NGI The Weekly Gas Market Report | E&P | NGI All News Access

Deloitte: Optimism Returning to Energy Patch

More than half (59%) of oil and natural gas industry executives surveyed by Deloitte recently said they believe the energy industry recovery has begun or will start next year, the consultant said Wednesday.

The two-year downturn in the oil and gas industry may be coming to a close, the firm said when releasing survey results, “2016 Oil and Gas Industry Survey: Optimism Emerges in the Aftermath of a Long Downturn.” Executives surveyed talked about rising commodity prices, increasing capital spending and growing industry headcounts as reasons to be cheerful, Deloitte said.

“This recovery in many ways mimics the pattern of the recovery from the Great Recession,” said Vice Chairman John England of Deloitte LLP U.S. and Americas oil and gas leader. “If last year was the year of hard decisions, 2017 will be the slow road back. Companies are generally optimistic that prices will rise to a more sustainable level next year; however, they understand that even if we see an uptick in price, the industry likely won’t fully recover until 2018 or beyond.”

From upstream to downstream, most respondents expect to see an increase in capital spending next year, the firm said. The upstream sector, which took the hardest hit in the downturn, is the most optimistic about a recovery, followed by the midstream sector, the survey found.

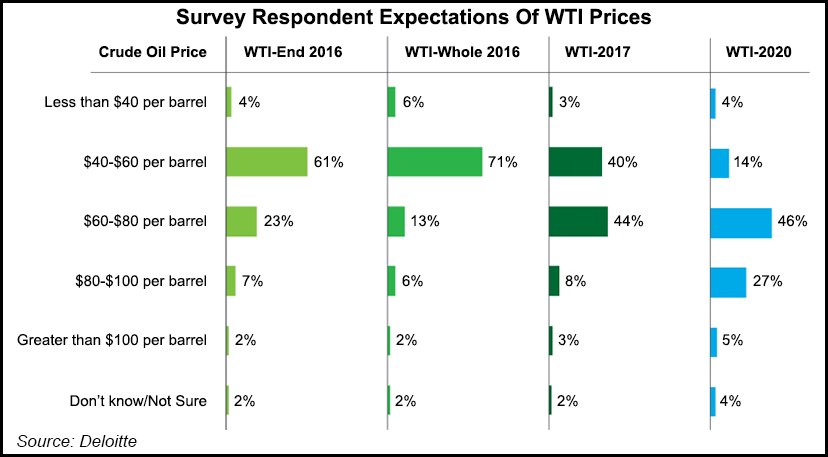

Most executives believe that $60/bbl oil is an important threshold for a revival in U.S. oil and gas exploration and production activity. Seventy-one percent believe it is possible for the 2016 average price per barrel to reach $40-60, or for prices to at least rise to that range by the end of the year (61%). Almost half of the respondents believe that prices will continue to rise, reaching $60-80 by 2017 (44%) or by 2020 (46%). Nearly one-third of the respondents (28%) foresee crude oil prices returning to $80-100 for West Texas Intermediate and Brent by 2020.

For 2017-2020, 70% of respondents expect natural gas prices to range $2.50-3.50/MMBtu, with one-third anticipating this price band in 2017. Respondents expect Asian natural gas prices to be much higher than Henry Hub until the end of the 2016-2020 period, which creates opportunity for U.S. liquefied natural gas exporters, Deloitte said. Of those surveyed, 81% believe international prices will range $5-10/MMBtu. However, an increasingly optimistic view (29%) is for prices to be in the $10-15/MMBtu range by 2017 to 2020.

When asked which policy or geopolitical issue would most affect their companies, survey respondents cited the Organization of the Petroleum Exporting Countries (OPEC) production decision as having the most impact on the upstream sector, but U.S. tax and policy decisions were next, outranking several prominent international issues.

OPEC’s ongoing influence on crude oil prices remains the most important concern for 45% of respondents. Next areas of greatest concern are changes in U.S. tax policy and regulation (38%) and environmental and local stakeholder issues (34%). While the survey did not break out specific regulations, professionals see a possibility of “profound” energy policy changes to be enacted, and for the scope and impact of those changes to depend on the outcome of the presidential elections in November.

The survey showed a shift in expectations about the impact of short- and long-term cost containment initiatives from 2016 to 2017. Long-term cost-containment initiatives, a hallmark of the oil and gas industry expansion before the downturn, are considered the most effective, as shown by an increase from 42% of respondents to 50% for 2017.

Short-term cost-reduction efforts are seen as less effective in 2017 — a key indicator of an expectation of recovery, Deloitte said. In addition, executives expect capital expenditures (capex) committed to exploration activities to rise in 2017 (42%) — more evidence for an optimistic outlook for the industry’s longer-term recovery, the firm said.

For next year, one-half of respondents see better operating efficiencies and enhanced well productivity as the biggest opportunity for cost reductions. This is a shift away from head count, portfolio changes and activity reductions, Deloitte said.

Although more than half of the respondents believe 40% or more of cost reductions are short term, an overwhelming 64% see operating efficiency gains as the best path to sustainable cost reductions, followed by contract renegotiations.

While 43% of respondents expect more personnel reductions in 2016, next year, only 31% believe there will be ongoing layoffs. In fact, 36% of the respondents expect hiring will restart in 2017.

For 2016, 42% expect capex to continue declining; but for 2017 the outlook changes as 43% of respondents anticipate capex to rise.

While it was once thought that the midstream sector was largely immune to commodity price volatility, everyone has learned that is not the case, and the segment is feeling its share of pain.

“…[T]he sector’s fee-based contracts are at risk of being renegotiated or challenged in bankruptcy court, given the financial stress of upstream producers,” said managing director Andrew Slaughter of the Deloitte Center for Energy Solutions, Deloitte Services LP. “We already are seeing movement toward consolidation, and more could be on the way. Professionals also see infrastructure building both in the U.S. and in Mexico as the biggest area of midstream opportunity.”

The midstream sector has many opportunities for profitable growth in the burgeoning U.S. export industry, and the U.S. Gulf Coast region is seen as the area that will present the most opportunity, according to 63% of respondents.

Sixty-two percent of respondents expect a moderate level of consolidation in both 2016 and 2017, but when asked about whether the midstream sector would consolidate significantly in 2017, affirmative responses increased from 15% to 23%. Midstream master limited partnership (MLP) rollups into C-corporation structures were seen as unlikely (28%) or moderate (52%), though. Cost reduction (52%) and regulation (41%) are seen as the midstream sector’s biggest challenges.

Midstream optimism is most clearly seen in the results related to rising capex. For 2016, only 26% of the respondents saw a net increase in capex, but that cohort’s expectation rose to 41% for 2017, with 28% of that group citing a modest 10% uptick.

In the downstream refining and marketing segment, regulatory challenges are offset by export opportunities, Deloitte found. Regulation (39%) and costs (35%) top the list of the biggest challenges facing this segment. The outlook for refined products exports next year is seen as positive as U.S. crude oil exports have offered new competition. Capex will likely increase from 2016 to 2017, according to 33% of survey respondents, but by no more than 10% year over year. Slightly fewer (30%) expect a net capex reduction next year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |