CRE Readying Next Phase of Pemex Natural Gas Contract Release Program

Energy regulators expect by next month to finish preparations for the second phase of Mexico’s natural gas release program, which requires the state-run former monopoly Petroleos Mexicanos (Pemex) to relinquish a majority of its marketing contracts by the end of 2019.

“Currently, we already have a well-advanced version of the accord through which the commission will determine the characteristics of this next phase,” a spokesperson for the Comision Reguladora de Energia (CRE) told NGI’s Mexico GPI. “We expect to publish the accord…in May.”

As part of Mexico’s ongoing gas market liberalization, the CRE is applying asymmetrical regulations to break up Pemex’s dominant position in the marketing segment. These measures include forcing the state company’s downstream subsidiary, Pemex Transformacion Industrial (Pemex TRI), to cede around 70% of its 3.56 Bcf/d marketing portfolio by the end of next year.

The next round of contract releases, if successful, would also bring the program to a close since the regulator has decided to hold one final process, instead of two separate phases as originally planned, according to the spokesperson.

This final process would get underway only after the CRE publishes the accord, which would outline rules, procedures and timelines. The regulator also expects to modify the design of the final phase incorporating lessons learned from last year’s process, the spokesperson said.

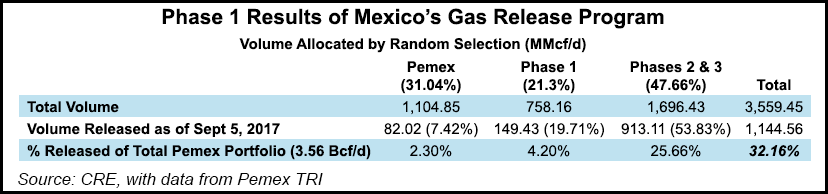

Phase 1 of the gas release program occurred last year. In February 2017, the CRE randomly selected 31% of Pemex TRI’s clients to remain with the state company, 21.3% for Phase 1 and 47.7% for later phases. Small consumers were packaged together based on their location on Mexico’s main gas transmission network, the Sistrangas, formerly operated by Pemex.

Pemex TRI was then required to issue and publish binding offers for the Phase 1 customers, following a special contract model approved by the CRE. Third-party marketers were able to negotiate with these clients and make counter-offers that had to be, at a minimum, on par with the base conditions in the Pemex proposals.

By its conclusion in September, Phase 1 had well exceeded the CRE’s expectations. Pemex TRI ceded 32.2% of its contracts to other companies, or 1.15 Bcf/d of the 2.5 Bcf/d mandated for release. This contributed to the regulator’s decision to the fold the remaining contracts into a single phase.

Under the program’s rules, all Pemex TRI gas customers may, at any time in the process, sign contracts with other marketers, decide to remain with the state company, or reserve capacity on pipelines in order to start buying gas themselves. In fact, only 150 MMcf/d of the 758 MMc/d in contracts originally selected for Phase 1 were released by September.

“A substantial share of the contracts intended for phases 2 and 3 jumped ahead and were released in the first phase,” the spokesperson said. “This also influenced the commission’s decision to combine the next two phases into a single process.”

The spokesperson added that “looking at the results of the first Sistrangas open season, a significant percentage of the capacity on that system was assigned to shippers other than Pemex.”

Sistrangas held an open season in March last year, awarding 2.23 Bcf/d of one-year firm capacity contracts to 24 companies. Those contracts are now up for renewal.

Overall, private shippers have reserved around 16% of the system’s total operating capacity of 6.12 Bcf/d. The remainder is allocated among Pemex, federal power utility Comision Federal de Electricidad (CFE) and independent power producers, all of which were allowed to take capacity prior to the March open season.

Pemex and CFE also hold most of the available capacity on the import pipelines along the U.S. border, which provide around 55% of Mexico’s gas supply. The two state-run companies may release that capacity through auctions organized by the Centro Nacional de Control del Gas Natural, i.e. Cenagas, which operates the Sistrangas.

The Pemex TRI marketing contracts on offer in the next phase of the release program represent a combined volume of 1.35 Bcf/d. While the leftover contracts include various that were originally slated for Phase 1, the remaining customer portfolio remains broadly representative of the Mexican gas market.

“Their characteristics reflect the market’s structure,” the spokesperson said. “The remaining contracts for release consist of, in order of importance, power sector users, industrial consumers, and distribution companies. Geographically, the main volumes up for release are located in the Gulf, Central and West” tariff zones on the Sistrangas system.

The contracts released through Phase 1 were also mainly for power consumers and were likewise concentrated in the Gulf zone. This area includes Mexico’s industrialized northeast region, where a most U.S. pipeline imports currently flow into the country.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |