NGI The Weekly Gas Market Report | E&P | NGI All News Access

Despite Staggering Losses, Mexico’s Pemex Says Farm-outs Still Not on Table

Despite acknowledging the existential threats posed to its business by an immense debt load, staggering losses and a collapse in oil demand from Covid-19, Mexico’s state oil company Petróleos Mexicanos (Pemex) does not plan to farm out stakes in its exploration and production (E&P) acreage anytime soon, according to the firm’s 20-F annual report.

“Over the last several years, we have pursued farm-outs and other partnerships in order to diversify and strengthen our exploration and production portfolio and to focus on the most profitable projects,” Pemex said in the report filed to the U.S. Securities and Exchange Commission (SEC) last Friday.

However, President Andrés Manuel López Obrador’s government last June suspended farm-out auctions, made possible by the 2013-2014 energy reform of his predecessor, Enrique Peña Nieto.

Pemex’s 2019-2023 business plan instead calls for replacing farm-outs with integrated exploration and extraction contracts, known by their Spanish acronym CSIEEs. CSIEEs are fee-based oilfield services (OFS) contracts in which OFS firms must assume 100% of capital expenditures (capex) and exploration risk, with Pemex retaining full operatorship of the area in question and ownership of any hydrocarbons produced.

“CSIEE contracts are expected to replace farm-outs as a vehicle for private sector involvement, although existing farm-out arrangements will be maintained for the duration of their respective terms,” Pemex said in the filing. However, at the end of 2019, it noted that “no CSIEE was in effect.”

The business plan calls for signing 10 CSIEEs/year from 2020-2023, including a goal for 101 MMcf/d of non-associated natural gas via CSIEEs this year.

Local experts including GMEC consultancy founder Gonzalo Monroy, Talanza Energy Consulting CEO Marco Cota and MCM Abogados founding partner Miguel Cervantes have warned that the CSIEE model is unlikely to generate much interest from the industry. They have argued that farm-outs are a more attractive option.

Before López Obrador was elected, Pemex farmed out operating stakes to BHP Group plc at the Trion ultra-deepwater block in the Gulf of Mexico, as well as stakes to a predecessor company of Wintershall Dea for the Ogarrio onshore field. Pemex also farmed out interests to Cheiron Holdings Ltd. at the Cardenas-Mora onshore field.

BHP has said Trion could reach first oil by the mid-2020s, while upstream regulator Comisión Nacional de Hidrocarburos (CNH) in March 2019 approved development plans for Ogarrio and Cardenas-Mora with combined investment of more than $1.4 billion.

Pemex said based on the results of the existing projects, the government will determine whether to pursue future farm-outs.

While Pemex farm-outs are on hold, the secondary market for Mexico acreage held by other operators is alive and well, as evidenced by Qatar Petroleum’s recent acquisition of about 30% of Total SA’s participating interest in blocks 15, 33 and 34 in the Campeche Basin offshore Mexico.

CNH on Tuesday also approved a request for Royal Dutch Shell plc to relinquish its 40% stake in shallow water Area 15 to operator Total to give the French major a 100% operating interest. Area 15 was awarded through the Round 2.1 tender in 2017.

Pemex reported a staggering $23.4 billion loss for the first quarter, and its bonds were downgraded to junk status in April by Moody’s Investors Service, following a similar downgrade by Fitch Ratings in 2019.

The downgrades “have increased our cost of financing,” Pemex said in the 20-F. “Any further lowering of our credit ratings may have material adverse consequences on our ability to access the financial markets and the terms on which we may obtain financing…

“We have a substantial amount of indebtedness and other liabilities and are exposed to liquidity constraints, which could make it difficult for us to obtain financing on favorable terms and could adversely affect our financial condition, results of operations and ability to repay our debt and, ultimately, our ability to operate as a going concern.”

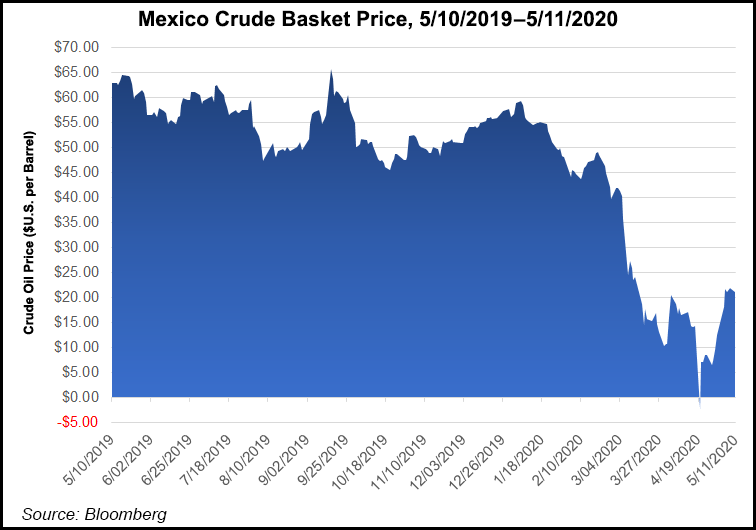

Pemex’s crude oil export basket dropped to minus $7.33/bbl on April 28, the same day that West Texas Intermediate crude futures plunged into negative territory for the first time ever. As of Tuesday, the Pemex export basket stood at $21.05/bbl.

Pemex has slashed its 2020 capex budget by about $1.7 billion in response to the impacts of coronavirus.

The plunge in demand caused by the virus “has significantly adversely affected our business, results of operations, and financial condition,” Pemex said.

In addition to the macroeconomic impacts, the pandemic also has struck Pemex closer to home. The company said Monday 28 employees, one external contractor and 37 retirees had died as a result of contracting the virus.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |