and equip costs were reduced 30-35% during the quarter compared to the 2014 peak. COO Michael Hollis said drilling costs per well are trending at around $5-5.5 million for a 7,500-foot lateral and $6.5-7 million for a 10,000-foot lateral.

The company lowered its lease operating expenses (LOE) per boe by 12% year/year, down to $6.84/boe in 2015 compared with $7.79/boe in 2014, Hollis said.

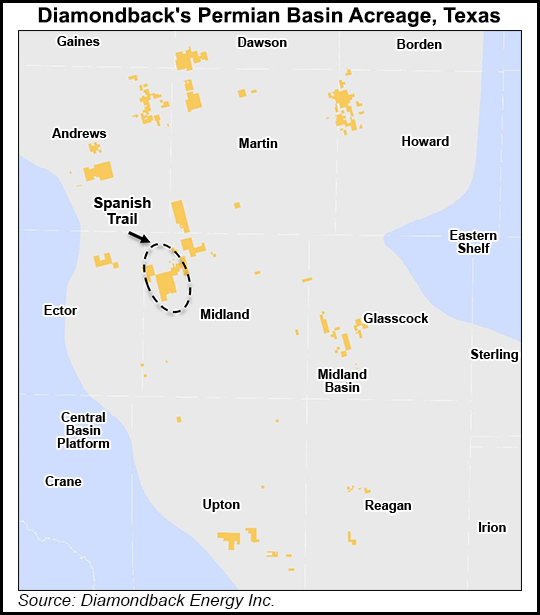

Hollis said the company continues to drill faster, drilling a three-well pad on its “Spanish Trail” acreage in 37 days from spud to rig release, while in Martin County, Diamondback drilled a 7,500-foot lateral in under 10 days from spud to total depth.

Prior to its earnings call, Diamondback announced completion of its first three-well pad in Glasscock County, TX, targeting the Lower Spraberry, Wolfcamp A and Wolfcamp B. Hollis said the wells had an average lateral length of 7,400 feet and produced a combined seven-day average of more than 3,600 boe/d.

Hollis said the E&P has completed drilling on a three-well pad in Howard County, TX, targeting the Lower Spraberry, Wolfcamp A and Wolfcamp B and is currently drilling another three-well pad in the county. Diamondback is aiming to complete these wells by mid-2016, he said.

Diamondback announced a 2016 capital budget of $250-375 million, with plans to complete 30-70 gross horizontal wells during the year. The company set 2016 production guidance at 32,000-38,000 boe/d, including 6,000-6,500 boe/d attributable to Viper.

The company reported 156.9 million boe of proved reserves as of Dec. 31, up from 112.8 million boe at year-end 2014.

Total production for the quarter was 37,614 boe/d, 76% weighted to oil, compared with 25,724 boe/d (75% oil) in the year-ago period. Production was up 10% sequentially from 3Q2015, the company said.

Diamondback’s full-year 2015 production averaged 33,098 boe/d, 75% weighted to oil, compared with 19,474 boe/d (76% oil) in 2014.

The E&P reported a net loss for the quarter of $186.8 million (minus $2.80/share), compared with a net income of $99.9 million ($1.74/share) in the year-ago period.

For full-year 2015 the company reported a net loss of $547.8 million (minus $8.74/share), compared with a net income of close to $196 million ($3.67/share) for full-year 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |