NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Corpus Christi LNG Commissioning Cargo Sets Sail

The first commissioning cargo of liquefied natural gas (LNG) is on its way from Cheniere Energy Inc.’s Corpus Christi facility in South Texas, marking the first gas exports from the state, as well as the first from a Lower 48 greenfield project.

According to the company, the LNG is being carried to overseas markets via the Maria Energy, chartered by Cheniere Marketing LLP.

“Exporting the first commissioning cargo of LNG from Texas demonstrates Cheniere’s ability to deliver projects safely and ahead of schedule, including the first greenfield LNG export facility in the Lower 48 states,” CEO Jack Fusco said.

“This milestone further reinforces Cheniere’s position as the leader in U.S. LNG, with a world-scale liquefaction platform that provides significant competitive advantages as we continue to execute on our growth strategy.”

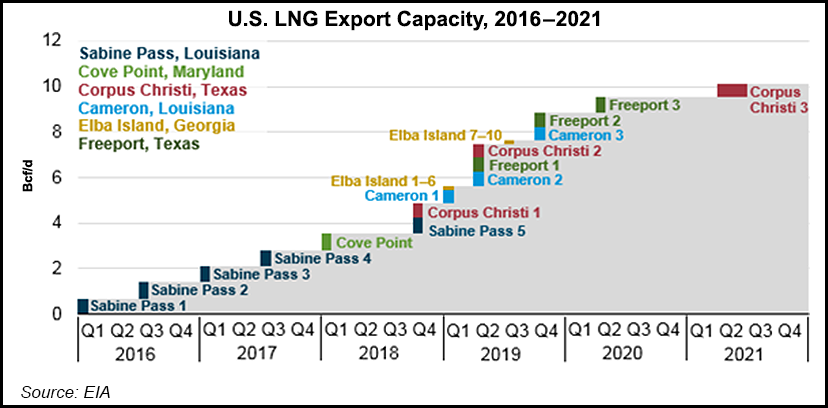

The Corpus Christi liquefaction facility initially consists of three large-scale trains and supporting infrastructure, with an additional seven smaller trains proposed. Train 1 produced its first gas in November, and the train is slated to be substantially completed early next year.

Train 2 is expected to be nearly completed in the second half of 2019, with completion of Train 3 set for the second half of 2021.

The Corpus facility is to have three LNG storage tanks with about 10.1 Bcfe total capacity, as well as two marine berths. The seven smaller trains now under development would increase the total expected nominal production capacity of the facility to about 23 million metric tons/year (mmty).

Cheniere has one of the largest liquefaction platforms in the world, with two Gulf Coast export projects.

Sabine Pass LNG in Calcasieu Parish, LA, in 2016 began exporting gas to global markets, and its fifth train was commissioned in late October.

Cheniere’s aggregate nominal LNG production capacity is estimated at around 36 mmty total either in operation or under construction. The company also is pursuing liquefaction “expansion opportunities and other projects.”

Concerns have been raised that exporting U.S. LNG could become uneconomic if domestic prices continue to climb this winter, but RBN Energy LLC analyst Amber McCullagh recently estimated it would take Henry Hub rising to $5.50-7.50/MMBtu before impacting demand on cargoes leaving the United States. McCullagh’s estimate is based on recent UK National Balancing Point futures averaging $8.50/MMBtu for January to March, and factored in several variable costs for potential LNG offtakers, including liquefaction, shipping capacity and regasification.

McCullagh concluded that the variable costs to move U.S. gas to Europe could range from a low of about $1/MMBtu to upwards of $3/MMBtu.

Setting aside Sabine Pass Train 5, Corpus Christi Train 1 and Dominion Energy Inc.’s Cove Point terminal, which has different economics because of its proximity to pricing at Transco Zone 5, McCullagh estimated liquefaction costs at Sabine Pass Trains 1-4 to be 15% of Henry Hub. Shipping costs may vary, depending on the offtaker.

“At current LNG charter rates of $170,000 and 15 days of shipping from the Gulf Coast to Europe (30 including the return voyage), for some offtakers, variable shipping costs could run as high as $1.65/MMBtu,” McCullagh said. “…For offtakers with ships and crews under contract, and the ability to use the ship elsewhere without a return voyage, the figure is likely much lower, potentially as low as just the boil-off rate.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |